The Skinny on Being Narrow: A Longitudinal Study on the Influence of Niche-Width in the Presence of Market Turbulence

Andrew Gaudes

University of New Brunswick, Canada

Abstract

This study examines whether product specialization offers retailers greater performance in a period of market turbulence. Incumbent retailers of home improvement products were followed over six years (1995-2001) comprising a period before, during, and after a period of environmental turbulence generated by the entry of large format retailers Home Depot and Revy to the Winnipeg market. Data collection involved survey, interview, and observational methods of 58 participants. Niche width was operationalized using four different methods, yet no significant difference could be found in the performance of organizations that specialized or generalized in home improvement products. This finding goes against much of the cross-sectional research on product specialization and niche strategies in retail, underscoring the importance of longitudinal study in research on organizations.1 Market analysts and strategists have offered incumbent retailers a myriad of strategies to position themselves for market turbulence from the entry of large-format retail stores. Yet, storeowners are still left scratching their heads, unable to launch any meaningful response to the strategic 'ploy' (Mintzberg, 1987) of 'everyday low prices' that large-formats place in the minds of consumers (Litz and Stewart, 1996; Peterson and McGee, 2000; Barber and Tietje, 2004). The Incumbent retailers struggle with the need to select a particular niche width that will make them competitive once again in the presence of large-format retailers. Should they specialize, offering a narrow but deep line in a particular area of retail home improvement products or should they generalize by offering a wide variety that caters to a broad array of home improvement items?

2 This study followed incumbent retailers of home improvement products over six years (1995-2001), comprising a period before, during, and after the entry of Home Depot and Revy to the Winnipeg, Manitoba market. In 1995, Winnipeg was a rather stable market, comprised of locally owned home improvement stores and national retailers of moderate size. There were no large-format sellers of home improvement products to contend with. Within two years of the arrival of the first large-format store only two-thirds of the incumbents remained. What characteristics did these surviving stores possess that enabled them to compete in the same market with the large-format retailers? This study utilizes literature from niche theory within population ecology to examine the differences between firms that survived and those that failed during the period of market turbulence experienced by incumbent retailers of home improvement in the Winnipeg market. A brief review of literature in population ecology and niche width are presented with context from prior research on large-formats in order to generate the hypothesis. Research methods, analysis and findings are then presented. The paper concludes with a discussion.

Literature Review

3 Population ecology has its origins in biology and ecology, a concept that regards natural selection or "survival of the fittest" as a means of explaining the success of one organism over another by virtue of having the right combination of characteristics to successfully adapt and thrive in their environment (Aldrich, 1979). The population ecology perspective fits well here since this study attempts to explain why certain organizational characteristics resulted in one-third of study participants failing. Fitness in organizations is defined as "the probability that a given form of organization would persist in a certain environment" (Hannan and Freeman, 1977; 937). Organizations that have a 'fit' with the environment are better suited and therefore 'selected' by the environment for survival while those that are less fit fail to continue existing in their current state and then are selected out. In the context of this study, incumbent retailers that did not have a fit with the retail home improvement market in Winnipeg failed.

Niche Theory

4 In niche theory, two similar organizations with the same environmental requirements cannot exist in the same time and space without competition. Competition between existing organizations in the same environment ensues when they compete for the same limited set of resources (Hawley, 1950; Hannan and Freeman, 1989; Baum and Korn, 1996). Organizations that are of greatest similarity will be in greatest competition. As a result, organizations will vie for areas of distinction that allow them to minimize any overlap, often exploiting a narrower set of resources not sought out by other organizations. This narrow set of resources has been identified in organizational ecology with terms such as a "niche" (Carroll, 1985), or "market" (Baum and Korn; 1996). While some organizations will pursue "specialization" via niche, others will look towards a "generalization" approach.

5 The distinction between specialism and generalism is often based upon the "width of the niche" -- the range of environmental dimensions across which a population exists (Carroll, 1985); or "market domain" -- the set of markets in which a firm operates (Baum and Korn, 1996; p. 256). Porter (1996) has characterized this activity as the "variety-based" approach for positioning an organization - drawing upon a specific subset of an industry's products and services. Specialists will maximize their focus in a particularly narrow niche. Incumbent retailers in home improvement that focus upon products such as paint or plumbing supplies are considered "specialists" in this study. By specializing, they reduce "niche overlap" (Baum and Singh, 1994) or "domain overlap" (Baum and Korn, 1996), thereby reducing exposure to competitive forces, but they assume greater risk of becoming irrelevant if the environment's resources were to shift completely beyond their niche (Hannan and Freeman, 1977). Generalists accept a lower level of risk from shifting resources by distributing their focus over a wider niche, thereby providing a wider spectrum of goods and services within a given environment (Hannan and Freeman, 1977). In return, generalists average their outcomes over a wide range of conditions. Incumbent retailers deemed generalists in this study are stores that offer a wide variety of products that cater to home improvements. "Generalist organizations compete in a variety of domains simultaneously, whereas specialists focus on only one or a limited few" (Carroll, 1985; p. 1266).

