Vol. 16, No. 2 July 2005

Rolf Björheden

Klara Helstad

Växjö University

Växjö, Sweden

The authors are, respectively, Professor, School of Engineering, and PhD Student, School of Technology and Design, Växjö University.

ABSTRACT

The sawmilling industry is facing serious challenges; intensified competition, increasing substitution of wood for new materials and powerful customers posing extensive new demands.

Obstacles for a change towards a more competitive configuration of the sawmilling industry are context and contingency related. Corporate strategy building must be based on an analysis of such factors. A contingency analysis of the sector reveals an array of factors that underpin severe fragmentation. Thus, sawmills have limited possibilities to exert power within the sawn wood supply chain. To break free from the ties of sector fragmentation, business level strategy may be based on

A sawmill with superior control of the inbound sawlogs will always have the upper hand on competition because it may produce and sell its products with high efficiency. In spite of their importance, these areas have received only limited attention. Controlled procurement, flexible management of forest operations and communication of short-term needs to the suppliers are vital issues for the purchasing sawmills, yet to be explored.

Keywords: Nordic, sawmilling, softwood lumber, competitive strategy, contingency analysis, logistics, procurement.

INTRODUCTION

An Old Material Facing New Challenges

Leading consumers of sawnwood products increasingly demand fast response, precision and flexibility in deliveries [1]. At the same time, prices of sawn products decrease in real terms [2]. If sawmills fail to meet the new demands, customers will substitute other materials for wood. The effect of these changes is a decreasing market share of sawn products in building and construction. New markets for sawnwood, e.g. DIY-retailers, exert a lot of power on the supply chains, superimposing even greater demands on sawmills [1]. All the new or more extensive demands placed on sawmills by dynamic customers must be met through improvements in the production process.

Sawn wood is a commodity and thus price is an important factor for the competition between sawmills. Traditionally, the sawmills' strategy has been cost orientated, aiming to reduce unit costs through employment of state-of-the-art technology. The sawmilling industry has a tradition of constant technological improvement and the major sawmills are all technically up to date. A purchasing sawmill that primarily relies on external purchases of sawlogs for its supply has limited possibilities to affect the prices on raw material. Therefore, rationalisation efforts have generally been aimed at decreasing raw material stocks and on reduced harvesting costs, c.f. Hakkila [3]. Sawmills normally outsource harvesting and transportation to the highly competitive market of forest operations contracting.

Thus, to increase competitiveness, other ways of improving the production process must be investigated, such as:

Wood as a building material is as old as culture itself. Also the art of industrial milling sawlogs into suitable dimensions is of age. Sawmilling is a mature industry. Especially in countries that depend heavily on export revenues from their forest industries, like Sweden, Finland and Canada, it is important that these industries keep a competitive advantage. This has become increasingly difficult. New producers of lumber establish themselves, new materials compete with traditional uses of wood and new building methods pose new demands on suppliers of building material. The rate of change is increasing and the sawmilling industry must respond to such new challenges or face atrophy.

A number of impediments are slowing down the shift towards a more competitive configuration of the sawmill industry. Many such obstacles are context and contingency related. As in all corporate strategy building, a first step to gain a more efficient control over the necessary process of change is to identify such contingency factors [12].

This paper aims to outline a contingency perspective on business level strategy and competitiveness in the sawmilling industry. Prominent contingency factors of the Swedish and Nordic sawmilling industry are identified and discussed from a strategic perspective. The main focus will be on how the these factors affect the sawmills procurement strategy and its management.

THE CONTINGENCY APPROACH TO BUSINESS STRATEGY

Two extreme approaches have been proposed for business level strategy;

The contingency approach to business strategy takes an intermediate position between these approaches, stating that the appropriateness of strategies must be evaluated against the competitive settings for the respective business. In opposition to the situation specific view, contingency theory states that although identical strategic settings never occur, classes of settings exist, for which strategic generalisations can be made [12].

Contingency variables are the relevant factors for describing the specific settings of a business. They are the building blocks that form the basis for dividing competitive settings into discrete classes. A problem is that that a very large number of contingency variables can and have been identified. Even with a fairly limited number of variables and a limited number of values for each variable, the total number of combinations soon becomes unwieldy, closing in on the situation specific approach. Thus, the advocates of the contingency approach agree that a limited number of variables, containing the most salient prerequisites should be identified and used for evaluating the appropriateness of different strategies. Porter [15] proposes three variables; the industries degree of concentration, the stage of product life cycle and the exposure to international competition. Other authors define different sets of variables to be included. Hambrick and Lei [12] presents a list of ten variables, basically a refinement of the three basic variables proposed by Porter [15]. However, also wider ranges of definitions have been found. Alkbring [6] pointed out that the 'culture', identified as common managerial values and ways of doing business within an industry, are important foundations to the corporate level strategy building. Baldwin [5] gives examples of variables that singly or aggregated shape the operating environment of the forest industry: currency exchange rates, monetary and fiscal policies, foreign exchange needs, weather events, consumer moods and transportation situations affecting on flows of goods.

