Volume 2 Number 1 June 1999

This paper identifies and analyzes five best practices that were persistently present in the management of successful companies in the banking, financial and insurance sector in Sri Lanka.

INTRODUCTION

Although the Sri Lankan economy gained stability with a 6% GDP growth rate in 1997 and showed a declining rate of inflation, there were mixed signals for the financial industry. The delay in the implementation of large infrastructure development projects caused some concern. The monetary and fiscal policies of the government with bias towards low interest rates seemed favorable to promote investment. The effect of currency crisis in the Southeast and East Asian region has been to decrease investment in projects from that region in Sri Lanka. Yet high value added and quality producing customers of the sector were not so badly effected by this phenomenon. The past two decades showed growth in the industry in terms of institutions and services. Also, the focus of funding has recently shifted from large corporate customers to small and medium enterprises that form the key vehicle in the development strategy. Customers in these enterprises are from many segments and to serve them the sector needs to develop diverse products. The players in these segments thus need to be innovative. In this context, the sector is seen to emphasize corporate image, high brand values, and distribution networking. Increasing competition in the capital market and broadening of functions of commercial banks and financial institutions is experienced. This results in growing competition in the banking sector for lending opportunities. The division between development banking and retail banking is blurred and development banks increasingly redefine their role from re-financier to direct lender for small and medium industry projects, while retail banks finance high-risk customers.

All these trends indicate that the financial sector is growing increasingly customer-oriented, developing commitment in its employees, developing integrity to serve these needs and becoming increasingly socially committed. The successful players in this sector stand witness to these facts. This research identifies 5 best practices that were persistently present in the management of successful companies in this sector, which we would like to describe and name as: Lifetime Partnership with the Customer, Dedicating Skills to the Organization, Building Affective Commitment, Now before How, and Well Orchestrated Controls.

Ten organizations consisting of 3 developmental banks--Development Finance Corporation Bank (DFCC Bank), National Development Bank (NDB) and Vanik Incorporation Ltd.; 4 retail banks--Commercial Bank of Ceylon Ltd., Hatton National Bank (HNB), Sampath Bank, and Seylan Bank; 2 insurance companies--CTC Eagle Insurance Co. and Union Assurance and 1 leasing company--Lanka Orix Leasing Co. Ltd. (LOLC)--were chosen to be surveyed. All these organizations are within the top 50 companies as rated by Lanka Monthly Digest of December 1997 for the year 1996/97.

In-depth interviews with the Chief Executive Officers of these companies were conducted by a team of researchers of the Postgraduate Institute of Management. In order to get further insight into best practices identified by the researchers, further surveys were done by student teams. Interpretation of the findings and analysis was made on the basis of current theoretical perspectives of management and using the Balanced Scorecard format.

THE 5 BEST PRACTICES

BEST PRACTICE 1: Lifetime Partnership with the Customer

Studies on entrepreneurial growth in developing countries have shown

that one of the main problems is the dearth of entrepreneurs in them, or

rather the inability of locating them and energizing them into action.

Such entrepreneurship often lies dormant in villages and untapped regions

of the world. If so, capital which is the complement of entrepreneurship,

needs to find way to these potential enterprises if economic development

is to be fostered in a country. Naisbitt (1995) predicts the growth of

villages into supercities and from nation states to networks among other

megatrends. Smart financial companies would do well to tap resources by

identifying, retaining and developing them into an effective partnership.

There is evidence of this behaviour in our sample of financial companies.

Identifying Potential Growth Customers

HNBs' theme 'your partner in progress' is quite evident in its Gemi

Pubuduwa scheme, considered its most successfully marketed financial

product targeted at the rural segment through the concept of barefoot banking.

The scheme is driven by the vision of elevating the quality of life of

villagers through small enterprises achieving financial success. In pursuing

this vision, commitment of the bank is built at the very inception by selecting

animators from among the rural youth from target areas whose visions and

aspirations are consonant with the aims of the scheme. These animators

are trained accordingly in the method of barefoot banking by the bank and

perform their task by liaising with opinion leaders such as the chief priest

of the village and the Grama Sevaka or village headman. These animators

virtually take the bank into homes by foot. HNB has been able to mobilize

Rs. 640 Mn. in deposits and has advanced a sum of Rs. 700 Mn as at December

31, 1997 with a recovery rate of 97%. The scheme has become a major impact

on the growth of the bank itself. It is an example of genuine concern for

the people turned into a profitable relationship for both partners.

