An Examination of the Current Value Impact of a Leveraged Buyback Announcement

M. Nauman Farooqi

Mount Allison University, Canada Concordia University

Abstract

This research is aimed at studying the impact of a substantial share repurchase financed through debt (known as a Leveraged Buyback) on the value of the stock of a company. Prior research shows evidence of a positive average effect, but factors determining the magnitude of response for an individual company are not well understood. This study focuses on explaining variations in response to a leveraged buyback. The study suggested that shareholders like a LBB when the size of the LBB is small and the principle behind it is to supplement their dividend income. However, in cases when the company announces a substantial LBB the shareholders perceive it as bad news. This is because the shareholders feel that such a major restructuring of the capital structure at the hands of an untrustworthy management would put at risk not only their dividend income, but also their original investment.Introduction

1 The relationship between capital structure and value was one of the first problems in finance to be addressed using scientific methods. However, there is still much that is not known about how capital structure affects value. Numerous studies have focused on the value impact of changes in capital structure, including repurchase of common stock. Previous research (Loomis, 1985; Wansley and Fayez, 1986; Davidson and Garrison, 1989) has found that positive abnormal gains accrue to shareholders of firms, which enter into share repurchase deals. Their research does not, however, allow us to identify reasons for this abnormal increase.

2 This research is aimed at studying the impact of a Leveraged Buyback (LBB) announcement on the market price of the stock of a company. The research will further try to isolate variables, which may be responsible for this increase and can be used in the future to predict the market price performance of the stock of a company after an LBB announcement.

3 Previous research has identified several possible reasons for a share buyback, among the reasons cited include; to correct price-value divergences, to distribute excess capital, to fine tune the capital structure, to send signals to the market, to provide a tax benefit to shareholders, to avoid takeovers, to counter dilution effects of stock options, to provide for agency problem solution etc.

4 This research initiative has two main objectives. The first focuses on determining whether abnormal positive returns accrue as a result of an LBB announcement. The second part of the research will focus on identifying some of the possible variables which theory dictates may be responsible for this increase.

5 Theory suggests several possible reasons for these positive abnormal returns, these include: reduction of free cash flow or debt capacity, signaling of management's optimism, distribution of tax preferred income, and dividend clientele effect. Variables representing these reasons will be used as independent variables and regressed against the excess returns occurring at the announcement time.

6 The variables used to test for each possible explanation are as follows:

- Reduction of Free Cash Flow or Debt Capacity:

- Free Cash Flow

- Debt Ratio

- Return to Assets

- Market to Book Value

- Earnings to Price Ratio

- Signaling of Managements Optimism:

- Percentage of Management Ownership

- Distribution as Tax Preferred Income:

- Holding Period Return

- Dividend Clientele Effect:

- Retention RatioDividend Yield to Total Returns Ratio

7 This research effort will provide new evidence for students of capital structure by identifying some of the important variables that are responsible for the excess returns. Corporate managers will benefit from this research through identification of variables, which are perceived to be important to the shareholders. This information will benefit them in their strategies to maximize the wealth of the shareholders. The results of the research will also benefit regulators in their understanding of the pertinent variables that affect the value of the company in such transactions, thereby enabling them to better look after the interests of the shareholders.

Literature Review

8 Austin (1969) and Masulis (1976) through extensive surveys found that the most important purpose of repurchasing stock was the executive compensation plan. They also found that 57% of the shares repurchased between 1961 and 1967 were reissued to corporate insiders. Another reason cited by Vermaelen (1984) was to resist attempts by outsiders to take control of the firm. Insiders-managers especially want to signal to the market the true value if the stock is undervalued, and therefore a choice takeover target.

9 Wansley, Lane and Sarker (1989) conducted a survey of chief financial officers of large U.S. corporations to determine the managerial reasoning and attitude towards share repurchase. The survey found that managers did use share repurchase to signal to the market their confidence in the firm, thus supporting the information-signaling hypothesis of share repurchase. The survey results did not support the idea that share repurchase was conducted to boost the market price of stock that was low or because management's proportional ownership was down. Sinha (1991) presented a model in which managers of takeover targets use share repurchase to bond themselves to reduce perquisite consumption and increase investment in the firm.

10 The seminal papers on capital structure were written by Modigliani and Miller (1958, 1963) in which they showed that in the absence of taxes the value of a company was independent of its capital structure.

11 However in a world where the government subsidizes interest payments on debt capital by allowing companies to deduct interest payments as an expense, the company can increase its market value by taking on more debt. Given the assumptions of the model, MM showed that the value of the firm would be maximized when it takes on 100% debt.

12 Several additional empirical studies focus on the price impact of a share repurchase. However, the authors of these studies do not claim that the results support one theory or the other. These studies are summarized in the following paragraphs.

13 Loomis (1985) conducted a survey in which he analyzed the shareholder returns of companies that had voluntarily repurchased substantial portions of their common stock between the years 1974 and 1983. Loomis compared their returns with the SP 500 stock index and showed that the stock of the buyback companies showed an annual average return of 22.6% as compared to a return of only 14% on the SP 500 stock index. He stated that the buybacks performed well for the shareholders only in cases where the stock was initially undervalued.

14 Wansley and Fayez (1986) studied the impact of share repurchase announcements on the returns of security holders of Teledyne Corporation. They found that positive abnormal returns accrued to common shareholders. They also found that subsequent share repurchase announcements did not diminish the absolute level or the significance level. They concluded that a wealth transfer takes place from bondholders to the shareholders that nullifies previous contradictory evidence in this case.

15 Davidson and Garrison (1989) also studied the impact of share repurchases on the repurchasing firms common stock returns for the years 1978 to 1983. They found that the firms' that repurchased more than 18% of their stock had large cumulative abnormal returns (CAR) than those firms that repurchased less than 18%. They also found that firms which repurchased stock as a defense against takeovers had a negative reaction to their stock price. They found that the most statistically significant returns were observed for those companies that purchased undervalued stocks as an investment. Denis (1990) confirmed the negative price response to a defensive share repurchase.

