Management Control Systems in Subsidiaries of Multinationals in the Emerging Market of Central Eastern Europe

Joanna Gusc

Wageningen University, The Netherlands

H.J. Bremmers

Wageningen University, The Netherlands

S.W.F. Omta

Wageningen University, The Netherlands

Abstract

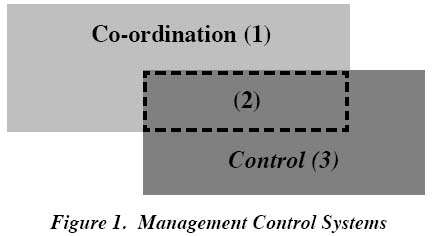

Using transaction cost theory and the theory of multinational enterprise, this study examines the extent of the degree to which management of multinational companies can control over its subsidiaries' configuration and coordination abilities. Empirical results showed that the subsidiaries enjoyed a significant freedom when decentralized standards were used in operational and the production activities. In the long-run, however, the centralized standards worked better— thegreater the coordination activities between the multinational companies and their subsidiaries the lesser the control needed.Introduction

1 This paper presents some empirical findings of an exploratory study into the governance relationships between multinationals and their Polish subsidiaries. The emerging markets of Central Asia and Eastern Europe (CEE) have become very attractive for setting up a subsidiary. Many multinational companies have established operations in new locations, or have expanded existing operations. New key strategy drivers such as first-mover advantage, scale economies, and serving local markets through the local companies are supplementing traditional investment incentives such as cheap labour and raw materials. These new factors have contributed a significant change in the global positioning of multinational corporations. As a result, the Eastern European and Central Asian countries accounted for more than 60% of "First-time" investments in 2002.

2 In order to compete and be successful in foreign markets, one needs to pay special attention to organisational structure and the corporate governance issues. Recently, a number of real life cases have provided some insights such that too much freedom provided by headquarters can have disastrous consequences on all parts of a multinational. For example, the Dutch retailers' (Ahold) insufficient supervision over its subsidiaries in the United States led to a serious financial and management crisis in 2003 (Smit 2004). Consequently, the management of the multinational company recognizes the need to change the governance structure to accommodate a wider dispersion of activities and the need to coordinate these activities.

3 Against this backdrop and building on existing studies on management control and coordination between headquarters and subsidiaries (Chow, Kato, et al. 1994; Andersson and Forsgren, 1996; Langfield-Smith, 1997; Harzing, Sorge et al., 2001; Chenhall, 2003), this study explores an intriguing research domain at the subsidiary level in one of the emerging economies of Central Eastern Europe, namely Poland. More concretely, we attempt to answer three general research questions:

- What is the configuration of the management control system (MCS) in the subsidiaries in Poland?

- Does the subsidiary's role influence the intensity and design of MCS?

- Does the configuration and intensity of the MCS contrast between best and the average performing subsidiaries? If so, how?

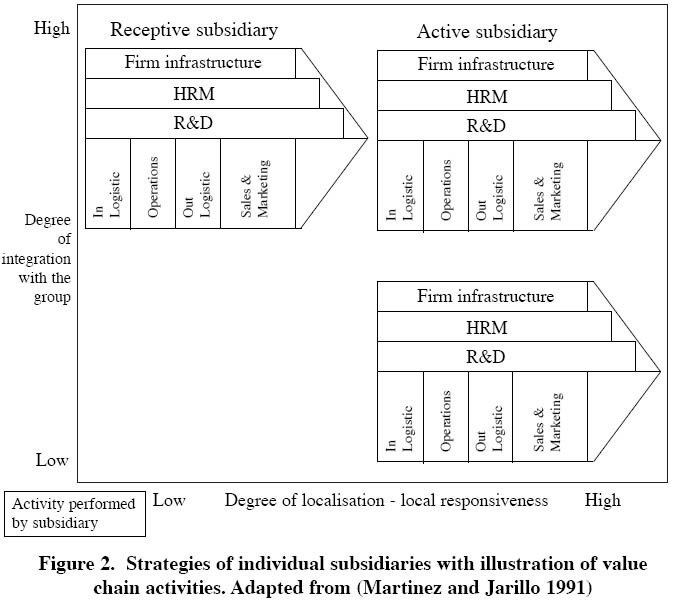

4 Using transaction costs theory and the theory of multinational enterprise, this study explores the degree and configuration of control and coordination activities embraced by management control systems used by international headquarters on their Polish subsidiaries.

Theoretical Framework

5 Transaction cost economics (TCE) originates from microeconomics (Hennart 1993; Hart 1995; Williamson 1998). It has been used to explain the trade-off between generic modes of governance. Transaction costs economics (TCE) literature makes a distinction between methods of organising these transactions (hierarchy and price system) and institutions (firms and markets) (Hennart 1993). These transactions delegate to a central party the right to constrain their behaviour. The full delegation organisation-mode is called hierarchical. Under hierarchy, one party has a right to make all decisions concerning allocation of the resources of other party (e.g. employee); the evaluation system here is based on the obedience to the supervisors' directives. Markets (in the absence of transaction costs) rely on prices to convey information necessary to reach optimal joint decision (Meyer 1998; Williamson 1999). Although its application has been confined to issues at the level of generic forms, the TCE explanatory structure is highly micro-analytical in its orientation with the (individual) transaction as a unit of analysis.