Potential resources in a village is seen when Seylan recently made to the general public an issue of 3,000,000 unsecured, redeemable five year debentures of Rs. 100 each. The issue was oversubscribed within a few hours of the opening on 30th September 1998. A further 3,000,000 debentures were issued and Rs. 600 Mn. was achieved by October 13, 1998, well before the closing date of October 29, 1998. The extraordinary feature of this was more than 90% of the subscriptions originated from places outside Colombo, as far as Dehiattakandiya. The success of the issue is attributable to Seylan being close to the customer even in far outposts.

Vanik's ventures go even further to the regions of SAARC, where its first overseas location in the region is Bangladesh. This is seen as an opportunity for Sri Lanka's financial skills to be advantageously used in the region to a new class of customers.

A persistent problem in entrepreneurship is the high rate of uncertainty in predicting the success of an entrepreneur. According to Sandberg (1986), in addition to the characteristics of the industry and markets the entrepreneur would venture into, his personal characteristics including psychology and ability are important. For this purpose accurate tools are required for prediction.

LOLC had developed comprehensive instruments for use during its interviews with clients who call in for leasing facilities. Weightages are assigned within the instrument for critical assessment features based on correlation of past experiences so that the net assessment of credit worthiness of the customer is assessed as a quantified index. HNB makes an assessment of the credit worthiness of its prospective partners in relation to their commitment to task during interviews with them, and go to higher levels of risk and relax collateral based on this assessment. Seylan too, due to its widely distributed network and the intimate knowledge of the customer and his need to have a long-term relationship with the bank, based on an assessment of the manager, would stretch its limits on credit. NDB, DFCC and Commercial banks too have already moved into tapping this resource.

Retaining Customers

Once identified and linked up, depending on the customer's needs and

capabilities, the customer is very soon aware of the services available

among competitors in the industry. Financial products therefore need to

be competitive in terms of being value adding through innovative augmentations

and extensions, as it is critical for the organization not to lose the

customer at this stage.

Our sample of financial institutions was aware of this fact and used various methods to realize customer commitment. Generally the offices of these institutions were friendly, inviting and comfortable in appearance. LOLC, in an effort to be more customer-focused, had gone through a re-engineering process in 1997, and as a result now deal with their entire customer needs in one spot. Back office operations are located away from front office areas and each front office area has a group of multidisciplinary officers to assist the customer comprehensively so that his questions and needs could be addressed at one spot.

NDB does this by establishing a single customer contact point. A customer is constantly in touch with a particular officer who sees to all his needs, visits him, and offers advice to help him through his work. UAL and Sampath expressed the need to continuously create value to the customer. Sampath's vision to be the 'most chosen bank in the new millennium' pushes the bank towards its role through virtual banking and constant contactability in a 'borderless organization'. Their new debit card is seen to ease the burden of purchaser in automatic double entry. The bank sees the customer as growing in individualism and would need the freedom to transact independently through the media, and seeks to support this freedom. Sampath therefore works towards being a network of electronic contact points of one-stop-shop booths and home centres supported by a remote backup of regional centres. CTC Eagle gives added value services to customers in the form of risk management and safety related advice.

As regards relational banking, HNB augments its Gemi Pubuduwa scheme by simplifying procedures in addition to providing soft securities, fast approvals and quick disbursements.

Developing the Partnership

The twin goals of national development and organizational development

are achieved through the continuous development of the customer in terms

of capability, and in products in terms of quantity, quality and complexity.

Developing the customer is a basis for mutual development of the partnership.

Our sample of financial institutions was seen to provide this support in

various ways. Developed customers go beyond mere requirements of loans

and go beyond generic products.