6 In a stable environment, generalists and specialists can find equilibrium: specialists relying upon a narrow band of resources within an environment, leaving the remaining environment for others; and generalists relying upon a broad spectrum of resources, but not so much in any specific area as to be in direct conflict with specialists. Prior to the entry of Home Depot and Revy, the Winnipeg home improvement market would have fit the definition of "stable" (Khandwalla, 1977). According to research in population ecology, in a stable market, specialists will be able to out-compete generalists in their given area (Hannan and Freeman, 1977). However, when the environment becomes unstable due to external shocks, then generalists and specialists alike are exposed to a more turbulent environment and become vulnerable to losing necessary resources to survive.

7 Increased competition in the market due to the entry of large-format retail to a region would deem an environment as turbulent leading to a reduction in performance or firm failure (Khandwalla, 1977). "The competitive environment is in continual flux, as customers, suppliers, and competitors enter and depart, as technologies evolve, and competitive initiatives are launched and countered in the arena" (Dess and Picken, 1999; p. 104). Heightened competition can increase the 'niche density' such that it affects the finite carrying capacity of an environment. The turbulence generated by the entry of competition leads to a "shake out" (Porter, 1985) where unfit firms struggle. This prompts an adjustment where incumbents either 'escape' from their original niche (Delacroix et al, 1989), or experience organizational 'death' (Hannan and Carroll, 1992). The incumbents that remain once equilibrium has been reestablished comprise a population that, in general, demonstrates the best fit with the new environment's competition and market demand (Aldrich, 1979; Delacroix et al, 1989; Hager, Galaskiewicz, Bielefeld, and Pins, 1999).

8 Carroll (1985, 1987) found in a study of daily newspapers that when competition was increased beyond the carrying capacity of the market, the death rate of generalist newspapers increased, while that of specialist newspapers decreased. "Increased concentration among general dailies enhances life chances of specialized newspapers" (Carroll, 1985; p. 1273). This would suggest that, from a pre-entry standpoint, incumbent retailers that specialize should enjoy better performance over generalists during the period of turbulence. However, Baum and Korn (1996) found in their study of competitive rivalry of California commuter airlines that when the degree of multi-market contact, or domain overlap between firms increased, competition in one market was attenuated by the potential for retaliation in another market similarly held by the two firms. This 'mutual forbearance' meant that close competitors in multi-markets may not actually be the most intense rivals. Instead, multi-market firms may focus upon single-market holders or specialists that possess a market domain overlap in a single area (p. 257). This finding suggests the opposite effect from an environmental shock from increased competition within a given ecological niche. So, mixed signals are received on this particular characterization of the firm.

9 However, in the context of retail, there appears to be greater consensus on the discussion of specialists or generalists in the presence of increased competition. Miller, Reardon, and McCorkle (1999) found that while the entry of large format retail may create initial market turbulence, the long term effects result in a positive market where small retailers and large formats may coexist. McGee and Rubach (1996) compared the effectiveness of different strategies when 238 small independent retailers perceived the environment as 'hostile' or 'benign' following the recent arrival of Wal-Mart in their trade area. They found that in terms of overall performance, the strategy of 'target marketer' (providing products that address a specific market segment or niche) was the best among four strategies to apply in a hostile environment (an environment where the presence of a Wal-Mart is deemed to have made an impact on their business). The strategy of 'variety' (emphasis placed upon product variety) was rated lowest in performance. When retailers perceive their environment as 'benign' (the presence of a Wal-Mart is deemed to not have made an impact on their business) the strategy of 'target marketer' (carrying relatively deep lines of unique and highly recognizable products) generated the greatest net income after tax of the three strategic approaches studied.

10 These findings suggest that, in both hostile and benign environments, retailers that focus upon product depth and specialization will generate greater performance than incumbents that engage in product breadth and variety. Litz and Stewart (1998) found that independent retailers tend to reduce product diversity, instead increasing upon service diversity or complexity. Furthermore, they parallel McGee and Rubach's (1996) findings that under high competition situations independents tend to become more niche-oriented in their products, opting for depth over breadth. Barber and Tietje (2004) also found that smaller stores, in the presence of large-formats, will find market opportunities by niching. It would appear that research in retail suggests a specialist approach in the presence of large-format retail. However, Litz and Stewart (1998) and McGee and Rubach (1996) did not utilize longitudinal methods that included pre-entry data collection in their research. As well, Barber and Tietje, 2004, focused on three retail stores in a given community, two incumbents and the entering Home Depot, while collecting consumer data two months prior to the entry of Home Depot and then six months post entry. The sample and data collection period may not have been sufficient to have witnessed any 'shake out' effects from the entering large format retailer.

11 Given the above discussion on the effect of the environment on organizations, and the difference in performance found in research

that categorized organizations as "specialists" and "generalists" the following hypothesis is presented.