6 TCE suggests that management control structures can usefully be analysed as (implicit or explicit, formal or informal) contracts between the organisation and its members that serve to govern these contributions (Spekle 2001). Covaleski et al. (2003) completed the Spekle's efficiency-seeking approach with legitimacy seeking facets for management control and described the influence of societal and regulatory environment. Network approach presented by Powell (1990) added that some forms of economic exchange are embedded in a particular social context and that some relationships are more dependent on social contacts, mutual interests and are less guided by the formal structure of authority.. He described a third mode of exchange that cannot be placed on the market hierarchy continuum. It is characterised by high interde-pendencies among parties - a network of companies. A similar approach has been developed for international management by Bartlett and Goshal (1998). They observed that companies with governance structures tailored for competing whether on local (decentralised governance) or global (centralised) markets do not succeed in sourcing from the opportunities of current economic developments. Companies focusing on local markets, and therefore decentralising their governance could not acquire sufficient information about their foreign operations and hence lost control. This narrow focus would impede the development of the whole company or even would threat their profits. On the other hand, global centralisation restrains from incorporating ideas and signals from the subsidiaries, which makes the governance too rigid and can result in conflicts. In this research we attempt to integrate both the transactional and relational (societal) issues and develop a model for management control.

Conceptualisation of Management Control Systems

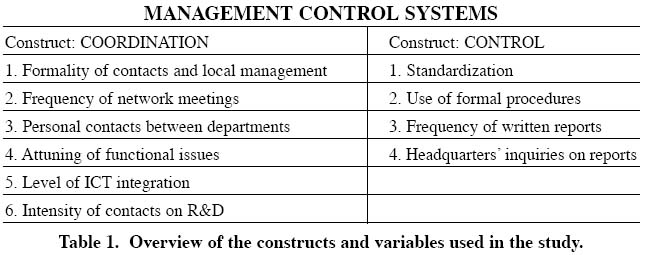

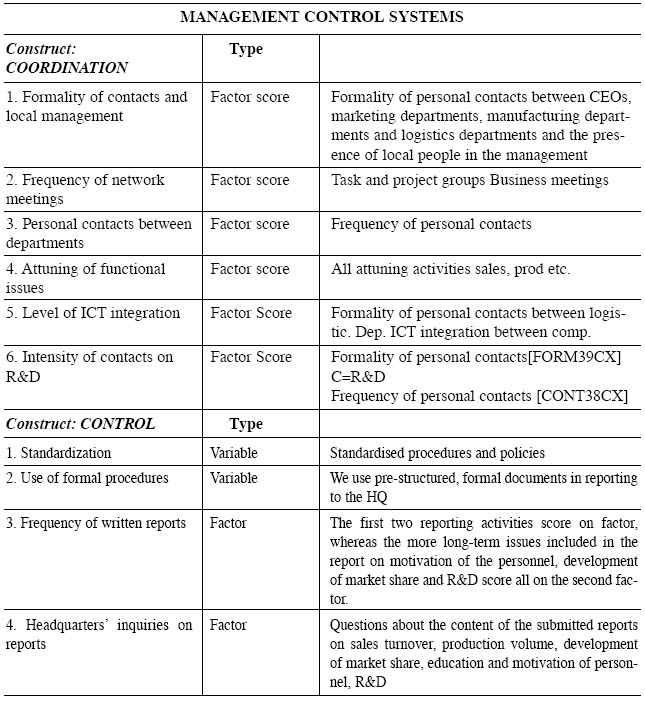

Table 1 presents a general overview of the Management Control System variables used in the study.Table 1. Overview of the constructs and variables used in the study

Display large image of Table 1

7 The broad definition of control described by Omta (1995) and De Leeuw (1994) has embraced that any activities that aim at goal directed influence, both those facilitating centralisation and decentralisation, is control. Anthony and Govindarajan (2001) added word "system" to the management control, for the activities of the management control are prescribed and have a repetitive character.

8 Control can include devices to influence interpersonal behaviour, limiting opportunism and creating transaction costs. On the other hand, not all coordination is control, since not all co-ordinated activities limit behavioural alternatives. Otherwise stated, the power element in co-ordination is more ‘ implicit' sometimes. According to Anthony and Govindarajan (2001), co-ordination establishes concerted actions among functional activities or organisational units with the aim of internalisation of norms and beliefs by employees. Planning as an element of coordination attempts to reduce uncertainty (Hofstede 1980). Coordination in this research includes setting standards, specifying activities and the application of liaison devices. In our view, co-ordination and control mechanisms are complementary and are parts of the management control systems. The relationship between the two concepts is visualised in Figure 1.

Figure 1. Management Control Systems

Display large image of Figure 1

- Co-ordination, no control: persuasion, copying behaviour, planning, etc.

- Co-ordination and control: hierarchy, formalisation, flexibility, etc.

- Control, no co-ordination: prisoner's situation.

9 Management control system consists of mechanism, which has primary an internal focus as opposed to strategic control, which emphasizes how to compete in the market. Similarly to Mintzberg's (1983) approach, in the present study managerial control primarily stresses the power element in the relationship between headquarters and subsidiary, and concentrates on standards and plans' assessment. A "control"-relationship means a formal, hierarchical unbalanced relationship between headquarters and subsidiary, regulating activities according to the expectations of the headquarters. Such a relationship has mostly an impersonal character: a subsidiary is supposed to refer to a document or a rule instead of looking for personal contact with the headquarter personnel (Harzing 1999). If these documents or rules are in a written form and/or bear official character (include stamps, signatures etc.), then we talk about the for-malization aspect of control (Nobel and Birkinshaw 1998). Some companies apply unified forms of reports throughout the whole multinational (including all the subsidiaries). In that case these reports are standardised. The frequency and variety of reports are used to measure the realised output (Cray 1984). The submission of these reports is usually imposed by external stakeholders (e.g. tax authorities). Consequently, often a subsidiary provides headquarters with a copy of the same report. This makes it difficult to assign whether the information included in the report is being read or processed. Adding to the existing theory on the management control, this study includes the frequency of inquiries from the headquarters on the submitted reports.