Sampath indicates that there is a growing tendency of customers to discuss their future with the bank. The 'account manager' concept at Sampath encourages and creates relationships with the customer based on this need, similar to the single officer relationship with the customer of NDB. The Gemi Pubudu scheme of HNB attempts to develop the entrepreneur further by providing technical, marketing and accountancy advice, and even finding market opportunities for products produced by entrepreneurs. Conducting entrepreneurial development programmes at locations too extends their focus on societal marketing. NDB's project officers who are in contact with their specific customers are trained to identify and diagnose problems of client's operations, and provide further consultancy services to them even at consessionary terms which may involve rescheduling financial facilities too. Further, the 'Top Ten Clients' awards are presented to selected customers, while their achievements are recognized by publishing them in NDB's magazine 'Achievers'. NDB also participates in equity of developed clients' projects, enabling the bank to participate in management of the project for mutual benefit of the client as well as the bank. A large percentage of the sample provide greater focus to these activities.

BEST PRACTICE 2: Dedicating Skills to the Organization

In a competitive environment, an organization needs to develop skills

of its employees in a unique way so as to have a competitive edge in the

industry. It is not only that these skills need to be developed to give

a high quality of performance, but that they need to also be as unique

and non-replicable in the industry as possible. To the extent that this

is possible, the core skills of the people would be dedicated to the organization.

This would give meaning to brand identity and unique value in the industry.

Development of such skills is possible through an organization that learns

by doing, learns by listening and learns by making. All organizations are

learning systems according to Nevis et. al. (1998), and three learning-related

factors are important for their success: 1. Well developed core competencies

that serve as launch points for new products and services, 2. An attitude

that supports continuous improvement in the business's value-added chain,

and 3. The ability to fundamentally renew and revitalize. Our sample of

financial organizations was critically aware of this and did so by placing

the human resource at the centre of the stage.

Learning by Doing

LOLC considers on-the-job training of employees more important than

book learning. Information gathered from past practices is used for continuous

improvement by correlating these practices to results obtained from performing.

The instruments developed in-house such as that used to assess customer

credit worthiness and the newly developed performance appraisal form are

outcomes of these efforts. Increasing contact with the customers, for example

in HNB's Gemi Pubuduwa scheme and the regional dispersion of banks such

as in Seylan and Commercial, provide focus on developing specific skills

suited for regions. NDB's identification of nine separate segments of customers

as Food, Beverage and Tobacco; Agriculture; Agro Business and Fisheries;

Textiles and Wearing Apparel; Wood and Paper Products; Rubber and Leather

Products; Metals, Chemicals and Engineering; Hotels, and Services; and

the allocation of a one-to-one contact of customer and officer, leads to

specialization and learning by doing. All other financial organizations

had similar specialization.

Learning by Listening

By far the largest effort in skill development in the financial sector

is the process of structured learning. Such learning in the sample was

provided by in-house training facilities, where particular skills identified

as important to the organization were imparted by local as well as foreign

consultants along with in-house resource persons. Off-the-job structural

learning for managers such as MBA was often sponsored by the organization.

Following such courses was said to provide cross-industry and cross-organizational

knowledge fertilization. Managers were also sponsored to follow foreign

MBA courses in addition to short-term skill courses in prestigious foreign

institutes.

CTC Eagle spends around Rs. 12 Mn. per annum on training and development, estimated by them to be around three times the current industry average in Sri Lanka. Training and development is particularly critical to HNB in its Gemi Pubudu Scheme. The bank exercises great care in selecting the animators called the Gemi Pubudu Upadeshakas, who are selected from the particular area of operation as they have a thorough knowledge of the area, people and the culture. They are then given a rigorous training to understand the concept of barefoot banking. In addition to the technical knowledge that they gain, they are also trained to be better communicators. In banks that have high-technologically intense environments training to work with the technology, yet retaining customer contact is particularly important. At Sampath, from the first day of induction, employees are trained to provide a superior service by combining the human touch enhanced by the technological capabilities of the system. There is a guideline at the bank which states that: 'any teller must be able to serve a customer at the counter within 50 seconds'.