In this paper, the variables suggested by Porter [15] form the basis for the discussion, complemented with other observations believed to be of importance. Thus, factors affecting the sawmills opportunities to manage and control the timber procurement are:

The sawmill sector - ANALYSIS AND DISCUSSION

Structure of the Sawmill Sector

The structure, the degree of saturation and the intensity of competition are among the most important conditions for any industry. These factors will influence the individual firm's possibilities to act and develop its business, as well its possibilities to influence relationships towards customers and suppliers. Through analyses of structure, saturation and competition, it is possible to identify many subordinate factors, which influence the configuration of the industry. Such analyses are important when formulating a business level strategy.

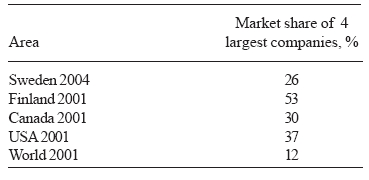

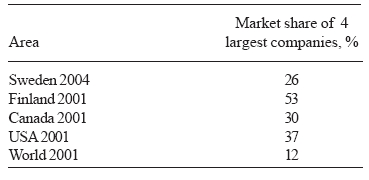

A measure of industry structure is the market share of the four largest companies. If this share is below 55 percent, the industry is described as fragmented [12]. Table 1 shows the market share of the largest companies in Sweden, Finland, Canada, USA, and the world. Since fragmentation indexes should rather be calculated as market share of world exports and since individual sawmills within a company often act as independent result units, fragmentation is more severe than indicated by the key figures of Table 1. The sawmill industry is severely fragmented, both in Sweden and globally.

Table 1. The share of national (world: global) production for the four largest sawmill companies in Sweden, Finland, Canada, USA and globally. Sources [16, 17].

Traditionally, sawmills have been considered as channel leaders. The strong fragmentation of the industry, however, indicates that power lies with external bodies, e.g. by customers or suppliers to the industry. Sikanen [18] supports this view indicating that sawmills tend to treat their suppliers, the many small forest owners, as customers, rather than as suppliers certainly supports that view. On the customer side, Gustafsson [1] has shown that the emergence of new, strong customer types such as power retailers of the DIY chains will impact on the configuration of the sawmills. These retailers make strict and new demands on the sawmills and sell sawn wood products as customised products e.g. bar coded products and consumer packages This is evidence of the limited power of the sawmill industry, a lack of power that will strongly impede any efforts to 'take charge' over the supply chain, including the management of raw material supply.

Factors Behind the Fragmentation of the Swedish Sawmill Sector

When formulating strategies for a fragmented sector, it is essential to find the basic causes of fragmentation [15]. In this section, the most prominent reasons for the fragmentation of the Swedish sawmill sector will be presented. The same is likely valid not only for Swedish sawmills, but for large parts of the global sawmilling sector.

Tradition and history are important parts of the explanation. Generally, mill site location and conversion options are resource driven choices of the producers [5] but in Sweden, this fundamental approach is overlaid with the fact that establishment of individual companies has been ruled by governmental concession, based on timber supply analyses. There is also a strong logistical element behind the emergence of the many different sawmills. To make good use of the waterflow for power and as a transport system, sawmills were located along waterways corresponding to a watershed area large enough to produce a yearly supply of timber. Typically, this meant inland placement. Later, with the introduction of steam powered sawmills, many major and strictly export-orientated sawmills were placed at the mouths of the major rivers, each replacing a number of older, inland mills.

High transportation costs have thus historically contributed to the fragmentation of the Swedish sawmill industry. With few exceptions, sawmills still rely on local procurement of raw material for their production [7], even if marginal quantities of sawlogs may regularly be procured from distant markets.

The impediments to establishment, other than the supply of raw materials, is limited within the sawmill industry. It is fairly easy to found a new sawmill. Technologies are well known and the level of investment is moderate.