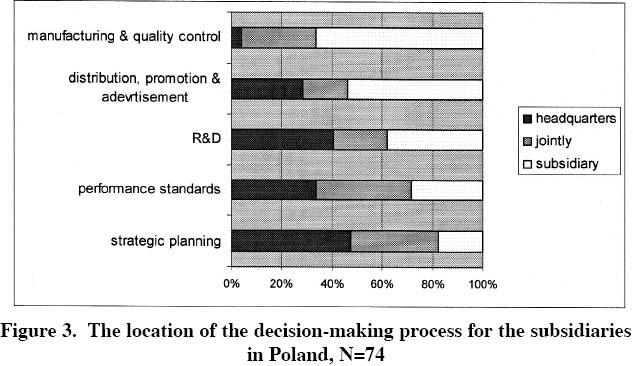

10 The power element in coordination seems to be more ‘ implicit' and aims at establishing concerted actions among functional activities and the internali-sation of norms and beliefs between organisation members. Coordination activities have mostly personal character and embrace personal contacts, personal supervision, joint actions and application of liaison devices 1. We classified the coordination activities across the structural and functional lines in the organisation. On the structural level, a measure for personal contacts between the different departments was used by Bremmers et. al (2003) and included the frequency of contacts between the heads of several departments in company. Next to exploring the contacts between departments, we adjusted Cray's (1984) measures for the functional attuning between headquarters and subsidiaries. He used the functional attuning in the research on the integration of French and British subsidiaries of U.S. multinationals.

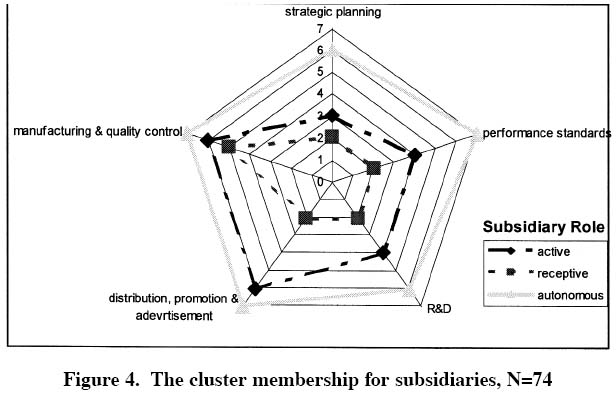

11 According to Martinez and Jarillo (1989), in increased international competition pure structural and formal mechanisms fail to respond to diverse strategic requirements of global strategy and local (national) responsiveness. To cope with complex environmental conditions a need for increased flexibility in the management of multinational operations arises. Therefore existing structural and formal managerial devices are extended with new cross-departmental, informal and other subtle mechanisms. To give an example: micro structural arrangements (liaison devices or lateral relations) cross the formal lines of the macro structure — teams, task forces, committees, individual integrators and integrative departments, informal communication channels, informal relations among the managers without the distinction between HQ-managers and subsidiary managers (Martinez and Jarillo 1989). In the present study, these coordination mechanisms were adapted from Nobel and Birkinshaw's (1998) socialisation and networks and included the frequency of joint (with headquarters and other subsidiaries) participation in committees and project groups, information exchange between companies and business meetings with other subsidiaries.

Subsidiary role and the Management Control System

12 The second research question concerns the subsidiary's role in influencing the management control systems. Multinational companies (MNC) deal differently with different subsidiaries and such dealings are not symmetrical (Goshal and Nohria 1989). Control issues in MNC's should not only consider the design of various control systems for subsidiaries top-down control, but also pay attention to the control exercised by powerful subsidiaries bottom-up or laterally. This question relates to the importance of distinguishing various subsidiary roles and the effect these roles may have on the level and the type of control exercised. The recent emergence of the multi-centre - or transnational -firms stimulates transfers not only from headquarters to subsidiaries but also the opposite way as well as among subsidiaries (Martinez and Jarillo 1991). Transnational companies combine global efficiency (e.g. making use of scale economies) with local responsiveness (adjusting products and process to local markets). It is only possible if the headquarters are able to collect information and knowledge from local markets and utilize it in global arena. This cannot take place without a change in the role of a subsidiary.

13 A subsidiary's role varies according to the level of strategic integration of the operations across countries (Doz and Prahalad 1984). Strategic integration stems from economic, technological and competitive conditions of the firm's activities, while national responsiveness is required by the diversity in market conditions, social environment and political systems. The existence of the needs for both responsiveness and integration raises difficult issues for international management. With this in mind, subsidiaries can be divided into three groups:

- receptive subsidiaries - which are pipelines of the headquarters' operations, usually perform only a small part of the activities, e.g. only sales function,

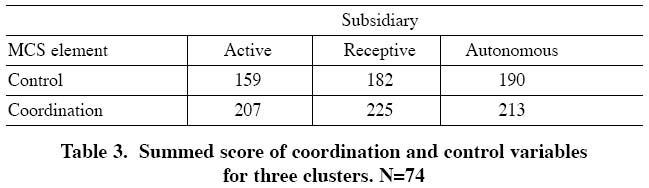

- autonomous subsidiaries — which is highly responsive to the local needs, and usually perform many activities independent of the headquarters

- active subsidiaries — play an important role in the headquarters' network, perform many activities including R&D.