Hypothesis In the presence of market turbulence as the result of increased competition from entering large-format retailers,

incumbent retailers that occupy a narrow niche will outperform incumbent retailers that occupy a wide niche.

Methods

13 A significant contributing element offered by this study is the rare look into the activities undertaken by numerous incumbent retailers at the pre-entry, entry, and post-entry stages of a large-format retailer. Based upon my review of the literature, no other study has looked at the impact of entering large-format retailers in a longitudinal analysis that includes pre-entry data with incumbent retailers as the unit of analysis. The data for this study was collected over six years in Winnipeg, Manitoba; a city rated as Canada's most economically diverse and closest in matching the overall economic diversity of Canada (Moody's Investors Services, 2000). The first wave of data collection, 1995, was prior to the physical presence of Home Depot or Revy in Winnipeg. However, rumours had already started that two large-format home improvement retailers would soon become part of the local retail market. The second wave occurred in 1997, a point at which Revy and Home Depot had entered the market. The third period of data collection occurred in 1999, which would reflect a point where both Revy and Home Depot had settled into the local retail market. A fourth and final collection of data occurred in 2001. This last wave completed three full periods of study and was limited to confirming whether or not the remaining incumbent home improvement stores in 1999 were still in existence, thereby determining the effect that their stated strategies in the 1999 data collection had on their operations two years hence.

14 The sampling frame applied for the first wave of collection (1995) was the local yellow pages, in which firms that met the sampling criteria were randomly selected for the study. The selection criteria had three requirements. First, businesses had to have a product line that would overlap with the products offered by Home Depot or Revy. The product sectors in home improvement included lumber/building supplies; paint/wall-paper/blinds; flooring/carpet/ vinyl; hardware; electrical/heating; lighting/fans; plumbing; kitchen/bathroom cabinets; and lawn/garden. Second, the business had to operate within the business trading area that Home Depot and Revy would be entering, which covers about 465 square kilometers, comprising the geographical area of the city of Winnipeg. Third, retail sales had to account for more than half of the business generated by the store.

15 In total, 72 retailers were contacted in T1 (1995) to participate in the study. Of the 72, data were received from 58 stores, for a response rate slightly over 80%. Sampling in subsequent waves of data collection (1997, 1999 and 2001) was limited to participants in the initial wave of data collection. Therefore, periods of data collection after the first wave (T1) were limited to the initial 58 participants. However, initial criteria still had to be maintained for a participant to remain in the study. If, for example, a study participant relocated to an area beyond the region in the study they would be deemed as having exited the competing market area and that would have been noted as a failure to compete with the large-format stores.

16 Over the span of the study, 20 of the 58 stores experienced firm failure, terminating their competition with the big box stores. At T2 (1997) twelve of the 58 incumbent stores had failed. By T3 (1999), eight more failed. A fourth survey in 2001 found that the incumbent population had stabilized, with total firm failure remaining at twenty. The total failure rate for the duration of the study was slightly under 35% (34.48%).

17 Data collection involved survey, interview, and observational methods. The application of the three methods allowed for triangulation of data (McGrath, 1982), generating support for findings collected in each of the three methods, as well as offering a richness of detail not necessarily found when limited to fewer methods. The results should increase the ability to draw conclusions from the study (Scandura and Williams, 2000). For example, statements made by storeowners could be compared against corresponding data found in the survey or by observations made onsite.

18 Dillman's Total Design method (1978) was utilized in order to develop and administer the survey instrument. With the help of a trained research assistant familiar with the home improvement industry, pilot testing of the 1995 survey was performed on a few Winnipeg businesses and later refined, dropping or adjusting questions as necessary. The survey instrument adopts the format designed by Litz and Stewart (1996) as a template, with the intent of gaining understanding of each retailer's products offered, customers served, and prior year's performance.

Operationalization of Independent Variables ( top)

19 Niche width has been applied in a variety of industries, with the bases for a firm's degree of generalization or specialization being reliant upon relevant contextual knowledge of their industry (Carroll et al, 2002). This has resulted in a myriad of ways to categorize niches across industries. Litz (1997) reported that firms could niche along five distinct bases, one of which includes product/service characteristics (p. 15). Porter (1980) stated that one of the most effective methods in which firms could specialize is to focus upon "a tightly constrained group of products" (p. 208). Moreover, Porter (1985) instructed that to identify particular product types or 'segments' an individual should isolate all products based upon physical distinction. For the purpose of this study, home improvement products were distinguished along fourteen different categories based upon the products offered by Home Depot or Revy, including segments such as building hardware, tools, plumbing and lumber: The more that a firm focused upon a particular segment, the narrower their niche. Based upon this distinction, four different methods of establishing a firm's niche were developed; specialists and generalists, retail store typology, niche focus, and niche width score.