The economy of scale is limited. As a result of the 'normal' commodity product strategy of sawmills, many sawmills try to mimic process industries. But the nature of production rests on the flow of individually treated logs through the sawmill, resulting in a flow of principally individual output products. A large part of the production process is spent on homogenising the production into batches based on tree species, dimension and quality parameters. Increasing the scale of operation beyond optimum single line simply means adding lines. The replicated lines of production will have only marginally lower costs than the first, single line. Månsson [9] studied the scale elasticity of the Swedish sawmilling sector on a production basis. His results show that economies of scale exist. Interestingly, he could also conclude that while many sawmill operations would gain from expansion, there are also units who would increase their efficiency by becoming smaller. (It is important to stress that the economy of scale is different for production, procurement and sales, respectively).

Divided markets also tend to push an industry towards fragmentation. In his study of north Swedish sawmills, Alkbring [6] supports the findings of Månsson [9] and adds explanatory facts: the market for sawn wood is heterogeneous, consisting of more or less separate sub-markets. The two main markets identified by Alkbring [6] are sawn wood for building & construction and for joineries & consumer products respectively. The large volumes are consumed by the first of these markets while the second, including mouldings, window, door and floor manufacturing consume smaller volumes but at higher prices. The two main markets may in turn be divided into various sub-segments with specific requirements on grades, appearance, dimensions and functions of the sawn wood. The heterogeneity of the market will affect economies of scale and thus effect on the structure and organisation of the sawmilling industry.

The sawmill industry is a typical cyclical industry characterised by speculation. Cyclically varying demands and prices for sawn products means that products must be kept in buffer storage when sales are low. Storage costs are high in the sawmilling industry, due to high raw material costs and a large number of bulky products. Smaller industries are often more flexible than larger in adjustment to periods of low demand. This will counteract concentration even if economy of scale is evident during periods when operations are fully employed. The last 10-15 years, though, the cyclical pattern has been less evident [6]. In spite of a strong market demand, prices have been low due to increased production capacity and competition on the export markets. The response of the Swedish sawmilling industry has been organisational restructuring towards higher concentration [19, 7].

Saturation and Intensity of Competition

The degree of saturation is a measure of an industry's capacity to meet the demands of its customers. Solberg & Moiseyev [4] published data concerning the saturation of roundwood and sawn wood products in Europe. The conclusion is that the need for sawn products can easily be met through increased production. Thus, the degree of saturation is generally high, although imbalances exist, regionally and for certain grades of lumber.

The distribution channel is fairly simple with only fundamental flows and lack of integration [1]. Price is an important factor on the market for sawn wood products since the sawmills' products often are marketed as 'commodities' rather than as 'products'. Consequently, sawn wood products are exposed to world market price fluctuations, which implies that the exchange rates have large effect on the sawmills' profitability and level of exports to different countries. As the president of the VIDA Group says: 'We are in fact more of an foreign exchange dealer than a lumber-dealer' [17]. The combination of high fragmentation, high saturation and commodity trade on a global market means that competition is intense.

Both the Swedish and Finnish sawmill industries are principally export orientated. During 2000, the Swedish sawmills directly exported 63 per cent of the production [7]. The geographical distance to the main markets and consumers has a negative impact on the flexibility and ease of information exchange concerning demand. Although modern Information Technology makes quick and simple information exchange possible, few sawmills have developed this option. Possibly the reason is a "cultural heritage" based on the traditional way of doing business [6]. A managing director of a Swedish small-size purchasing sawmill also indicates that the large proportion of exported goods is a 'necessary evil'. The distance to the foreign markets leads to increased risk and uncertainty and the exports require constant attention: 'if the sawlogs yielded only products merchantable on the Swedish market, we would have preferred to work domestically. That would have made it possible for us to become really efficient. Unfortunately, that is not the way it is' [17]. The statement indicates a will to work closer to the customers and to focus harder on a specific market. Consequential products, however, necessitates engagement in several markets and, further the lack of a unique offer to the market makes it hard to tie close bonds with customers - a sign of intense competition.

Market Strategy

Nearly 70 per cent of the sawmills in western North America claim to be pursuing a commodity product strategy [8]. However, smaller companies were more likely to produce speciality or custom-made products. Sawmills pursuing special or custom-made strategies perceived themselves to be in a better competitive position than those with a commodity product strategy [8]. Yet, many sawmills are not focused exclusively on one strategy, which according to for example Porter [15] could be a disadvantage [8, 20, 21]. However, Hansen et al. [8] suggest that the possibilities to successfully manage several strategies may be easier for large sawmills with multiple mills. In Sweden, this type of sawmill is becoming more and more common [7]. On the other hand, the greatest threat to a large, well-funded company may not be an even larger, more technically advanced facility, but a smaller competitor using alternate technology, producing in a closer-to-market facility [5].