14 Martinez and Jarillo (1991) divided the subsidiary roles according to their level of integration with the headquarters and extent of local responsiveness.

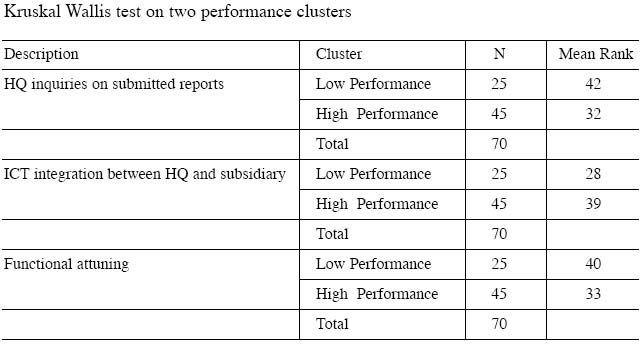

15 A firm configures its international strategy around the activities of a value-added chain (Kogut 1984). The concept of value chain was developed by Porter (1986) and consists of primary and supporting activities. Primary activities concern directly the production process and include: inbound logistics, operations, outbound logistics and marketing and sales. Support activities embrace the non-material activities in the company, such as general administration (infrastructure), human resource management, research, technology and

Figure 2. Strategies of individual subsidiaries with illustration of value chain activities. Adapted from (Martinez and Jarillo 1991)

Display large image of Figure 2

16 As Figure 2 shows, a broader value chain scope implies that the subsidiary has a specific role and is likely more self-contained with respect to various functional resources and thereby experiences a lower resource dependence vis-à-vis the rest of the MNC network (Bartlett and Goshal 1987). Subsidiary roles determine the level and the portfolio of control mechanisms (Harzing p. 294 (1999).

17 In the receptive subsidiary, the headquarters will make a greater use of formal control mechanisms (explicit) and that an active subsidiary will take part in networks and develop multilateral relationships (heavier use of informal and implicit co-ordination mechanisms). The autonomous subsidiaries require a lot of freedom from headquarters to be able to recognise and respond to the needs of the local market. Previous studies confirm that in this case the control should not be extensive so as not to hamper the development of the subsidiary. Therefore: H1 Subsidiaries that perform an autonomous role will be subject to lower level of overall management coordination than receptive and active subsidiaries.

18 Martinez and Jarillo's study (1991) shows that receptive subsidiaries are strongly controlled. Such subsidiaries are considered as an extension of the headquarters and are fully dependent on it, strategically as well as operationally. In this case a greater extent of formal control as well as intensive use of coordinating mechanisms (planning, formal meetings) can be expected. H2 Receptive subsidiaries will experience a larger extent of control than active and autonomous subsidiaries.

19 The latest phenomenon described in international organisation theory is the development of a new group of subsidiaries that are able to influence their headquarters (Martinez and Jarillo 1991; Birkinshaw and Morrison 1995; Harzing 1999). The international organisation changes in the direction of a horizontal structure, where the position of subsidiaries evolves from auxiliary to strategically significant one. In this new situation, subsidiaries (not exclusively headquarters as it used to be) develop and sustain extensive contacts and communication with headquarters and other subsidiaries. The development should also be noticeable in the portfolio of control and coordination mechanisms. Therefore: H3 Active subsidiaries will experience a higher level of co-ordination than the two other groups.

20 This research will focus on the development of the typology of coordination mechanisms applied by headquarters to its subsidiaries through tests of the hypotheses proposed above.

Management Control System (MCS) and Performance

21 The third research question tries to explain the relationship between the configuration and the intensity of MCS and the subsidiary performance. Multinational companies (MNCs) have generally diverse objectives when expanding into emerging markets (Geringer 1989). The concept of measuring performance in the international management is a frequently discussed and debated issue (Dess and Robinson 1984; Chakravarthy 1986; Luo and Peng 1999; Epstein and Roy 2001). The accounting perspective claims that the headquarters increase the intensity of the MCS after the performance has worsened in order to adjust for deviations from planned strategy and operations (Drury 2000; Anthony and Govindarajan 2001). On the other hand, an intensified MCS assures achieving planned goals and objectives (Egelhoff 1988; Harzing 1999). These two streams in the scientific research make the explanation of the relationship between management control systems (MCS) and performance extremely difficult. Additionally, the data for measuring success of the influence of MCS on the performance has still to be provided (Epstein and Manzoni 2002). The latest trends, including integrated measures (e.g. Kaplan &Norton Balanced Scorecard), suggest for evaluating various management controls. However, the integrated measures make comparisons between companies difficult 2 (Epstein and Manzoni 2002).

22 Definitely, the research of Chandler and Hanks (1993) offers an advantage in the use of the performance measures. It suggests that the use of subjective measures of firm performance (relative to competitors) are particularly useful in studying emerging businesses, and that these measures correlate with the objective measures with a high degree of reliability. Such measures were successfully applied by Luo and Peng (1999), who measured performance with managers' perceptions on four factors concerning the competitive position of a company and managers' satisfaction about the company operations.

23 Being aware of the difficulty in gathering and comparing financial data, we included the long-and short-term perceptions on performance satisfaction and then compared the groups with higher and lower performance clusters and their MCS configurations.

Data Collection

24 In 2004, we collected seventy-four extended surveys from the Chief Executive Officers of international manufacturing subsidiaries in Poland to explore the control relationship between headquarters and their subsidiaries. In some cases, the survey was filled out by other employees of the organisation and then consulted for an approval with the director. The items included in the survey were measured on the 7-point Likert scale with anchors strongly disagree to strongly agree, or by recurrence in time varying from daily to less than once per year in case of the meetings or contacts.