16 Dann (1981), Vermaelen (1981, 1984), Lakonishok and Vermaelen (1990) and Comment and Jarrell (1991) also found support for significant positive announcement period returns for stock repurchase announcements.

17 Research in the area of share repurchase leads us to conclude that a share repurchase decision leads to an increase in the value of the company. This research, however, does not help us in understanding and correctly identifying the factors responsible for this increase. Although several factors have been suggested, research has not been directed to link specific reasons to an increase in the value of the firm in an LBB, as such more research needs to be done in this area.

Reasons for share repurchase to affect value ( top)

18 A share repurchase involves a voluntary transaction by individual shareholders in which they tender their shares to the firm at a price, which is higher than the prevailing market price of the stock. A stock repurchase leads to a decrease in the number of shares outstanding. Share repurchases are interesting because they combine changes in capital structure with cash payments to the shareholders.

19 Several motives have been identified for a firm, which plans a LBB. The objective could be to raise the stock price (Dan, 1981; Masulis, 1980, 1983; Cornett and Travalos, 1989; Varaiya and Badrinath, 2001) or to further some other interest of management. Possible stock price related motives include:

- To use repurchase as a signaling device to send positive signals to the market concerning the financial health of the firm. (Guthart, 1965; Chirelstein, 1969; Norgaard and Norgaard, 1974; Stewart, 1976; Ross, 1977; Ahrony and Swary, 1980; Dann, 1981; Vermaelen, 1981; Asquith and Mullins, 1983; Handjinicolaou and Kalay, 1984; Ofer and Thankor, 1987; Mitchell and Robinson, 1999)

- To decrease the number of outstanding shares to increase the EPS. (Barrons, 1989; Mitchell and Robinson, 1999; Varaiya and Badrinath, 2001).

- To provide a tax benefit to the shareholders (Bierman and West, 1966; Chirelstein, 1969; Miller and Scholes, 1978; Ramaswamy, 1979; Vermaelen, 1981; Varaiya and Badrinath, 2001).

- To benefit from the tax deducibility of interest payments on debt raised to repurchase shares. (Modigliani and Miller, 1958, 1963).

- To correct stock price-value divergences. (Wu, 1963; Guthart, 1965; Young, 1967; Pratt and DeVere, 1968, Lorie and Niederhoffer, 1968; Jaffe, 1968; Nantell and Finerty, 1974; Stewart, 1976; Dittmar, 2000; Varaiya and Badrinath, 2001)

- To provide an agency problem solution (Torabzadeh and Bertin, 1986; Davidson and Garrison, 1989; Gupta and Radhakrishnan, 1991; Gupta and Rosenthal, 1991; Sinha, 1991; Garvey, 1992).

- To benefit corporate insiders who can detect and exploit price-value divergences. (Wu, 1963; Jaffe, 1968; Lorie and Niederhoffer, 1968; Pratt and DeVere, 1968).

- To attain an optimum leverage position, (Masulis, 1980; Dittmar, 2000; Varaiya and Badrinath, 2001).

- To use excess cash flow, which otherwise would be wasted by management. (Jensen, 1986a; Nohel and Tarhan, 1998; Barth and Kasznik, 1999; Dittmar, 2000; Varaiya and Badrinath, 2001).

- To consolidate the ownership of the company's stock. (DeAngelo, 1988; Mitchell and Robinson, 1999).

- As a defensive strategy to avoid a takeover (Sliver and Vishny, 1986; Dittmar, 2000).

- Flexibility offered by repurchase plans compared to dividends (Mitchell and Robinson, 1999, Jagannathan and Stephens, 2000).

- This research will focus on the stock price related reasons for share repurchase.

20 In the absence of market imperfections, the tender price does not affect the total wealth impact of a LBB. It does, however, effect the distribution of wealth between the tendering and non-tendering shareholders. The wealth distribution effects of a LBB are discussed in this section. First, a model of the wealth distribution effects of the tender price is developed. Then, practical considerations in price setting are summarized.

Research Design and Methodology

A model of wealth impact of the LBB ( top)

21 The purpose of this section is to examine how the price will be expected to respond around the announcement of a LBB. Previous research has shown that the announcement of a share repurchase has a positive effect on the price of the stock in the time immediately after the announcement.

22 We assume that an amount of total wealth "w" is created by the LBB. The expected relationship between the stock price before

and after the LBB announcement is:

P

a = P

b + w/N

b (1)

where:

- P = price of the stock.

- N = number of shares outstanding.

- b = time period immediately before the announcement of the LBB.

- a = time period immediately after the announcement of the LBB.

Setting price in a LBB ( top)

23 In order to motivate some of the existing shareholders to tender their shares for repurchase, the firm must offer them an incentive, or in other words some gain which represents present value of the expected future gain to the company. The value of the premium, which is paid over and above the prevailing market price of the firm's shares, has to be carefully decided by the firm. It should not be so low that an insufficient number of shareholders tender their shares. At the same time it should not be so high that the remaining shareholders do not get any share of the increase.

24 The two commonly used methods of pricing are a fixed tender price, set by the company after consulting its investment bankers, and a Dutch auction. In either case all tendering shareholders receive the same price. Thus the previous wealth distribution model holds for either pricing method (Gay, Kale and Noe, 1991). Research conducted by Comment and Jarrell (1991) showed that the signal was stronger for fixed price tender offers than for Dutch auction offers. They concluded that the fixed price tender offer sent a more powerful signal. Hausch, Logue and Seward (1992) confirmed their results. Lie and McConnell (1998) studied the earnings signals in fixed-price and Dutch auction sell-tender offers and found no difference in earnings improvements between the two types of offers.

25 The shareholders of the firm consist of different types of investors with individual investment preferences, different tax brackets, and different risk preferences. Thus investors in each category will tender only if the premium paid out to them compensates them for their transaction costs and results in a profit, net of taxes.