Learning by Making

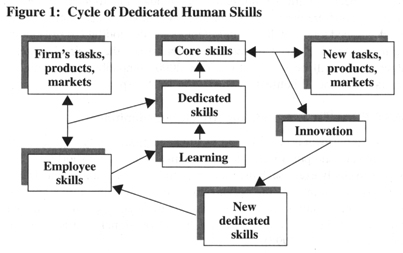

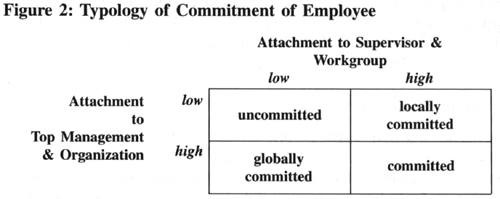

Innovation is the cornerstone of skill dedication. By focusing current

skills on current tasks, markets and products these skills are dedicated

to the organization, and by focusing these dedicated skills on new tasks,

products and markets that the organization ventures into innovation completes

the cycle of skill development. This is depicted in the following figure:

Innovation has been a key success factor at Vanik. Some of the innovative products introduced during its short period of existence (6 years since incorporation), in Sri Lanka are: (a) First lease securitization certificates in 1994; (b) First issue of share warrants in 1994; (c) First issue of unsecured quoted debentures in 1995; (d) Acquisition of the Forbes Group of Companies, the largest ever deal that has taken place at the Colombo Stock Exchange to date; (e) Announcement regarding the European Put Options; (f) Issue of the first Sri Lankan overseas credit card (Vanik Card), it being the first credit card issued by a local company in Bangladesh; (g) Arrangement for the issue of fully secured debentures guaranteed 50% by USAID and local bank; (h) Arrangement to use Web Factoring in Sri Lanka for the first time; (i) Establishment of 'Vanik Windoor' -- opening up of representative offices in different districts to popularise the capital market activities in rural areas; and proposal to set up an Index Fund and Capital Guarantee Fund to the securities and Exchange Commission of Sri Lanka.

Vanik has a culture that promotes innovation with cross-functional teams and an environment that allows mistakes to be made in the process of learning. Vanik establishes this environment in Bangladesh too. Bangladeshis working in Vanik's Bangladesh facility were specially trained in the Sri Lankan head office environment for a period substantial enough to carry the culture back home.

There was evidence that technological systems used by our sample were largely designed by in-house capability and often modified from international systems to suit local conditions. UAL and CTC Eagle show evidence of such capability. In the case of CTC Eagle, the software used for general insurance, purchased from software vendors based in Singapore, has been modified in-house to make it adaptable to local operations while the software used for the life insurance brand "Eagle Life" system was developed totally in-house and is continuously modified to suit changing needs. Vanik, UAL, Commercial and NDB say that their IT systems either are or will be well in time Year 2000 compatible and credit the assistance of the in-house IT expertise at least in part.

BEST PRACTICE 3: Building Affective Commitment

Commitment is central to motivation and productivity. The economics

of reward and punishment could be considered a more short-term and long-term

costly exercise than attitudinal inputs from commitment. Therefore it is

important that the organization builds, sustains and exchanges commitment

among its employees. Employment contracts in Japan have had many of the

important characteristics of relational contracts in particular (Morishima,

1996).

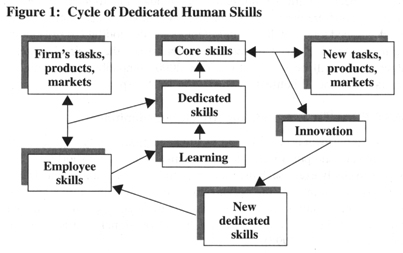

According to Hirchi (1969):

"...the more people feel bonded to society, the more effective are their inner controls. Bonds are based on attachments (having affection and respect for others), commitments (having a stake in society that you don't want to risk, such as a respected place in your family, a good standing in college, a good job), involvements (putting time and energy into approved activities), and beliefs (holding that certain actions are morally wrong)." (Henslin, 1993:200)Organizational Commitment also depends on the focus and base of commitment. Becher et al. (1993) describe qualitative differences of the focus of commitment arising from the extent of an individual's commitment to top management and organization as in combination with the extent of commitment to supervisor and work-group, in the following typology:

Organizational commitment is also the result of the acceptance of the

organization's goals, values and willingness to help the organization to

achieve its goals expressed by the desire to remain in the organization.