25 During the research process, an opportunity to engage several headquarters in the data collection appeared. So, finally, their characteristics were analysed as well.

Results

26 Having collected the surveys, the data was first explored for the general overview. Next, we applied statistical techniques such as correlations; cluster analysis and group comparisons frequencies to describe the underlying relationships. According to Hoyle (1999) these techniques are suitable for small sample size, ordinal data and non-normal distribution of data. Missing data was replaced applying EM (Expectation-Maximization) method, which is an iterative two-stage method for incomplete data problems. The EM method has various applications in social sciences and has been proven to provide better results than replacing missing data with a mean value (Little and Rubin 1987).

27 First we performed factor analysis (Principal Axis Factoring) on multi-item questions included for measuring two constructs of management control system: coordination and control. An overview of acquired factor scores and underlying items is included in the Appendix. The scale measurement reliability for the two constructs was tested by calculating Cronbach Alpha's: for control a = .76 and for coordination a = .77, both at an acceptable ≥ .7 level (Hair, Anderson et al. 1998).

Baseline Description

28 Despite the fact that in the majority of the cases the CEO was Polish, and the strategic decision-making was often centralized in the foreign headquarters. Standardized polices and procedures imposed by the headquarters were positively correlated with the centralization of the decisions on product distribution and advertisement. Similarly, the centralized standardization involved a higher formality in the contacts between the subsidiary and the headquarters departments. The same imposed standardization also implied a higher frequency of the subsidiary reports over long-term issues, development of the market share, education of the personnel and R&D. At the same time, intensified reports evoked more inquiries and questions on these issues (intensified communication) from the headquarters.

29 On the other hand, in the coordination activities, the frequent attuning of number of functional activities involved decentralized standardization and less frequent reporting on production volume and sales turnover. Interestingly, the intensity of attuning activities was associated with less frequent contacts between the heads of particular departments. The explanation here could be that the attuning took place mostly between line-employees instead of the heads of the departments. Frequent attuning was also associated with the engagement of the subsidiaries' employees in the permanent and/or contemporary project groups and task teams organized together with the headquarters. It seems that the more the coordination activities took place, the less the control was needed.

Subsidiary Role

30 In general, the results show that subsidiaries enjoyed a significant freedom in decision-making concerning the operational and the production issues. The long-term strategic decisions, such as strategic planning or setting performance standards, were centralised at the headquarters, however, as depicted in Figure 3.

Figure 3. The location of the decision-making process for the subsidiaries in Poland, N=74

Display large image of Figure 3

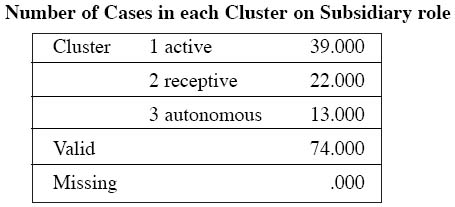

31 Following the theoretical design, the roles of subsidiaries were identified, and cluster analysis was performed on the five items in the question concerning the location of decisions in strategic and operational areas. First, we performed hierarchical between-groups cluster in order to explore the cases for possible clusters. Second, we validated the three identified hierarchical clusters by comparing the results with clusters from non-hierarchical (K-means) method with pre-specified cluster centres from hierarchical analysis. Both results showed a high level of convergence making the clusters stable and valid (Romesburg 1984). Figure 4 shows the cluster centres for three groups of subsidiaries: active, receptive and autonomous. The higher the value of the cluster centre the more decentralised the decision-making. Autonomous subsidiaries decide independently on both strategic as well as operational issues (the outer pentagram in the Figure 4). Only in decisions concerning strategic planning and R&D autonomous subsidiaries do not score the maximum value.

Figure 4. The cluster membership for subsidiaries, N=74

Display large image of Figure 4

32 Receptive subsidiaries present the opposite picture. Except for the manufacturing and quality control, all decisions were centralised at headquarters. This confirms our expectation for receptive subsidiaries to perform only selected operational activities independently of the headquarters. Active subsidiaries showed mostly joint decision-making with the headquarters (values 3 and 4 in Figure 4), especially in the strategic issues and setting performance standards. At the same time, they enjoyed a higher autonomy in the operational decisions concerning manufacturing and marketing (values 6 in Figure 4).

Subsidiary Role and Management Control System

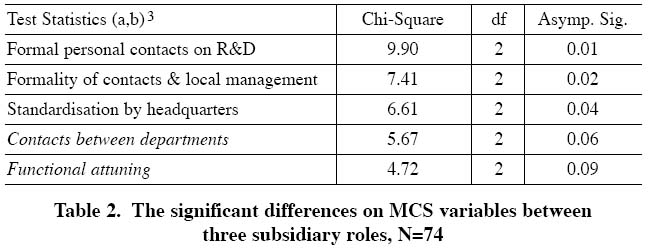

33 To compare the intensity of the Management Control Systems (MCS) across the three clusters of subsidiaries, we applied Kruskal-Wallis rank mean test. Out of eleven MCS variables compared across the three clusters, five variables showed significant differences between the clusters (See Table 2). 3

Table 2. The significant differences on MCS variables between three subsidiary roles, N=74