26 The firm, in consultation with its investment bankers, decides on the number of shares it wants to repurchase and decides on a premium, which will motivate a sufficient number of shareholders to tender their shares. Because the firm faces a supply curve of shareholders, the premium will be such that it will motivate investors with a certain risk-return preference.

27 An event study methodology was used to test the hypothesis. Event studies have been used in the past (Brown and Warner, 1980; Jensen and Ruback, 1983; Trifts and Scanlon, 1987; Mikkelson and Partch, 1988; Cornett and Sankar De, 1988; Schweitzer, 1989; Trifts, Sieherman, Rosenfeldt and Cossio, 1990) to explore abnormal returns accrued to shareholders during mergers, re-capitalization and restructurings, to measure the extent to which bad news affects banks stock returns, and to measure response to new information concerning a group of firms in a particular industry. The event studied in this research initiative is a substantial LBB. An ordinary least squares market model was used to estimate the expected returns. Market model coefficients were calculated using the estimation period t = -30 to t = -180. As the announcement relating to the event could be spread around in a number of days, three alternative event windows, t = (-10,10), t = (-10,0) and t = (-1,0) were investigated. The performance of the sample stock was studied in relation to the performance of a benchmark for the market, in this case the CRSP equally weighted market index with dividends.

28 The main hypothesis focuses on the question of whether average excess returns are realized in a LBB. The remaining hypotheses

are designed to provide evidence with regard to the possible reasons for a positive response to a LBB.

Hypothesis: There is no difference between the stock price before the announcement of a LBB and the stock price immediately

after the LBB.

29 In the second part of the analysis cumulative excess return for each security (CERi) were used as a dependent variable to

run a regression analysis. The independent variables in the analysis were variables that may have an impact on the LBB. These

have been discussed earlier. The regression equation used is:

(CERi) = a0 + a1X1i + a2X2i + a3X3i + a4X4i +a5X5i + a6X6i + a7X7i +a8X8i + a9X9i+a10X10i + a11X11i + a12X12i + a13X13i +

a14X14i + a15X15i + Ei (2)

30 The following definitions for the independent variables was used in the regression analysis. These variables were calculated using the four quarters of financial statements immediately preceding a date 30 trading days before the announcement of the LBB. The data was taken from the Compustat files.

- Cash Flow: (X1) The cash flow measure will be the sum of the net income, depreciation and amortization divided by the total assets of the company.

- Size of the company: (X2) The size of the company can be determined by the total assets of the company.

- Debt Ratio: (X3) The Debt Ratio is obtained by dividing the total liabilities by the total assets.

- Percentage of Management Ownership: (X4) This is obtained by dividing the number of common shares owned by management by the total number of common shares outstanding.

- Defensive/Non-defensive Repurchase: (X5) This is a dummy variable. The value "1" will be used in case the buyback was a defensive repurchase and the value of "0" will be used to denote a non-defensive repurchase. The information concerning defensive/non-defensive share repurchase will be obtained from the Wall Street Journal Company News Index.

- Effect of Tax Law of 1986: (X6) This dummy variable will study the effect of he 1986 tax law change on the excess returns.

- Percentage of Shares Repurchased: (X7) This is given by dividing the number of common shares repurchased in the buyback by the total number of common shares outstanding.

- Return on Assets: (X8) This variable is obtained by dividing the net income by total assets of the company.

- Market to Book Value: (X9) This is given by dividing the market value of common stock by the book value of common stock. The market price of the stock is its price 30 days prior to the announcement; adjusted for all stock splits, stock dividends etc.

- Earnings to Price Ratio: (X10) The earnings to price ratio is the earnings per share divided by the price of the stock 30 trading days prior to the announcement.

- Stock Price Growth: (X11) This is the geometric mean HPR for the estimation period t = -30 to t = -180.

- Retention Ratio: (X12) This is the earnings per share dividend by dividends per share.

- Previous Announcement: (X13) This dummy variable will identify those companies, which repurchase shares on a regular basis.

- Dividend Yield to Total Return: (X14) Dividend yield is given by dividing the dividends for the 12 months starting 30 days prior to the announcement by the total return for the stock.

- Return on Assets/Free Cash Flow Ratio: (X15) This dummy variable will identify those companies in the sample, which had low profitability; measured by return on assets, and high free cash flow relative to the median of the sample.

Sample and Selection ( top)

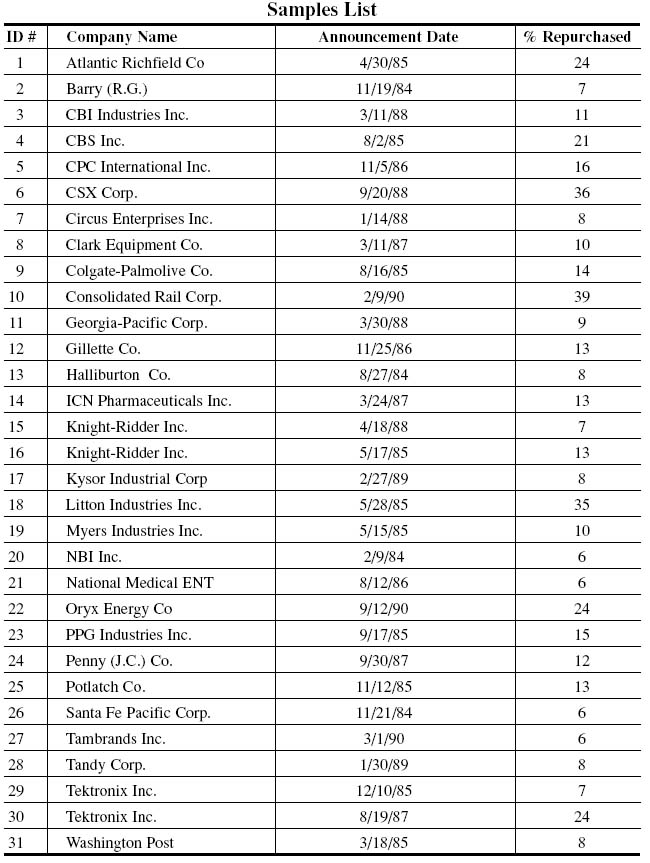

31 The sample for the research were selected from the Wall Street Journal General News Index between the years 1983 to 1991. Some of the major criterion included; the company should have repurchased at least 5% of its common stock from the market by raising at least 50% of the repurchase cost through raising debt. The company should also have been listed on either the New York Stock Exchange or the American Stock Exchange. The study did not include companies that repurchased their stock because of a greenmail threat. These companies were omitted from the sample by tracking them down in the Wall Street Journal Company News Index and checking for any news of a greenmail offer. The event date was decided to be the first announcement of the LBB in the Wall Street Journal. Initially 180 companies were targeted but the list was narrowed down to 31 companies that met the sampling criteria.