Specialists and Generalists ( top)

20 Population ecologists have characterized organizations as generalists or specialists for several decades (particularly following Hannan and Freeman, 1977) in order to discuss competition among organizations that differ along a single environmental dimension (niche width). I applied this method in categorizing retail home improvement stores and classified each store, based upon their reported product variety, and my knowledge of the industry. This combination provided the sufficient institutional information to assign the product niche of retail home improvement stores, which is an accepted approach to niche categorization (Dobrev et al, 2001). Retailers in this study were deemed specialists if their products mainly focused upon any one of the fourteen product areas identified in the survey with limited variation. Examples of specialist firms are paint stores, or flooring. Generalist stores would provide a wider focus in products, crossing into multiple product types. Examples of generalists would be general home improvement stores or merchandisers that cross into multiple product categorizations.

21 The number of specialists dropped from 40 at T1 to 32 at T2. By the end of the study 27 remained. The failure rate of specialists was 32.50%. Generalists reduced from 18 (T1) to 14 (T2), stopping at 11 by T3, for a failure rate slightly below 39% (38.9%). In a Chi-square test, no significance was found for the distribution of generalists and specialists across incumbents that survived or failed.

22 While the most frequently used categorization of organizational forms is as specialists or generalists, researchers have called for alternative methods of classification (Baum, 1996), stating that there are various alternative methods (Usher and Evans, 1996). Carroll (1985) has argued that it is "essential to define units of analysis that represent arenas within which most competitive action occurs. (p. 1268). This study explores alternative methods of categorization based upon the width of the band of resources that organizations choose to exploit in a given environment in order to reflect the notion of variety-based positioning.

Retail Store Typology ( top)

23 Retail store type is a less coarse-grained categorization of retail stores than the specialist and generalist distinction. Retail type is determined by assigning each incumbent retailer the classification that Miller, Reardon and McCorkle (1999) arrived at following their review of store classification types. Upon their review, Miller et al voiced concern for the imprecision present in extant classifications, which they believe may lead to nonexclusive categorization. They prepared a retail categorization that identifies retail stores as one of three types: "limited-line specialists", "broad-line specialists", and "general merchandisers," taking into account the consistency that is present in the end-use of product lines that a retailer offers.

24 Limited-line specialists "offer the highest level of consistency of product lines" (p. 108) and in the context of this study, would relate to stores catering to a specific line of products, such as paint or flooring. Forty of the 58 participating retailers were assigned the category of limited-line specialists. Broad-line specialists provide a "broader level of consistency of product lines" (p. 108) thus offering complementary products towards a similar end-result. An example of a similar end-result would be retailers that offer products that would support a full home renovation, yet, would not extend to products external to the generic end-result, such as automotive products. Thirteen out of the 58 stores were identified as broad-line specialists. General merchandisers offer "relatively inconsistent product lines" (p.108), providing products that satisfy needs that are not necessarily complementary in end-use. Five of the stores were identified as general merchandisers.

25 The number of limited line specialists dropped from 40 at T1 to 32 at T2. By the end of the study 27 remained. The failure rate of limited-line specialists was 32.50%. Broad line specialists reduced from 13 (T1) to 9 (T2), stopping at 6 at T3, for a failure rate slightly below 54% (53.85%). General merchandisers remained steady at five stores throughout the study. In a Chi-square test, no significance was found in this categorization with incumbents that survived or failed.

Niche Focus ( top)

26 The third method of categorization recognizes the possibility that subtle variation in the width of a band of resources may exist among organizations within a particular ecological niche. Given this variation, organizations are given a fine-grained continuous measure based upon their product niche width (Dobrev et al, 2001); the greater an organization focuses upon a particular line of products, the narrower their niche width. This measure relied upon the responses of retailers regarding the percentage of each product category they reportedly sold in their store, and reduces the potential for any bias I may have introduced in the first two niche categorizations.

27 The extent that a retailer focused upon a single product line was determined and labeled as the 'niche focus.' Store participants were asked to allocate the percentage of products sold in their store. At T1, The categories included building hardware, tools, electrical supplies, plumbing, lumber plywood, gardening supplies and tools, kitchen cabinetry, flooring, paint and wallpaper, lighting fixtures, yard and garden furnishings, housewares, appliances, and other. Participants could choose percentage blocks for each product type, ranging from 0%, increasing in blocks of ten percent (1-9%, 10-19%, 20-29% and so on).

28 A retailer's niche focus was assessed based upon their reported allocation of the most products sold in a given category as

compared to the sum of all products sold. The niche focus was determined based upon the maximum value reported over the sum

of all the products sold in the same time period:

[Largest Product Category / Sum of all Product Categories = Niche Focus

29 The range of niche focus ran between '0' and '1.0'. The higher the value resulting from this equation suggested a greater niche focus by the retailer. A low value would mean that the retailer sells products in many different categories, suggesting a wide niche or generalist approach. T1 niche focus (N=57) had a mean ratio of .7568. The mean generated for T2 (N=38) was .7401. The T3 (N=37) ratio was .7518.