According to Sen (1982: 94):

"...commitment drives a wedge between personal choice and personal welfare, and much of economic theory relies on the identity of the two....The question is whether people behave egoistically often enough to justify economic theory. When it comes to their reasons for working, it is important to include morals and ethics, because to run an organization entirely on incentives to personal gain is pretty much a hopeless task."

Building Commitment

Our sample of financial organizations was seen to have taken effective

measures to create environments which are conducive to generate commitment

in their employees. They were aware that prime importance should be given

to recruiting people who had the right attitude to work. HNB's careful

recruitment of people with interest in their own region is seen as a requisite

to build commitment at the inception. LOLC states that near relations of

directors are not recruited and Seylan states that they have no bias towards

any particular ethnic or religious group, leaving recruitment to be done

solely on merit. UAL has a structured interviewing system whereby three

successive interviews are scheduled and persons are assessed on many criteria

including exterior personality, education, training and exposure, language

capabilities, ability and aptitude, extra-curricular activities, personality

and disposition, motivation, and circumstances. Outcomes of these assessments

are categorized into five levels of merit. The successive two panels carry

out the same procedure as well, the final panel consisting of the CEO,

the head of the division requiring the recruit, and the Assistant General

Manager of the HRD division. Vanik seeks people who would like to be led

rather than managed and could work independently with only guidelines.

At DFCC, multi-disciplinary skills are a key advantage for selection, and

of the 97 executive staff, 29 have multi-disciplinary qualifications.

Sustaining Commitment

A person may enter an organization with the right attitude and ability

but this can often be stifled by an organizational climate that is oppressive.

McGregor's Theory Y ideas about people particularly recognize that everyone

has imagination and can be creative, if the right atmosphere is there.

Our survey results supported this view.

One of the factors that divert commitment from the organization is the competing commitment to a trade union. Unique to Seylan was the existence of an in-house trade union where all employees other than the CEO were members. It has a written constitution, all office bearers are managers, and does not have any political affiliations. Grievances are handled with the general manager, and due to mutuality of interests, settlements are facilitated. This is a system in which dual commitment of an employee to the organization as well as the union is a possibility.

The vision of a company embodied in a brand such as CTC Eagle's is designed to generate commitment in employees. The following statements in its promotional brochure bear witness to this: "Our Promise: Unwavering and strong in its commitment.... The eagle is unsurpassed for sheer power and unwavering strength in flight - so too is the promise of Eagle. Unwavering and strong in its commitment...The eagle is well known for excellence of vision and its unfaltering pursuit of objectives - so too is the promise of Eagle. It's a far sighted commitment."

At LOLC, there is a mentor system whereby a senior manager is assigned to continuously guide the new recruit through his initial years. The management also has an open-door policy in its dealings with employees. For instance, if a member of the staff feels that another is abusing the open flexible and work-on-trust practices of the organization, he or she is encouraged to bring it to the notice of management rather than show loyalty to the individual. It is felt that if such abuse is not corrected it would spoil the opportunities for the other members of the staff and the company. Also at every staff or management meeting, there is an open forum to discuss decisions taken by the management. Constructive criticism is often encouraged and emphasized. The idea is to iron out differences and misunderstandings in order to achieve superordinate goals that are important for the survival of both the employee and the company.

The entire sample had comprehensive performance appraisal systems in place. All of them were one-to-one superior-subordinate appraisal systems. Every organization, however, has made some modification to the system as they were not entirely satisfied with them and expressed concern as to the validity of them. HNB particularly was concerned how well such systems took the Sri Lankan culture into consideration. They preferred annual informal interviews with executives, where they are given an opportunity to air their views about their career. HNB says that this open system of performance evaluation has helped the bank to assign staff members to sectors based on their strengths and preferences. NDB has reviewed its performance evaluation system twice and linked it to the reward system. The system starts with Management by Objectives (MBO) and performance is evaluated by targets using 4 rating scales. A component of the annual bonus is linked to the system and the recorded outcome is that at least 15% of employees perform outstandingly and at least 35% are rated good. UAL has modified the standard appraisal format by incorporating a five-step sequence of appraising to eliminate bias. The first step is carried out by the superior of the subordinate and the next by superior and his superior and so on ending at the final step with evaluation by a panel consisting of the AGM (HRD), the Head of the division the employee works in and the CEO.