32 Most of the data was obtained from the Compustat Data Retrieval System at the St. Louis University's School of Business Computer Laboratory. Some of the variables were collected manually from the St. Louis University's Pius Library, Washington University's Business School Library, University of Chicago's Library, and also by writing directly to the companies. The following table provides a list of companies used.

Samples ListResults

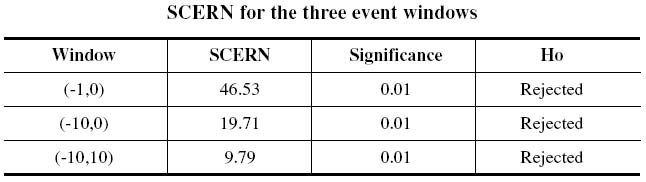

33 Standardized Cumulative Excess Returns (SCERN) for three event windows were calculated to study if excess returns were generated as a result of the LBB announcement for three event windows; (-1,0), (-10,0) and (-10,10). The results obtained from this testing led to the rejection of the Null Hypothesis at the 0.01 level of significance for all the three event window periods.

SCERN for the three event windows

Display large image of table 2

34 The regression model was used to explain the relationship between excess returns and some independent variables. The regression was run using the most significant excess return for the event window (-1,0) as the dependent variable. The goal of the regression runs was to obtain independent variables that were individually significant and resulted in a jointly significant model, at the same time, which met all the requirements of the regression procedure.

35 The Micro TSP package version 6.5 was used for the statistical analysis of the regression runs. The package allows for adjustments for some of the common problems faced with regression analysis. The problem of Autocorrelation is tackled through the use of the Durban-Watson Statistic. Another technique, Autoregressive Correlation Correction, was also used to deal with Autocorrelation. Finally Multicollinearity between the independent variables was checked through the use of a Correlation Matrix.

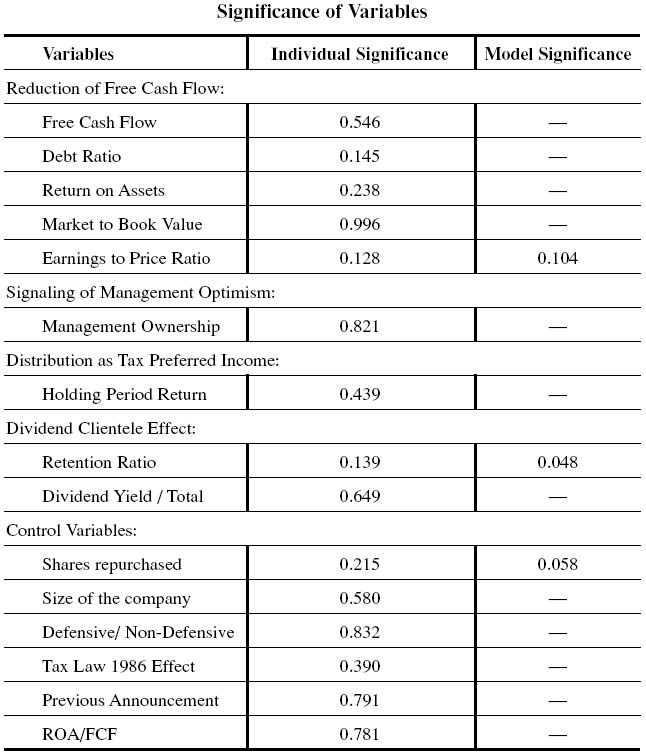

36 The variables X1, X2, X4, X8, X10, X14, X15 showed excessively high correlation values. The deletion of X1, X2 and X8 resulted in the solution of the correlation problem between the above-mentioned variables. The following table shows the significance of variables.

Significance of Variables

Display large image of table 3

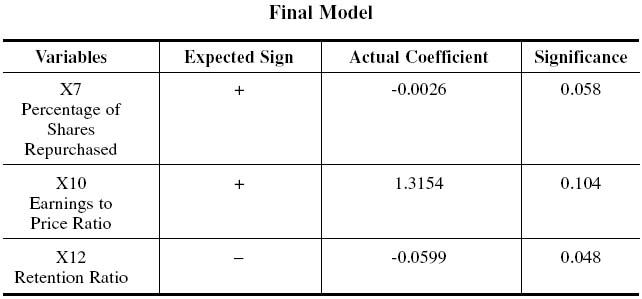

37 Several runs of the regression equation were made and some of the variables were deleted in the process because of their high correlation with other variables and some because of their insignificance towards explaining the model. The final iteration revealed a model in which three independent variables - percentage of shares repurchased (X7), Earnings to Price Ratio (X10), and Retention Ratio (X12) - meet the conditions set forth in the regression model. They were all individually significant at the 90% level of confidence and also jointly significant at the 95% level of confidence. The final model consisted of the following variables:

Final Model

Display large image of table 4

38 These three variables explained around 27% of the relationship between excess returns and the independent variables. The final iteration showed a Durban-Watson Statistic of 2.03526, which is well within the ideal range (around 2.00). The regression model is significant at the 95% level of confidence. The relationship between the earnings to price ratio and excess returns was significant at the 90% level of confidence and between retention ratio and excess returns significant at 95% level of confidence. One of the control variables used, percentage of shares repurchased, was significant at the 94% level of confidence.