Display large image of Table 2

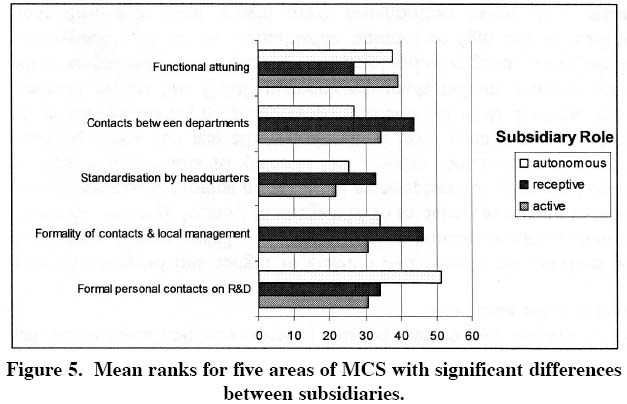

34 The formalisation factor and the frequency of personal contacts between R&D departments of headquarters and subsidiaries showed the strongest contrast between three clusters. Autonomous subsidiaries presented the highest intensity and formalisation in R&D contacts, followed by receptive and active ones. Active subsidiaries had also a lower (than receptive subsidiaries) level of formalization of documents in communication with headquarters. Personal contacts between the CEO and the different department heads together with attuning of functional activities showed differences at lower level of signifi-cance— (italics in Table 2) 0.10 4. Concerning the control construct, only one of the four variables used showed significant difference between clusters. It appears that headquarters imposed standardised procedures and policies, especially in receptive subsidiaries. Conversely, active subsidiaries showed the lowest mean value for these standardised policies and procedures. Figure 5 presents the mean ranks for all significant differences between the three clusters of subsidiaries.

Figure 5. Mean ranks for five areas of MCS with significant differences between subsidiaries.

Display large image of Figure 5

35 Next, we took a more in-depth look into the differences between the clusters by applying post hoc analysis (LSD test) for multiple comparisons. This method allows for identifying differences between the groups. The results of post hoc analysis showed significant differences in frequency of reporting on strategic issues between active and receptive subsidiaries. Active subsidiaries reported less often (than receptive subsidiaries) to the headquarters on strategic issues like R&D, market share development and education.

36 Finally we summed up the means for the three clusters for six variables in the coordination construct and four in control construct to compare the overall level of Management Control Systems (MCS). Table 3 shows that active subsidiaries had the lowest values for the overall intensity of MCS whereas receptive and autonomous subsidiaries showed much higher scores. Receptive subsidiary were strongly controlled whereas the others had a higher intensity of coordinating mechanisms.

Table 3. Summed score of coordination and control variables for three clusters. N=74Performance comparison

37 The last phase of the analysis dealt with evaluating the performance of the subsidiary. As mentioned in the theoretical part, there are a number of impediments in evaluating foreign subsidiary performance. Definitely the most important one is the availability and willingness of sharing the internal company (headquarters-subsidiary) financial data. However, in earlier research projects, we experienced that including questions on financial indicators can seriously decrease the response rate. Additionally, financial indicators to be used for comparisons should be corrected for a number of characteristics (e.g. company size, strategy, multinationality), which makes the research too extensive and thereby may negatively influence the response rate. To avoid such threats, this research concentrated on investigating the perceptions of the subsidiary's CEOs about their subsidiary's performance: short term and long term performance as compared to competitors from the customers' perspective. The performance concept was measured by six questions on a 7-point Likert scale and had a reliability score of 0.83 (Cronbach Alpha), indicating a high level of reliability (Cortina 1993).

38 Generally, the managers were satisfied with their overall performance, especially in evaluating their short-term performance — 55% of the respondents stated accomplishment of the operational goals last year. When evaluating a subsidiary's position compared to its competitors, CEOs choose for a more moderated position. More than half of the subsidiaries' representatives positively evaluated their current position compared to their competitors, but only 15 % strongly agreed with the statement.

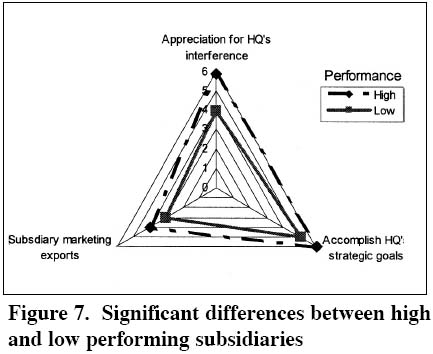

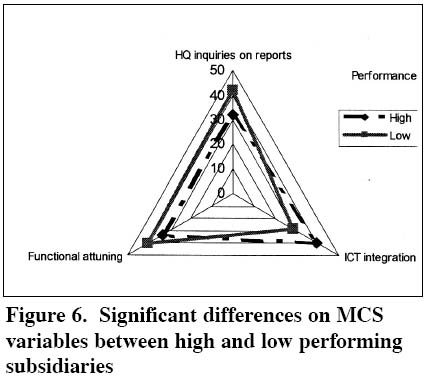

39 In the next step of the analysis, we created two clusters of higher and lower performing subsidiaries based on five questions related to performance. These groups were then compared for the differences on eleven variables of Management Control Systems. The level of ICT integration and the frequency of headquarters inquiries on submitted reports showed significant differences for two performance groups. The intensity of attuning of functional activities slightly missed the significance level in Kruskal-Wallis test but was significant when the median test was applied. Both the intensity of inquiries on submitted reports on sales turnover, production volume, market share development, R&D and human resource issues as well as the intensity of attuning with headquarters for these issues were higher in the low-performing group than in the high-performing subsidiaries. As to ICT integration, companies in the cluster with better performance were highly integrated with their headquarters. That is to say, they were able to forward and receive information much faster than the low-performance group. Figure 6 presents the higher rank mean values of inquiries and attuning for low-performing subsidiaries and a higher ICT integration of high performing subsidiaries. As we can see in Figure 7, the high performing group appreciate the headquarters interference and succeeded in accomplishing the headquarters' strategic goals. For the latter one we also questioned 16 managers from multinational headquarters based in France. The score was very similar to the response from the subsidiaries (mean value 5.6).