Exchanging Commitment

Affective commitment of employees needs to be reciprocated by the employer.

Evidence of such behaviour often took the form of rewards which ranged

from gratifying expectation to totally surprising the employee. Vanik reports

on a practice where they delight employees who have gone beyond their duty

in doing extraordinary things for the company. Surprising the doer with

gifts and flowers rewards such deeds, or as the case may be even a trip

abroad, connected with business. CTC Eagle's 'hall of fame' is a special

unit within the head office, done up with dˇcor to signify respect and

honour, where employees whose dedication to duty and professionalism in

salesmanship are given an exclusive place by placing their gilt-edged framed

photographs within. Seylan has no restriction in upward mobility for committed

employees and a large proportion of people at the top had started at the

bottom. Employee shared ownership plans are another method that was used

to reward commitment. There was evidence that in the entire sample, reward

was directly related to merit.

BEST PRACTICE 4: Now before How

Customers of financial services should experience many 'moments of

truth' in receiving their services. There is no time for awaiting instructions

in competitive business. Gone are the times when a customer was kept waiting

by an indecisive employee. Employees need to be empowered, and to be so,

they need to have the necessary power, authority, responsibility, and access

to resources including information to make effective decisions. This would

make the employee confident and flexible to provide the customer's needs.

Following LOLC's business process re-engineering exercise in 1997 to identify non-value added functions and to change these processes, the organizational structure has been made flatter and the company's functional divisions were reorganized into self-directed teams. Team leaders lead these teams, and this enables the customer to be serviced from a single point of contact.

Seylan operates what they call a 'cellular organization' organizational structure, which is intended to give a large degree of autonomy for each operating unit and branch within the overall integrated structure. Each branch of the bank is an identified profit center, and each department such as marketing, internal audit, information technology, training centre and credit control are independent profit centres too. These branches, operating units and departments operate as Strategic Business Units, and invoice each other for services performed. This gives autonomy to the heads of these units for making decisions regarding prioritizing business and usage of resources.

HNB operates a committee system that speeds up decision making and moves it away from the centre. At head office level, there are 37 committees set up for the management of various functions and a senior member of the corporate management team heads each committee. At branch level, there are three main committees: the customer service committee, the marketing committee, and the recoveries committee. The number of committee members varies from 3 to 4 at the small branch level and 6 to 7 staff members at the large branch level. The customer service committee, for example, would search ways of improving customer service and inquire into complaints by customers and decide on ways of eliminating them. This committee continuously evaluates the service standards of the branch, and findings of the committee are presented to the branch manager and his collaboration is sought to implement improvements. The marketing and recoveries committees too operate on similar fashion, but they work towards quantified targets given by the manager. These targets lead to individual targets for individual managers. The average rate of performance of these committees is reported to be around 75%.

At Vanik, resource persons are centered into project teams from across

the organizational structure and each person is assigned specific tasks,

while the whole cross-functional team is responsible for the execution

of the project. Any delay in completion effects all members of the group,

and therefore the members share their work and are said to complete their

projects on time. A leader is appointed by consensus to be more a coordinator

than a director, and group members themselves are free to form sub-groups

for the purpose of fulfilling individual goals. The CEO is informed of

the stages of development of the project during its execution.

The high incidence of multiple skills among employees of DFCC makes

networking easier for managing projects. The investment banking division

and consultancy division are two areas where such networking is used to

advantage. Prior to bidding for an assignment, the head of the department

will, with the assistance of corporate management identify a few persons

who have composite skills to form the core team and will see the assignment

to completion. One of the most important assignments so far has been the

advisory mandate on the restructuring of the telecommunications sector

in Sri Lanka, including the privatization of Sri Lanka Telecom, DFCC provided

inputs in areas of investment banking, legal aspects and coordination of

all activities in Sri Lanka. For this assignment, DFCC formed a team consisting

of in-house experts in the fields of investment banking, finance, management

and law.