Summary and Conclusion

39 Using three event windows, (-1,0), (-10,0), and (-10,10), the results obtained led to the rejection of the null hypothesis at the 99% level of confidence. The average excess return for the (-1,0) period, for example, was 0.0130221. Thus, this research validates the findings of the previous research that positive abnormal returns accrue as a result of a share repurchase, and extends these to include LBB announcements. The results also develop a model, which consists of three variables whose effect on the abnormal returns has been proven to be significant.

40 The signs of two of the coefficients in the final model; earnings to price ratio and retention ratio, are as expected. However the coefficient of the variable percent of shares repurchased has a sign that was not expected. Possible explanations for this unexpected sign are discussed later.

41 The earnings to price ratio shows a directly proportional relationship with excess returns, thereby implying that the excess returns are inversely proportional to the price-earnings ratio. In other words, the stocks of companies, which have lower price-earnings ratios, respond more positively to an LBB announcement, relative to those with high price-earnings ratios. A low price-earnings ratio is usually interpreted as meaning that investors are not optimistic about the performance of the company. It appears that in these cases shareholders prefer that managers return the money to them. Badrinath and Varaiya (2001) reported that investors of companies with poor performance, which conducted a stock buyback program, looked at the buyback as being favorable and welcomed the return of capital via the buyback.

42 The retention ratio is inversely proportional to the excess returns, implying that the payout ratio (inverse of retention ratio) has a direct relationship with the excess returns. Thus, investors appear to respond more favorably to a buyback that supplements dividends than to a buyback that is used as an alternative to dividends. These observations about the price-earnings ratio and payout ratio can be used to interpret the somewhat surprising result that a small LBB is preferred over a large LBB.

43 A low price-earnings ratio suggests that the shareholders are not satisfied with the way management is looking after the affairs of the company. In cases like these when management announces a small LBB, the announcement appears to be received as good news by the shareholders of the company. This may be because they consider the LBB to be a supplement to their dividend income. The shareholders are pleased with the extra income they receive through a small LBB. Furthermore, this action removes free cash flow and debt capacity from management control.

44 However, when the management of these companies announces a substantial LBB, this news is received as bad news by the shareholders of the company. This may be because, given the fact that the shareholders are not satisfied with the performance of management, a substantial LBB would involve a major restructuring of the capital structure of the company. This change will involve an increase in the leverage of the company, eroding the shareholders claim in the company, at the same time jeopardizing their dividend payments as the leverage would call for higher interest payments. Since the shareholders already lack faith in the management, they also lack faith in management's ability to handle the new challenges caused by these changes.

Limitations of the study ( top)

45 This study consisted of a sample of 31 companies. Originally 180 companies were targeted, but the list was narrowed down to the 31 companies in light of the criteria of the research design. The study only used those companies in the sample that traded their stock on either the New York Stock Exchange or the American Stock Exchange. The time frame for the study spanned nine years, from 1983 to 1991. The study also selected those companies that repurchased their stock through public tender offers and not through any other means. An estimation period of 150 days was used for the calculating the expected returns for the sample.

46 The sample was not restricted with regard to any other financial or economic information, apart from the announcement of a greenmail offer, which might have had an effect on the excess returns generated in a LBB. In cases where there was a public record of a greenmail offer the study excluded those companies from the sample.

47 Because of these criteria, the sample is not randomly drawn from the universe of LBB's. Obviously there is no way to be certain that the results of this sample can be extended to the LBB population as a whole.

Implications for future research ( top)

48 In view of the limitations discussed earlier, a number of possibilities exist for further research. The first could be to increase the sample size by studying a much longer time frame. Another option could be include those companies whose stock is traded over the counter.

49 The excess returns were significant for the three event windows studied. A new study could be focused on finding more precisely the time when news of the announcement is actually incorporated into the price by the shareholders.

50 The study focused on companies which repurchased more than 5% of their stock through a LBB, further research could be directed towards studying the impact of very large and comparatively small scale LBB's.

51 Share repurchase transactions have been on the increase and in recent years have leap-frogged the corporate issues of new stock. In early 2000 over $ 50 billion worth of buyback deals were announced in the United States. In view of these developments it will be interesting to explore if the results of this research can be compared for a later time frame.

52 Ikenberry, Lakonishok and Vermaelen (2000) studied stock repurchases in Canada and found abnormal performance over a three year holding period. Future research can be directed at looking at the Canadian repurchases and the factors that may be responsible for this result on similar lines of investigation as this research.

53 A new study could also incorporate the effect of other financial and economic news that may have an effect on the stock price during the LBB announcement time frame. This study could evaluate the true impact of the LBB announcement after discounting for the price effect of other financial and economic news concerning the company.

References

Aharony, J., and I. Swary (1980). Quarterly dividend and earnings announcements and stockholders' returns: An empirical analysis. Journal of Finance, 35, 1-12.

Ang, James S., and A.L. Tucker (1988). The shareholder wealth effects of corporate greenmail. Journal of Financial Research, 11, 265-280.

ANONYMOUS (1987). The restructuring wave: A new fact of life. Buyouts and Acquisitions (July/August), 23-27.

Asquith, P., and D. Mullins (1983). The impact of initiating dividend payments on shareholders' wealth. Journal of Business, 56, 77-96.

Austin, D. (1969). Treasury stock reacquisition by American corporations 1961-67. Financial Executive, 13, 40-61.

Badrinath, S.G.and N.P. Varaiya (200). Share repurchase: To buy or not to buy. Financial Executive, 17, 43.

Bagwell, Laurie S. (1992). Dutch auction repurchases: An analysis of shareholder heterogeneity. Journal of Finance, 46, 71-105.

Barth ME, and R. Kasznik (1999). Share repurchases and intangible assets. Journal of Accounting and Economics, 28, 211-241.

Baxter, N. "Leverage (1967). Risk of ruin and the cost of capital. Journal of Finance 22, 395-403.