Niche Width Score ( top)

30 In this fourth classification, Miller et al's (1999) retail typology is combined with the fine-grained niche focus measure,

which is derived from an incumbent retailer's reported product variety, to create a niche width score. Retail store typology

is multiplied by the niche focus value:

[Retail Type x Niche Focus = Niche Width Score]

31 The two measures create a new measure where values are distributed anywhere on a scale from "0" to "3.0". The narrower the retailer's focus, the greater the niche width score, suggesting a highly specialized approach to providing products in retail home improvement. The mean niche width score at T1 (N=57) was 2.0870. At T2 (N=38) the mean was 2.0597, and at T3 (N=37) the mean increased to 2.1122. Over time, the mean niche width score of incumbents increased.

Operation of Dependent Variables

32 The following two dependent variables are performance-related outcome measures. The first measure looks at firm failure while the second is a subjective performance measure, reported performance.

Firm Failure ( top)

33 Firm failure offers an important measure that is based upon the firm's ability to maintain operations in light of turbulence from the entry of large-format competition. There are several ways that a firm can be marked as failing to maintain its presence in the given market. The store could experience organizational 'death' (Hannan and Carroll, 1992), terminating their competition with the big box stores by closing their doors. Also, the incumbent could 'escape' (Delacroix et al, 1989) by 1) being acquired by another incumbent, 2) relocating their business outside the study or market area, or 3) altering their products so as not to have a competitive overlap with the big box stores. In either method of firm exit (death or escape), they provide a valuable proxy for measuring the intensity of competitive rivalry (Baum and Korn, 1996). Usher and Evans (1996) treated migrations out of an ecological niche as failures. Baum and Korn (1996) stated that failure includes "exit by [a] losing firm or exit by a firm that chooses to yield to the dominant rival in that market without ever engaging in competition" (p. 258). Therefore, exit as avoidance of heightened competition (in this study, incumbent retailers that exit prior to the entry of large-formats at T2) has also been considered an example of firm failure. This is particularly important, given that this study includes pre-entry as part of the longitudinal data collection. For the purpose of this study, any of the above methods of terminating competition are denoted as firm failure.

34 Over the span of the study, 17 of the 58 stores experienced organizational 'death,' terminating their competition with the big box stores by closing their doors. Only three 'escaped' either by being acquired by another incumbent (N=1), relocating their business outside the study area (N=1), or altering their products/services to avoid a competitive overlap with the big box stores (N=1).

35 Incumbent retailers that were noted as 'failed' at T2, were assigned a T2 Fail value of '1'. Incumbent retailers that were noted as 'failed' at T3, were then assigned a T3 Fail value of '1'. If a firm survived through all periods of data collection, then their T2 Fail and T3 Fail values would both be '0' (there were no failures recorded at T4).

Reported Performance Measure ( top)

36 While failure provides the ultimate measure in an incumbent's ability to navigate a turbulent period, Dess and Robinson (1984) argue "success or failure offers little condolence to the manager of a small firm moving toward membership in the latter group" (p. 266). Yet the practice of using failure has largely been due to the difficulty in retrieving financial information from often privately held smaller firms in order to generate objective performance measures. In lieu of objective measures of performance from all participants, the alternative is to rely upon subjective reports to generate performance results of firms. However there is concern that managers may inflate their profits, or downplay their losses. Kets de Vries and Miller (1984) have found that organizations, which display overconfidence and a feeling of invulnerability, can goad themselves into staying the course during a period of turbulence, ultimately entering into a death spiral. Clarke and Perrow (1999) suggest that organizations may have a plan to deal with events that precipitate failure, however these plans merely amount to 'fantasy documents,' particularly if generated by managers that have never experienced what they are planning for (such as embarking upon large-format competition). In both cases, management would have disclosed positive performance reports, yet still result in firm failure. Still, in lieu of acquiring objective measures, subjective measures are a suitable alternative and have been reported as highly consistent with objective internal and external measures (Dess and Robinson, 1984; Venkatraman and Ramanujam, 1987).

37 Subjective outcome items were collected in the survey, comprising a series of questions that aimed at understanding the firm's past, present and future sales levels, profit and growth rate:

- How satisfied are you with your store's current performance in each of the following areas (1 = "very unsatisfied" ...5 =

"very satisfied")?

- sales levels

- net profit

- sales growth rate

- How have each of the following changed for your store over the past five years (1 = "significant decrease" ...5 = "significant

increase")?

- sales levels

- net profit

- sales growth rate

- What changes do you expect for your store over the next five years (1 = "significant decrease" ...5 = "significant increase")?

- sales levels

- net profit

- sales growth rate

38 Exploratory factor analysis was conducted on the above items, extracting principle components with an Eigenvalue over 1.0. Direct oblimin rotation was applied in the analysis since the items are related.