BEST PRACTICE 5: Well Orchestrated Controls

According to Wickens (1995:3):

"The ascendant organization combines high levels of commitment of the people and control of processes to achieve a synthesis between high effectiveness and high quality of life leading to long-term, sustainable business success"In our sample we observed that while performance controls were present, they relied more on cooperation rather than coercion. All organizations surveyed derived their controls from corporate plans. All corporate plans were bottom up as well as top-down designed. There was evidence that guidelines and targets for divisions and down to individuals were derived from them. In effect, all controls were found to be orchestrated to perform in harmony. Inspiration was often derived from the mission statement of the organizations that were intended to give direction to long-term action. Action plans derived from these corporate plans were supported by standard operating procedures. The virtuosity of the players has been built up through a process of skill dedication to be capable of performing in harmony. Networking and cross-functional teams backed by information technology were quite common.

Composing the Score

CTC Eagle has a rolling corporate plan with a horizon of 5 years. The

plan, once formulated has to be approved by the major shareholder Ceylon

Tobacco Company, which holds 63% of the share capital. The budgets drawn

from them reflect the expectations of this shareholder in terms of return

on investment. The scope of the document is not only restricted to financial

progress, but also gives specific direction to such factors as distribution

channels, product development, effectiveness of information technology,

human resource development and corporate image building. Once the major

stakeholder approves the budget, the CEO's objectives are derived from

it down to the objectives of each division and each individual. Yet, although

objectives seem to flow top to down, before approval by CTC and formulation

of the plan, objectives are established bottom-up by each individual. The

process complies with standard procedure of British American Tobacco Co.,

which has a large stake in CTC, and emphasizes documentation of all formal

procedure that flows from the plan. As such, payment guidelines, limits

of authority and exposure limits, formal IT policy, HRD policy, the brand

manual, investment philosophy and process, document retention policy, the

formal grievance handling policy and the adoption of the AIMR (USA) code

of ethics for fund management, are followed to ensure that standards are

met. The foreign shareholder has set international standards as benchmarks

for the company and its operations. This is reflected in the company's

vision statement, "We will be perceived by the public as the benchmark

financial services company in Sri Lanka."

Strategic Business Units provide specific focus on target markets and provide the necessary autonomy and clarity of purpose for pursuing corporate goals in each specific market. Immediately after the acquisition of the Forbes group of companies, all companies of the Vanik group were structured into six main sectors: Financial Services, Plantations, Plantation Services, Travel and Tourism, Real Estate and Food Products. The strategic investment made in 1998 by Vanik in Watawala Plantations Ltd. and the previously held Kahawatte Plantations Ltd. helps the tea brokering arm to generate substantial profits for the Vanik group. Although these SBUs are distinctly different and carry out different business activities, they function under the Vanik culture as one company.

Building Virtuosity and Performing in Harmony

Competition leads to competitive advantage. Competitive advantage could

be developed by dedicating skills to the organization and integrating with

the level of information technology available in the organization. IT provides

a powerful tool in concurrent control, as it gives real-time information

through networking. Successfully managed MISs enable organizations to make

timely and effective decisions for management control. Our sample firms

had established such systems mainly in operations areas, and showed indications

of moving into areas of strategic usage.

Vanik uses a IBM RS 6000 computer system. The accounting package has a general ledger module and several operating system modules. These modules have been internally developed and are continuously upgraded. Vanik has formulated an IT strategy as part of its overall strategy, and is presently carrying out a business process reengineering exercise which includes IT workflow solutions. CTC Eagle's use of IT is still mainly in the operations area although it uses IT also as a strategic tool for enhancing market/product services in a very limited way.

The role of the CEO in the use of IT could be considered a strength for future use of IT as a strategic tool. At UAL, the CEO heads the MIS steering committee. The CEOs technical competence in IT is also a factor of special importance. Sampath's top management being technologically driven is a critical success factor for the bank. The IT department is under direct supervision of the CEO. From its inception the bank has employed IT to support its operations as it was vital to support the UniBanking system which was a critical success factor for the growth of the bank. Sampath's MIS provides information on profitability of the bank, cost of funds and its movement, yield on advances, portfolio management including information on the money market and lending operations, management efficiency measured in terms of cost/income, profit/employee, cost/employee rations etc., treasury functions, return on shareholders equity, monthly reports on the performance of individual branches etc. Sampath's trends indicate phasing out of Automatic Teller Machines and replacing them by such systems as telebanking with interactive voice response software, Kiosks with audio-visual responses to simulate ATMs, and home banking through websites.