Bianco, A., Z. Schiller, L. Therrien, and M. Rothman (1986). A flurry of greenmail has stockholders cursing. Business Week, 2916 (December 8), 32-34.

Bierman, H., and R. West (1966). The acquisition of common stock by corporate issuers. Journal of Finance, 21, 687-696.

Bradley, M., and L. Wakeman (1983). The wealth effect of targeted share repurchases. Journal of Financial Economics, 11, 301-328.

Brigham, Eugene (1964). The profitability of a purchase of its own common stock. California Management Review, 7, 69-76.

Brown, K., L. Lockwood, and S. Lunner (1985). An examination of event dependency and structural change in security pricing models. Journal of Financial and Quantitative Analysis, 20, 315-335.

Brown, S.J., and M. Wanstein (1985). Derived factors in event studies. Journal of Financial Economics, 14, 491-495.

Brown, S., and J. Warner (1980). Measuring security price performance. Journal of Financial Economics, 8, 205-258.

Brown, S.J., and J.B. Warner (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14, 3-31.

Chirelstein, Marvin A. (1969). Optional redemptions and optional dividends: Taxing the repurchase of common shares. The Yale Law Journal, 78, 739.

Coates, E.R., and A.J. Fredman (1976). The price behavior associated with tender offers to repurchase common stock. Financial Executive, 44, 40-44.

Comment, R., and G.A. Jarrell (1991). The relative signaling power of Dutch auction and fixed-price self-tender offers and open market share repurchases. Journal of Finance 46, 1243-1277.

Cornett, M., and Sankar De (1988). An examination of stock market reactions to interstate bank mergers. Southern Methodist University Working Paper (September).

Cornett, M.M., and N. Travlos (1989). Information effects associated with debt-for-equity and equity-for-debt exchange offers. Journal of Finance, 44, 451-468.

Corrado, C.J. (1989) A non-parametric test for abnormal security price performance in event studies. Journal of Financial Economics, 23, 385-395.

D'Mello, R., and P.K. Shroff (2000). Equity undervaluation and decisions related to repurchase tender offers: An empirical investigation." Journal of Finance, 55, 2399-2424.

Dann, L.Y. (1981). Common stock repurchases: An analysis of returns to bondholders and stockholders. Journal of Financial Economics, 9, 113-138.

Dann, L., and H. DeAngelo (1983). Standstill agreements, privately negotiated stock repurchases and the market for corporate control. Journal of Financial Economics, 11, 275-300.

Davidson, W.N., III, and S.H. Garrison. "The Stock Market Reaction to Significant Tender Offer Repurchases of Stock: Size and Purpose Perspective." Financial Review 24 (February, 1989): 93-107.

DeAngelo, H., and R.W. Masulis (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8, 3-29.

Denis, David J. (1990). Defensive changes in corporate payout policy: share repurchases and special dividends. Journal of Finance 45, 1433-1456.

Dielman, T., and T. Nantell, and R. Wright (1980). Price effect of stock repurchasing: A random coefficient regression approach. Journal of Financial and Quantitative Analysis, 15, 175-189.

Dittmar, A.K. (200). Why do firms repurchase stock?. Journal of Business, 73, 331-355

Dodd, P., and J.B. Warner (1983). On corporate governance: A study of proxy contests. Journal of Finance, 38, 401-438.

Downes, David (1980). Discussion of stock repurchases by tender offer: An analysis of the causes of common stock price changes. Journal of Finance, 35, 319-321.

Elek, Steven, III (1986). Tax impact of restructuring on shareholders. Journal of Buyouts and Acquisitions 4, 57-62.

Elton, E.J., and M.J. Gruber (1968). The effect of share repurchase on the value of the firm. Journal of Finance, 23, 135-149.

Fama, E.F. (1983). Agency problems and the theory of the firm. Journal of Political Economy, 8, 361-400.

Fama, E.F., L. Fisher, M.C. Jensen, and R. Roll (1969). The adjustment of stock prices to new information. International Economic Review, 10, 1-21.

Friend, I., and L.H.P. Lang (1988). An empirical test of the impact of managerial self intent on corporate capital structure. Journal of Finance, 43, 271-281.

Garvey, G.T. (1992). Leveraging the underinvestment problem: How high debt and management shareholding solves the agency costs of free cash flow. Journal of Financial Research, 2, 149.

Gay, G.D., J.R. Kale, and T.H. Noe (1991). Shareholder repurchase mechanisms: A comparative analysis of efficacy, shareholder wealth and corporate control effects. Financial Management (Spring): 44-57.

Gelb, D.S. (2000). Corporate signaling with dividends, stock repurchases, and accounting disclosures: An empirical study. Journal of Accounting, Auditing and Finance, 15, 99-120.

Golz, W.C., Jr. (1986) Valuation and LBO's. Buyouts and Acquisitions, 4, 41-44.

Gupta, A., and Leonard Rosenthal (1991). Ownership structure, leverage and firm value: The case of leveraged recapitalizations. Financial Management (Autumn), 69-83.

Guthart, Leo A. (1965). More companies are buying back their stock. Harvard Business Review, 43 (March/April), 41-53.

Guthart, Leo A. (1967). Why companies are buying back their own stock. Financial Analysts Journal, 23 (March/April), 105-110.

Handa, P., and A.R. Radhakrishnan (1991). An empirical investigation of leveraged recapitalizations with cash payout as takeover defense. Financial Management (Autumn), 58-68.

Handjinicolaou, G., and A. Kalay (1984). Wealth redistributions or changes in firm value. Journal of Financial Economics, 13, 35-63.

Hanson, Robert C. (1992). Tender offers and free cash flows: An empirical analysis. The Financial Review, 22, 185-209.

Harris M., and A. Raviv (1988). Corporate control contests and capital structure. Journal of Financial Economics, 20, 55-86.

Hausch, Donald B., Denis E. Logue, and James K. Seward (1992). Dutch auction share repurchases: Theory and evidence. Journal of Applied Corporate Finance, 5, 44-49.