39 The factor accounting for the greatest percentage of variance (37.667%) had six of the items (1a, 1b, 1c, 2a, 2b, 2c) load together with an Eigenvalue of 3.997. This measure was identified as 'reported performance'. The mean of three or more of the six reported performance items are used to form the total score for reported performance in each time period with a range between a low of '0' and high of '5.0'. By taking the mean of only three of the six items it is possible to maximize the number of cases represented in the analysis. Reliability analysis conducted on the measures for reported performance provided acceptable Cronbach's alpha scores to use in the study: T1 (alpha = .88), T2 (alpha = .92), and T3 (alpha = .89).

Analysis

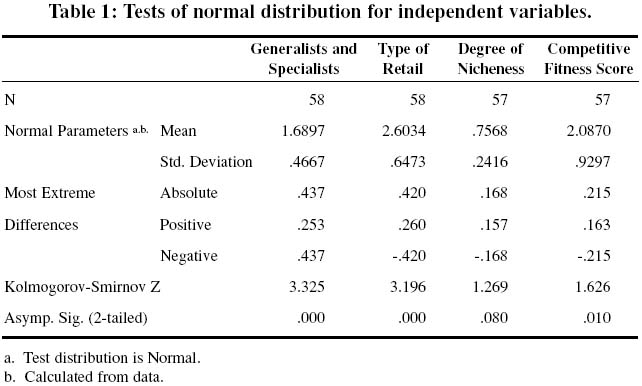

40 A One-Sample Kolmogorov-Smirnov Test (K-S Test) was conducted to test the distribution of each of the independent variables. Each test resulted in a significant finding (p >100), indicating that the independent measures are not normally distributed (see Table 1). Attempts to normalize the data, utilizing a variable's natural log or square root generated were not successful. Testing of the hypothesis therefore utilized non-parametric methods.

Table 1: Tests of normal distribution for independent variables.41 The first series of tests utilized the simple differentiation between 'specialists' and 'generalists,' followed by the categorization of 'limited-line,' broad-line,' and 'general merchandisers.' A third series examined the niche focus as outlined earlier, concluding with analysis that combined niche focus and retail store type for a measure labeled as 'niche width score.' The results of the test generated no significance in any of the outcome measures.

Specialists and Generalists ( top)

42 An initial series of cross-tabulations were conducted to determine if there were any significant differences between specialists and generalists that survived and failed. There were no significant differences in firm failure or reported performance found between stores identified as generalists and specialists. This suggests that the distinction between the two store types does not necessarily offer any difference in competitive advantage. Further testing of these variables was conducted utilizing Mann-Whitney Rank Sum tests to determine if significant findings may be present in a more fine-grained non-parametric. The findings in the Mann-Whitney Rank Sum tests however confirm the cross-tabulations conducted. No significant differences could be found in firm failure or reported performance between stores identified as specialists or generalists.

Retail Store Typology ( top)

43 An initial Chi-Square test was conducted on surviving stores to determine if there was any significant difference in any retail store type from the overall rate of failure. Then cross-tabulations were carried out using only incumbent retailers identified as limited-line and broad-line retail. However, both the one-sample Chi-square test and the cross-tabulations were unable to find any significant difference in firm failure. Given the overall survival rate, the expected survival rate of each retail type did not differ significantly. The remainder of the testing of retail type was conducted utilizing Mann-Whitney Rank Sum tests. The M-W tests produced no findings that would suggest that any difference in retail type produces a more favourable market position. The distinction of a limited-line, broad-line, or general merchandiser has produced no significant difference in firm failure or reported performance.

Niche Focus ( top)

44 Testing of the scalar measure niche focus was conducted by utilizing the Mann-Whitney Rank Sum tests to determine if significant findings may exist. The M-W tests produced no findings that would suggest any difference in niche focus would produce greater performance.

Niche Focus Score ( top)

45 Testing of the scalar measure niche width score was conducted by utilizing the Mann-Whitney Rank Sum tests to determine if significant findings may exist. However, the Mann-Whitney Rank Sum tests produced no findings that would suggest that any difference in the niche width score of incumbent retailers produces a more favourable niche in the market using either firm failure or reported performance.

Summary ( top)

46 The hypothesis in this study suggests that firm performance can be explained in part by the niche width of incumbent retailers. This was supported by literature in population ecology and prior studies on turbulent environments and the impact of entering large-format retailers. Four different methods of defining niche width were tested in order to see if different approaches yielded different results. Analysis of the data has provided overwhelming evidence that categorization or distinction of incumbent retailers of home improvement by virtue of the breadth of products does not lead to any significant difference in outcome measures associated with performance (firm failure, reported performance). The data does not provide any statistical support for the hypothesis. These findings are surprising given the preponderance of prior research that state to the contrary. Specialists are expected to outperform generalists in turbulent environments. However here, not only was I unable to attain statistical significance, the direction of the relationship between niche width and firm performance was not consistent from one test to the next.