Figure 6. Significant differences on MCS

Display large image of Figure 6

Figure 7. Significant differences between high variables between high and low performing and low performing subsidiaries subsidiaries

Discussion and Conclusions

40 By combining the generic elements of TCE with social context and mutual interest from networks in this research, we showed the importance of a systems approach to this relationship. The extensive application of coordination activities in the management of foreign operations, especially concerning operational issues, confirms the necessity of incorporating coordination variables in the research on MCS. Control was used less often, at least concerning written reports. The monthly frequency indicates possible external obligations of the subsidiary concerning reporting to tax offices and other authorities.

41 The research showed some differences in MCS devices between subsidiaries clustered in three groups: active, receptive and autonomous. However the hypothesis 1 proposing a lower level of an overall management co-ordination for autonomous subsidiary can be only partially supported because active subsidiaries showed even lower level of coordination.

42 Hypothesis 2 predicting a highest extent of control for receptive subsidiaries again is supported only partially as autonomous subsidiaries received the highest score for control intensity. This is clearly in contradiction to the previous results (Cray 1984; Egelhoff 1984; Harzing 1999). The explanation could be in the environmental factors. Indeed, we found a positive correlation between environmental uncertainty (legal and political aspects) and number of personal contacts between the heads of different departments. The intensified contacts in an uncertain environment aim probably at reducing uncertainty of managing autonomous operations, particularly relating to a chance for opportunistic behaviour of subsidiaries' employees. It could also indicate that autonomous subsidiaries such as recognised in so-called Western-Countries do not exist in emerging economies in their pure form. In other words, the overall high level of interaction and intensified communication between headquarters and its polish subsidiaries prevents from somehow uncontrolled developments in subsidiaries such as those experienced by Dutch Ahold mentioned in the introduction.

43 The last hypothesis predicting the highest intensity of MCS for active subsidiaries must be wholly rejected. The theory suggested that this group of companies searches for feedback and cooperation from their subsidiaries in anticipation of changes in the market and customer tastes and to take advantage of opportunities of the dynamic environment. On the contrary, this group showed the lowest overall score for the MCS, both coordination and control. However, we saw that that many decisions are made jointly with the headquarters hence probably intensified coordination and control was not needed because of this joint decision process. We also controlled for the influence of external environment for the active subsidiaries and investigated the relationship between the dynamism of the environment and the coordination variables: The result showed that attuning of functional activities was positively correlated with changing customer tastes and intensity of competition (environmental dynamism). Moreover, the reports on motivation of the personnel, development of market share and R&D were positively correlated to the environmental munificence. These two positive correlations are in line with the hypothesis 3.

44 Two important conclusions could be drawn from the performance analysis. Firstly, the average performing subsidiaries seemed to need more intensified attuning of functional activities such as sales turnover, production volume, development of the market share, education and motivation of personnel, and product and process R&D. For this group of worse performing subsidiaries, headquarters asked more often questions on the submitted reports. So both control and coordination were used intensively. This is in line with the general accounting theory, which uses MCS to correct and adjust behaviour or actions to the planned track. The high ICT integration found in the well-performing group stresses the importance of availability and use of up-to-date (often realtime) information flow for management of foreign operations. It can compensate for the disadvantages of the geographical distance.

45 To conclude, our research has made two key contributions. First, the empirical results confirmed the complementary character of the control and coordination activities in the management of foreign subsidiary. It points out the practical relevance of the application of the management control systems to subsidiary management. Secondly, this research has attempted to increase our understanding of under-researched field of the international management in the emerging market of Central Eastern Europe.

Appendix

Number of Cases in each Cluster on Subsidiary role

Display large image of Appendix 1

MANAGEMENT CONTROL SYSTEMS

Display large image of Appendix 2

Kruskal Wallis test on two performance clusters

References

Andersson, U., & Forsgren, M. (1996). Subsidiary embededness and control in the multinational corporation. International Business Review, 5(5): 487-508.

Anthony, R. N., $ Govindarajan, V. (2001). Management Control Systems. New York, McGraw-Hill.

Bartlett, C. A., $ Ghoshal, S. (1998). Managing Across Borders: The Transnational Solution. Boston, MA, Harvard Business School Press.

Bartlett, C. A., $ Goshal, S. (1987). Managing across borders: New organizational responses. Sloan Management Review, pp. 43-52.

Birkinshaw, J. M., $ Morrison A. J. (1995). Configurations of strategy and structure in subsidiaries of multinational structure. Journal of International Business Studies, 26(4): 729-754.

Bremmers, H. J., Omta, S. W. F., & Smit, M. (2003). Managing environmental information flows in food and agribusiness chains: a study on the relationship between ICT development and environmental performance. Wageningen, Wageningen University.

Chakravarthy, B. S. (1986). Measuring strategic performance. Strategic Management Journal, 7: 437-458.

Chandler, G. N., & Hanks, S. H. (1993). Measuring performance of emerging businesses. Journal of Business Venturing, 8: 3-40.

Chenhall, R. H. (2003). Management control systems design within its organizational context: findings from contingency-based research and directions for the future. Accounting, Organizations and Society, 28(2-3): 127-168.