Heinkel, A., and A. Kraus (1988). Measuring event impacts in thinly traded stocks. Journal of Financial and Quantitative Analysis, 23, 71-88.

Holderness, C., and D. Sheehan (1985). Raiders or saviors? The evidence on six controversial investors. Journal of Financial Economics, 14, 555-579.

Houston, J., and J.D. Mallese (1983). Financial characteristics of significant share repurchases. Paper presented at Mid West Finance Association meeting St. Louis, MO. (April).

Ikenberry D, J Lakonishok, and T Vermaelen (1995). Market underreaction to open market share repurchases. Journal of Financial Economics, 39, 181-208.

Ikenberry D, J Lakonishok, and T Vermaelen (2000). Stock repurchase in Canada: Performance and strategic trading." Journal of Finance, 55, 2373-2397.

Jagannathan M., C.P. Stephens, and M.S. Weisbach (2000). Financial flexibility and the choice between dividends and stock repurchases. Journal of Financial Economics, 57, 355-384.

Jaffe, J.F. (1974). Special information and insider trading. Journal of Business, 47, 120-135.

Jensen, M. (1986). The takeover controversy. Midland Corporate Finance Journal, 4, 6-32.

Jensen, M.C., and W.H. Meckling (1976). Theory of the firm: managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 11, 305-360.

Jensen, M., and R. Ruback (1983). The market for corporate control. Journal for Financial Economics, 11, 5-50.

Jensen, M., and C. Smith (1985). Stockholders, managers and creditors interests: Application of agency theory. In E. Altman and M. Subramanium (eds), Recent Advances in Corporate Finance. Homewood, IL: Irwin Publishing Company, 93-132.

Kalay, A., and A. Shimrat (1986). Firm value and seasonal equity issues, price pressures, wealth redistributions or negative information. New York University Working Paper.

Kaplan, Steven 1989). Management buyouts: Evidence on taxes as a source of value. Journal of Finance, 44, 611-632.

Karafaith, I. (1988). Using dummy variables in the event methodology. The Financial Review, 23, 351-357.

Kim, E. Han (1978). A mean variance theory of optimal capital structure and corporate debt capacity. Journal of Finance, 33, 45-63.

Kitching, John (1989). Early return on LBO's. Harvard Business Review, 67 (November/December), 74-81.

Klein, A., and J. Rosenfeld (1988). The impact of targeted share repurchase on the wealth of nonparticipating shareholders. Journal of Financial Research, XI, 89-97.

Kraus, A., and R.H. Litzenberger (1973). A state of preference models of optimal financial leverage. Journal of Finance, 28, 911-922.

Lakonishok, J., and T. Vermaelen (1990). Anomalous price behavior around repurchase tender offers. Journal of Finance, 42, 455-477.

Lang, Larry H.P., Rene' M. Stulz, and Ralph A. Walking (1991). A test of free cash flow hypothesis. Journal of Financial Economics, 29, 315-335.

Leland, H., and D. Pyle (1977). Information asymmetrics, financial structure and financial intermediaries. Journal of Finance, 32, 371-387.

Lie E., and J.J. McConnell (1998). Earnings signals in fixed-price and Dutch auction self-tender offers. Journal of Financial Economics, 49, 161-186.

Litzenberger, R.H. (1986). Some observations on capital structure and the impact of recent capitalizations on share prices. Journal of Financial and Quantitative Analysis, 21, 59-71.

Litzenberger, R., and K. Ramaswamy (1979). The effect of personal taxes and dividends on capital asset prices: Theory and empirical evidence. Journal of Financial Economics, 7, 114-164.

Loomis, C. 1985). Beating the market by buying back stock. Fortune, (April), 42-48.

Lorie, J.H., and V. Niederhoffer (1968). Predictive and statistical properties of insider trading. Journal of Law and Economics, (April), 35-53.

Maletesta, P., and Rex Thompson (1985). Partially anticipated events: A model of stock price reaction with an application to corporate acquisitions. Journal of Financial Economics, 14, 237-250.

Masulis, R.W. (1978). The effect of capital structure change on security prices. Unpublished Ph.D. Dissertation University of Chicago.

Masulis, R.W. (1980). The effect of capital structure change on security prices: A study of exchange offers. Journal of Financial Economics, 8, 139-177.

Masulis, R.W. (1980). Stock repurchases by tender offer: An analysis of causes of common stock price changes. Journal of Finance, 35, 305-319.

Masulis, R.W. (1983). The impact of capital structure change on firm value: Some estimates. Journal of Finance, 38, 107-126.

McConnell, J.J., and G.G. Schlarbaum (1981). Evidence on the impact of exchange offers on security prices: The case of income bonds. Journal of Business, 54, 65-85.

McConnell, J.J., E. Han Kim, and P.R. Greenwood (1977). Capital structure rearrangements and me-first rules in efficient capital markets. Journal of Finance, 32, 789-809.

McDonald, B. (1987) Event studies and systems methods: Some additional evidence. Journal of Financial and Quantitative Analysis, 22, 495-504.

McNally, W.J. (1999). Open market stock repurchasing signaling. Financial Management, 28, 55-67.

Mikkelson, W.H. (1980). Convertible security calls and security holder returns: Evidence on agency costs, effect of capital structure change and supply effects. Unpublished Manuscript, University of Oregon.

Mikkelson, W.H. (1985). Corporate capital structure in the U.S. Chicago, IL: University of Chicago Press.

Mikkelson, W.H., and M.M. Partch (1988). Withdrawn security offerings. Journal of Financial and Quantitative Analysis, 23, 119-133.

Miller, M. (1977). Debt and taxes. Journal of Finance, 32 , 261-275.

Miller, M.H., and M. Scholes (1978). Dividends and taxes. Journal of Financial Economics, 6, 333-364.

Mitchell, J.D., and P. Robinson (1999). Motivations of Australian listed companies effecting share buy-backs. Abacus 35, 91-119.