Discussion

47 This research utilizes literature on niche theory to offer explanation on the performance of incumbent retailers in the presence of market turbulence due to competition by entering large-format retail. Suggestions that niching creates superior performance in the presence of market turbulence were the foundation for the hypothesis.

48 The results of the analysis generated findings, which were not fully anticipated, casting doubt on some of the research literature or possibly on the methods that were previously applied in order to generate their findings. Distinction of retailers by virtue of their niche width, as operationalized in the four different ways in this study, generated no significant difference in the success or failure of retailers. Furthermore, the fact that four approaches to describing the width of a retailer's niche all ended with no significant relationship to firm performance means that for this study, discussions on specializing based upon a variety-based position will not ensure good performance in a period of market turbulence.

49 Prior research in large-format retail has largely taken the stance that specializing, or exploiting a narrow band of resources provides optimal positioning in a period of turbulence. However, a key difference between the prior studies and this one is the inclusion of pre-entry incumbent store data to draw from in the analysis stage. If the environment had reached stability by T3 (which is assumed, since no firm failures occurred in the sample after T3, then market equilibrium has been reached. If that is the case, and if exit by incumbents prior to entry by large-formats is deemed avoidance of competition (Baum and Korn, 1996), then the least fit organizations may have actually exited the study market area prior to Home Depot and Revy entering. This would suggest that some of the richest information on firm failure and competition in the presence of large-formats occurred at pre-entry. In an attempt to replicate previous studies of entering large-formats, a Chi-square test was conducted on the hypothesis using only data that could have been gathered from incumbent retailers that were in existence at T2 and T3, leaving out all data from T1, including the twelve firms that had failed by the time Home Depot and Revy had entered the market. The tests generated significant results (p ≤ 100), suggesting that specializing would offer superior performance.

50 This exercise underscores the critical importance of longitudinal data collection when conducting research on organizational change at the population level. As Miller et al (1999) have stressed "competition is by its nature, a longitudinal construct" and "further examination [longitudinally] is needed" (p. 119). As well, because this study is longitudinal, it provided an opportunity to have an examination of incumbent retailers that includes firm failure as an outcome variable. This offered a look into the pre-existing conditions of incumbent retailers that resulted in firm failure. It also offered a response to prior calls for study on the impact of different strategic positions made by incumbent retailers and whether their actions (or inaction) has led to firm failure (Miller et al, 1999; McGee and Rubach, 1996). Furthermore, including firms that experience firm failure eliminates implicit bias of studying only surviving firms, which has been noted as a research limitation by authors in prior studies (Litz and Stewart, 1996; Peterson and McGee, 2000).

51 A major limitation of this study however is the low number of participants in the data. This could explain why it was not possible to generate a normal distribution in the independent variables used. However, where this data-set lacked in number of participants, it gained in having the data collected at four points over six years. Regarding construct measurement, the measures used in testing niche width may not have provided sufficient representation of a niche being narrow or wide. Still, some significant results were generated when the analysis did not include T1 data. However, assigning a niche width based upon coarse grain 'specialist' and 'generalist' categorizations; the consistency of the end use of products; a mathematically derived value of niche based upon the products sold, or any combination of the above may not be reliable measures of niche width.

52 As well, Generalizability of the findings must also be considered. While the niche dimensions described here could be applied in other retail environments the product variety and industry activities of the sector that the tests were undertaken in are fairly specific to the industry of home improvement.

53 Finally, we must accept that not all fit firms survive, and not all unfit firms fail. Aldrich (1979) stated "just as the fittest sometimes fail, because of random variations in the selection process, so patently maladaptive organizations sometimes survive" (p. 54). Here as well, some organizations that are not fit will close their doors for reasons not accountable in the hypothesis generated.

54 Although I have explored the position of retailers based upon variety-based positioning; one of three distinct sources as identified by Porter (1996), I have not looked at needs-based positioning - tailoring a set of products to best serve the needs of its target customers, or access-based positioning - configuring activities so that they are optimal in reaching the buyer. Initial study undertaken with this data set shows promise for significant differences in store performance based upon needs-based positioning. As well, prior research in retail has looked at access-based positioning, suggesting how stores may create advantages by increasing accessibility via location and store hours and therefore convenience to consumers. Longitudinal research that attends to the evaluation and interrelation of needs-based and access-based positioning of retailers is required so that we can confirm that positions recommended by past studies are still relevant.

References

Aldrich, L. (1979). Organizations and environments. Englewood Cliffs, NJ: Prentice-Hall.

Barber, C., and Tietje, B. (2004). A distribution services approach for developing effective competitive strategies against "big box" retailiers. Journal of Retailing and Consumer Services, 11, 95-107.

Baum, J. (1996). Organizational ecology. In S. Clegg and C. Hardy (Eds.) Studying Organization: Theory and Method (71-108). Thousand Oaks, CA: Sage Publications.

Baum, J., and Korn, H. (1996). Competitive dynamics of interfirm rivalry. Academy of Management Journal, 39(2) 255-291.