Chow, C. W., & Kato, Y. et al. (1994). National culture and the preference for management controls: An exploratory study of the firm— labour market interface. Accounting, Organizations and Society, 19(4-5): 381-400.

Cortina, J. M. (1993). What is coefficient alpha? An examination of theory and applications. Journal of Applied Psychology, 78: 98-104.

Covaleski, M. A., & Dirsmith, M. W. et al. (2003). Changes in the institutional environment and the institutions of governance: extending the contributions of transaction cost economics within the management control literature. Accounting, Organizations and Society, 28(5): 417.

Cray, D. (1984). Control and coordination in multinational corporations. Journal of International Business Studies, 15(2): 85-98.

Dess, G. G., & Robinson, R. B. (1984). Measuring organizational performance in the absence of objective measures: The case of privately-held firm and conglomerate business unit. Strategic Management Journal, 5(3): 265-73.

Doz, Y., & Prahalad, C. K. (1984). Patterns of strategic control within multinational corporations. Journal of International Business Studies, 15(2): 55-72.

Drury, C. (2000). Management & Cost Accounting. London, Thomson Learning.

Egelhoff, W. G. (1984). Patterns of control in U.S., U.K. and European multinational corporations. Journal of International Business Studies, 15(2): 73-84.

Egelhoff, W. G. (1988). Strategy and structure in multinational corporations: A revision of the Stopford and Wells model. Strategic Management Journal, 9(1): 1-14.

Epstein, M. J., & Manzoni, J.-F. eds. (2002). Studies in Managerial and Financial Accounting. Performance Measurement and Management Control: A compendium of Research. Amsterdam, JAI.

Epstein, M. J., & Roy, M. J. (2001). Sustainability in Action: Identifying and Measuring the Key Performance Drivers. Long Range Planning, 34(5): 585-604.

Galbraith, J. R. (1994). Competing with Flexible Lateral Organizations, Reading : Addison-Wesley.

Geringer, J. M. B., Paul W.; & daCosta, Richard C. (1989). Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal, 10(2): 109-119.

Goshal, S. & Nohria, N. (1989). Internal differentiation within multinational corporations. Strategic Management Journal, 10(4): 323-37.

Hair, J. F. J., & Anderson, R. E. et al. (1998). Multivariate Data Analysis. New Jersey, Prentice-Hall.

Hart, O. (1995). Firms, Contracts, and Financial structure. Oxford and New York, Oxford University Press.

Harzing, A.-W., & Sorge, A. et al. (2001). HQ-Subsidiary Relationship in Multinational Companies: a British-German Comparison. Challenges for European Management in a Global Context - Experiences from Britain and Germany. Retrieved 18-02-2003, 2003.

Harzing, A.W. K. (1999). Managing the Multinationals: An International Study of Control Mechanisms. Cheltenham, UK, Edward Elgar Publishing Limited.

Hennart, J. F. (1993). Explaining the swollen middle: Why most transactions are a mix of "Market" and "Hierarchy". Organization Science, 4(4): 529-547.

Hofstede, G. (1980). Culture's Consequences: International Differences in Work-related Values. Beverly Hills, London, New Delhi, Sage Publications.

Hoyle, R. H. (1999). Statistical Strategies for Small Sample Research. Thousand Oaks London, New Delhi, Sage Publications.

Kogut, B. (1984). Normative observations on the international value-added chain and strategic groups. Journal of International Business Studies, 15(2): 151-168.

Langfield-Smith, K. (1997). Management control systems and strategy: A critical review. Accounting, Organizations and Society, 22(2): 207-232.

Leeuw, A. C. J. d. (1994). Besturen van veranderingsprocessen: fundamenteel en praktijkgericht management van organisatie-veranderingen, Assen: Van Gorcum.

Little, R. J. A., & Rubin, D. B. (1987). Statistical Analysis with Missing Data. New York, Wiley.

Luo, Y., & Peng, M. W. (1999). Learning to compete in a transition economy: Experience, environment, and performance. Journal of International Business Studies, 30(2): 269-95.

Martinez, J. I., & Jarillo, C. (1991). Coordination Demands of international strategies. Journal of International Business Studies, 22(3): 429-444.

Martinez, J. I., & Jarillo, J. C. (1989). The evolution of research on coordination mechanisms in multinational corporations. Journal of International Business Studies, 20(3): 489 - 514.

Meyer, K. E. (1998). Entry into Transition Economies: Beyond Markets and Hierarchies. Kopenhagen: 31.

Mintzberg, H. (1983). Structure in Fives. Designing Effective Organizations. Englewood Cliffs NJ, Prentice Hall.

Nobel, R., & Birkinshaw, J. (1998). Innovation in multinational corporations: Control and communication patterns in international R&D operations. Strategic Management Journal, 19: 479-496.

Omta, S. W. F. (1995). Critical Success Factors in Biomedical Research and Pharmaceutical Innovation. Dordrecht, Kluwer Academic Publishers.

Porter, M. E. (1986). Competition in Global Industries. Boston, Harvard Business School Press.

Powell, W. W. (1990). Neither market nor hierarchy - Network forms of organization. Research in Organizational Behaviour, 12: 295-336.

Romesburg, C. H. (1984). Cluster Analysis for Researchers. CA, Lifetime Learning Publications Belmont.

Smit, J. (2004). Het drama Ahold. Amsterdam, Balans.

Williamson, O. E. (1998). Transaction cost economics: How it works: Where it is headed. De Economist, 146(1): 23-58.

Williamson, O. E. (1999). The Mechanisms of Governance. Oxford, New York, Oxford University Press.

Endnotes