Modigliani, F., and M. Miller (1958). The cost of capital, corporation finance and the theory of investment. American Economic Review, 48, 261-297.

Modigliani, F., and M. Miller (1963). Corporate income taxes and the cost of capital: A correction. American Economic Review, 53, 433-443.

Myers, S., and N. Majluf (1984). Corporate investment and financing decisions when firms have information that investors do not have. Journal of Financial Economics, 13, 187- 221.

Nantell, T.J., and J.E. Finnerty (1974). Effect of stock repurchase on price performance. Paper presented at the Financial Management Association Meeting, San Diego.

Narayan, M.P. (1985). Managerial incentives for short-term results. Journal of Finance, XL, 1469.

Noorgard, R., and Corine Noorgard (1974). A critical examination of share repurchase. Financial Management, 3, 44-50.

Nohel T., and V. Tarhan (1998). Share repurchases and firm performance: new evidence on the agency costs of free cash flow. Journal of Financial Economics, 49, 187-221.

Ofer, A.R., and A.V. Thakor (1987). A theory of stock price responses to alternative corporate cash disbursement methods: Stock repurchases and dividends. The Journal of Finance, 42, 365-394.

Owers, J.E., and R.C. Rogers (1992). The pricing of tax shields and merger premiums. Financial Review 1, 71-105.

Peavy, J.W., and J.A. Scott (1985). The effect of stock for debt swaps on security returns. Financial Review, 20, 303-327.

Peterson, Pamela (1989). Event studies: A review of issues and methodology. Quarterly Journal of Business and Economics, 28, 36-66.

Pourian, H., and Carroll D. Aby Jr. (1983). Event study methodologies in the financial structure: Event conditions, the date and the issue of distribution. Financial Review, 56, 77-96.

Pratt, S.P., and C.W. DeVere (1968). Relationship between insider trading and ratio of returns for NYSE Common Stocks: 1960-66. Unpublished Paper presented to the seminar on Analysis of Security Prices.

Rappoport, A. (1987). Converting merger benefits to shareholder value. Mergers and Acquisitions, 21, 49-55.

Rappaport, A. (1987). Stock market signals to managers. Harvard Business Review, 65 (Nov/Dec), 57-62.

Ravid, S.A., and O.H. Sarig (1991). Financial signaling by committing to cash outflows. Journal of Financial and Quantitative Analysis, 2,: 165.

Rogers, R.C., and J.E. Owers (1985). Equity for debt exchanges and stockholders wealth. Financial Management, 14, 18-26.

Rosenfeld, A. (1982). Repurchase offers: Information adjusted premiums and shareholder response. Working Paper Purdue University.

Ross, S.A. 1977). The determination of financial structure: The incentive signaling approach. Bell Journal of Economics>, 8, 23-40.

Seitz, Neil E. (1982). Shareholder goals, firm goals and firm financing decisions. Financial Management, 11, 20-26.

Schweitzer, R. (1989). How do stock returns react to special events. Business Review (July/August), 17-27.

Shleifer, A., and R. Vishing (1986). Greenmail, white knights and shareholders' interests. Rand Journal of Economics, 17, 293-309.

Sicherman, Neil W., R.L. Rosenfeldt, and Francisco de Cossio (1990). Divestiture to unit managers and shareholder wealth. Journal of Financial Research, XIII, 167-172.

Sinha, Sidarth (1991). Share repurchase as a takeover defense. Journal of Financial and Quantitative Analysis, 26, 233-244.

Stewart, Bennet G., and David M. Glassman (1988). The motives and methods of corporate restructuring. Journal of Applied Corporate Finance, 1, 79-88.

Stewart, Samuel, Jr. (1976). Should a corporation repurchase its own stock. Journal of Finance 23, 911-921.

Stulz, R.M. (1988). Managerial control and voting rights, financial policies and market for corporate control. Journal of Financial Economics, 20, 25-54.

Thompson, R. (1985). Conditioning the return generating process on firm specific events: A discussion of event study methods. Journal of Financial and Quantitative Analysis, 20, 151-168.

Torabzadeh, K., and W. Bertin (1985). Analysis of shareholder returns of acquired firms: LBO's vs. other acquisitions. The Financial Review, 20, 115.

Torabzadeh, K., and W. Bertin (1986). Excess returns to shareholders of firms acquired in stock exchange, cash offers and LBO's. The Finance Review, 2, 87-92.

Torabzadeh, K., and W. Bertin (1987). Leveraged buyouts and shareholder returns. Journal of Financial Research, 10, 313-319.

Trifts, J., and K. Scanlon (1987). Interstate bank mergers: The early evidence. Journal of Financial Research, 10, 305-311.

Trifts, 4J., N.W. Sicherman, R.L. Rosenfeldt, and Francisco de Cossio (1990). Divesture to unit managers and shareholder wealth. Journal of Financial Research, XIII, 167-172.

Vermaelen, T. (1981) Common stock repurchases and market signaling: An empirical study. Journal of Financial Economics, 9, 139-184.

Vermaelen, T. (1984). Repurchase tender offers, signaling and managerial incentives. Journal of Financial and Quantitative Analysis, 19, 163-181.

Wansley, J.W., and E. Fayez (1986). Stock repurchases and security holder returns: A case study of teledyne. Journal of Financial Research, 9, 179-191.

Wansley, J.W., W. Lane, and S. Sarkar (1989). Managements view on share repurchase and tender offer premiums. Financial Management (Autumn), 97-110.

Warner, J. (1977). Bankruptcy costs: some evidence. Journal of Finance, 32, 337-347.

Williams, J. (1988). Efficient signaling with dividends, investments and stock repurchases. Journal of Finance, 43, 587-591.

Wu, Hsiu-Kwang (1963). Corporate insider trading profits and the ability to forecast stock prices. Elements of Investment 33, 45-63.

Young, A. (1967). The performance of common stock subsequent to repurchase. Financial Analysts Journal, 23, 117-121.