Baum, J., and Singh, J. (1994). Organizational niches and the dynamics of organizational founding. Organization Science, 5(4) 483-501.

Carroll, G. (1985). Concentration and specialization: Dynamics of niche width in populations of organizations, American Journal of Sociology, 90(6) 1262-1283.

Carroll, G. (1987). Publish and perish: The organizational ecology of newspaper industries. Greenwich, CT: JAI Press, Inc.

Carroll, G., Dobrev, S., and Swaminathan, A. (2002). Organizational processes of resource partitioning. Research in Organizational Behavior, 24, 1-40.

Clarke, L., and Perrow, C. (1999). Prosaic organizational failure. In H. Anheier (Ed.) When things go wrong: Organizational failures and breakdowns (179 - 196), Thousand Oaks, CA: Sage Publications.

Delacroix, J., Swaminathan, A., and Solt, M. (1989). Density dependence versus population dynamics: An ecological study of failings in the California wine industry. American Sociological Review, 54 (April), 245-262.

Dess, G. and Picken, J. (1999). Creating competitive (dis)advantage: Learning from Food Lion's freefall. Academy of Management Executive, 13(3) 97-111.

Dess, G., and Robinson, R. (1984). Measuring organizational performance in the absence of objective measures: The case of the privately held firm and conglomerate business unit. Strategic Management Journal. 5, 265-273.

Dillman, D. (1978). Mail and telephone surveys: The total design method. New York NY: John Wiley and Sons.

Dobrev, S., Kim, T., and Hannan, M. (2001). Dynamics of niche width and resource partitioning. American Journal of Sociology, 106(5) 1299-1337.

Hager, M., Galaskiewicz, J., Bielefeld, W., and Pins, J. (1999). "Tales from the grave": Organizations' accounts of their own demise. In H. Anheier (Ed.) When things go wrong: Organizational failures and breakdowns (51-70), Thousand Oaks, CA: Sage Publications.

Hannan, M., and Carroll, G. (1992) Dynamics of organizational populations: Density, legitimation, and competition. New York, NY: Oxford University Press.

Hannan, M., and Freeman, J. (1977). The population ecology of organizations. American Journal of Sociology, 82(5) 929-964.

Hannan, M. and Freeman, J. (1989). Organizational Ecology. Cambridge, MA: Harvard University Press.

Hawley, A. (1950). Human Ecology. New York: Ronald.

Kets de Vries, M., and Miller, D. (1984) Neurotic style and organizational pathology. Strategic Management Journal, 5(1) 35-55.

Khandwalla, P. (1977). The design of organizations. New York, NY: Harcourt Brace Jovanovich.

Litz, R., and Stewart, A. (1996). Lilliputian Strategies: Small Business Responses to Big Business Entry

Litz, R. (1997). Lilliputian strategies: The strategic significance of expert service, interfirm networks, and extraorganizational clan-building for small incumbents facing large entrants. University of Pittsburgh: Unpublished doctoral thesis.

Litz, R., and Stewart, A. (1998) Franchising for sustainable advantage? Comparing the performance of independent retailers and trade-name franchisees. Journal of Business Venturing, 13(2) 55-71.

McGee, J., and Rubach, M. (1996). Responding to increased environmental hostility: A study of the competitive behavior of small retailers. Journal of Applied Business Research, 13(1) 83-94.

McGrath, J. (1982). Dilemmatics: The study of research choices and dilemmas. In J. McGrath, J. Martin, and R. Kulka (Eds.) Judgment calls in research: 69-102. Newbury Park, CA: Sage.

Miller, C., Reardon, J., and McCorkle, D. (1999). The effects of competition on retail structure: An examination of intratype, intertype, and intercategory competition. Journal of Marketing, 63 (October) 107-120.

Mintzberg, H. (1987). The strategy concept I: Five Ps for strategy. California Management Review, 30(1) 11-24.

Moody's Investors Services, (2000). Gauging the economic diversity of Canadian CMBS, New York, NY: Moody's Investor Services.

Peterson, M., and McGee, J. (2000). Survivors of "W-day": An assessment of the impact of Wal-Mart's invasion of small town retailing communities. International Journal of Retail Management, 28(4/5) 170-180.

Porter, M. (1980). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York, NY: The Free Press.

Porter, M. (1985). Competitive Advantage: Creating and Sustaining Superior Performance. New York, NY: The Free Press.

Porter, M. (1996). What is strategy? Harvard Business Review, 74(6) 61-78.

Scandura, T., and Williams, E. (2000). Research methodology in management: Current practices, trends, and implications for future research. Academy of Management Journal, 43(6), 1248-1264.

Usher, J., and Evans, M. (1996). Life and death along gasoline alley: Darwinian and Lamarckian processes in a differentiating population. Academy of Management Journal, 39(5), 1428-1466.

Venkatraman, N., and Ramanujam, V. (1987). Measurement of business economic performance: An examination of method convergence. Journal of Management, 13, 109122.