THE 5 BEST PRACTICES ON A BALANCED SCORECARD

According to Kaplan and Norton (1992), current performance measurement systems are inadequate in that they measure the impact of performance often in only one aspect, either finance or productivity as the case may be. Such indicators do not give a measure on the net or resultant impact on all aspects of the organization. After a year's research with 12 companies at the leading edge of performance, they devised a balanced scorecard - 'a set of measures that give top managers a fast but comprehensive view of the company'. Such a balance was assessed in four dimensions, providing answers to four basic questions: How do customers see us? (customer dimension); What must we excel at? (internal perspective); Can we continue to improve? (innovation and learning perspective); and How do we look to our shareholders? (financial perspective). According to the authors, such an approach is consistent with strategic orientations of management taking into consideration long-term orientations along with short-term requirements.

The five best management practices of our sample could also be assessed similarly by estimating the net impact of each of the five practices on four dimensions: External Orientation (contribution to customer value addition), Internal Orientation (internal process improvement), Present Orientation (current performance) and Future Orientation (future performance). As the level of research conducted on the sample was tentative, only a qualitative judgement is possible of the five practices on these four dimensions. This estimation is presented in Table 1.

Table 1. Impact of 5 Best Practices on the Balanced Scorecard

| Assessed Impact on Orientation | ||||

| Best Practice | external | internal | present | future |

| Lifetime Partnership with the Customer | Very High | High | High | Very High |

| Dedicating Skills to the Organization | Very High | Very High | Very High | Very High |

| Building Affective Commitment | High | Very High | Very High | Very High |

| Now before How | Very High | High | High | Very High |

Even on a five-point assessment from very low, through medium to very high, all practices could be judged to have either high or very high impact on all four dimensions of the balanced scorecard.

CONCLUSION

This research identified the five best management practices in a sample of 10 of the best companies in the sector. The findings of the research indicate that the level of managerial capability is steadily increasing. The research also shows that the companies surveyed are on a strategic orientation in that they are conscious of all orientations in the balanced scorecard. Forming lifetime partnerships with the customer are both long-term and mutually strategic for both the customer and the firm. Dedicating skills to the organization ensures that while developing skills and competencies of the employees, the firm, by making them unique to the organization, is on the path to achieve competitive advantage. There is also evidence that the companies are moving towards being HRD oriented since their HR practices are seen to give rise to achieving employees' affective commitment, a very high form of motivation. There is also evidence that these firms realize the need to empower employees to act now and not look around for direction from above, or be bound by structural constraints. Nonetheless, further research is needed to determine critical parameters that make these practices effective.

REFERENCES

Drucker, Peter F. (1975). Management tasks, responsibilities and practices, Bombay: Allied Publishers Private Limited.

Galliers, R.D., and Baker, B.S H. (1994). Startegic information management, Oxford: Butterworth & Heinemann Ltd.

Henslin, James M. (1993). Sociology, Boston: Allen and Bacon.

Hirschi, Travis (1969). Causes of delinquency, Berkeley: University of California Press.

Kaplan, Robert S. and Norton, David P. (1992). The Balanced Scorecard-Measures that Drive Performance. Harvard Business Review, January-February.

Morishima, Motohiro (1996). Renegotiating psychological contracts: Japanese style. In C.L. Cooper, ed. Trends in organizational Behaviour, 3.

Naisbitt, John (1995). Megatrends Asia, London: Nicholas Brealey Publishing.

Nevis, Edwin C, DiBella, Anthony J & Gould, Janet M. (1998). Understanding organizations as learning systems. Unpublished paper. Cambridge: MIT Organizational Learning Centre.

Sandberg, William R. (1986). New venture performance - the role of strategy and industry structure, Toronto: D Heath & Co.

Sen, Amartya, (1982). Rational fools? A critique of the behavioural foundations of economic theory, in A. Sen (ed.), Choice welfare and measurement, Oxford: Blackwell.

Wickens, Peter D. (1995). The ascendant organization, London:Macmillan Press Ltd.