In commodity industries, the most common way to handle competition is to seek scale advantages and price advantages through increased production. This has been the case in both Canada and U.S.A. during 2002 [22]. The excess of supply has led to a 30 percent drop in prices and a difficult situation for sawmills with high costs [22]. The weak prices combined with a weakening dollar have caused Swedish sawmills to move volumes from the U.S.A. to other markets [23]. The market for sawn wood is characterised by a significant level of seasonal variations of demand. All in all, the industry could to a great extent be categorised by speculation and stock keeping.

The Production Process

Timber is a heterogeneous product in terms of quality. The dimensions, species and quality of inbound sawlogs have a decisive impact on the production range. Since the raw material represents a large proportion of the price of ready products, management will aim to maximise saw yield. This results in a highly divergent production flow. Also dimensions with low attractiveness on the market will be produced. 'We buy some forest with limited potential to produce the products in demand, but we have to handle it all' an MD of a Swedish sawmill explains [17].

The purchase of marked stands sets the first constraints to fulfilling the sawmills raw material demand and, subsequently, bucking cause additional constraints. The divergent material flow makes a complex planning situation, starting with one tree in the forest and ending up with a large number of products but also consequence products and by-products. The sawing process generates boards and deals in different proportions depending on selected sawing patterns, which makes product cost calculation difficult. The timber cost contributes at least 60 per cent of the product cost of sawn wood products [24]. Johansson and Rosling [24] argue that increased flexibility in timber procurement lead to more varied product costs.

The development of new markets and customers with new and more specified requirements has led to additional demands on the production. The value-added processes in connection to sawmills have increased in importance during the 1990's. Finger jointing and blanks for doors and windows have increased heavily, drying and length trimming to orders has increased steadily as well as glued joints [7]. As mentioned earlier, some customers demand bar coded products and consumer packages. To meet the demands and the competition on the world market, the Swedish sawmill industry goes through a period of structural rationalisation where groups of specialised sawmills are becoming increasingly common as a mean to decrease production costs.

Raw Material Procurement

Procurement is an activity of strategic importance to sawmills. Most sawmills are dependent on getting raw material from private forest owners. The Swedish timber market is characterised by keen competition, particularly in the south of Sweden where many purchasing sawmills are situated. The president of the largest purchasing sawmill company in southern Sweden states; 'buying timber is just as time consuming as the selling of sawn wood products' [17].

Purchasing managers and foremen feel obliged to indiscriminately buying any incoming sawlogs offered by NIPF (Non Industrial Private Forest owners). This attitude conflicts with the necessity to manage the supply. Many forest owners want to personally carry out the logging in general as delivery sales, denoting that the forest owner is responsible for cutting and off-road transport of timber to the roadside. This has negative effects on the sawmills supply management and consequently the sawmills attempt to delimit the proportion of delivery sales. According to [3] the negative effects are, e.g. small volumes in small piles, logging during winter resulting in large amounts at the end of the winter season, and that quality requirements are not always met.

The import is perhaps the most uncertain supply form. During 2002, the import decreased when the Russian ships found more profitable freights. When parts of the Baltic Sea were frozen during winter, the shipments decreased quickly. One sawmill reported an 80 per cent volume decrease [25].

The Suppliers

The Swedish woodland, like in many other countries, is divided into state-owned and other public forests, company forests and private forests. For purchasing sawmills, the private forests are the most important source of raw material. In Sweden, 51 per cent of the forest area is privately owned [2], in Finland 65 per cent [26] and in the US 57 per cent [27]. Most private forest owners are small, appearing only occasionally on the market. Swedish NIPF forest holdings average 48 hectares in size, and 41 per cent of the holdings are owned by multiple owners [28]. In Finland, 86 per cent of the private forest holdings are smaller than 50 ha in size [29] and the average forest holding size has diminished [30]. Thus, timber is mainly purchased from small NIPF forests. A single sawmill may annually harvest several thousand separately marked stands [31]. The fragmented ownership tends to increase the cost of timber procurement and affects the constraints placed on forest machines [3].

In 1995, most of the timber to Swedish purchasing sawmills was supplied as delivered purchases (74.5%) or standing timber purchases (22.2%) [19]. Own forests (1.8%) and imports (1.5%) represented only a small part of the transactions [19], although the import share has increased the latest years [7].

Depending on type of contract, sawmills have different possibilities of managing the supply. For example concerning bucking, the saw timber from own forests or procured through standing timber purchases allow sawmills free scope to manage the supply to the very last. The other supply forms such as delivery timber, cutting commission, delivery stumpage purchase, and traded timber do not offer the same possibility since the timber is sold at an agreed price per sort. The imported timbers involve certain problems, e.g. regarding control of log length, uncertain delivery time, material damage and costs.

The origin of the important NIPF group is traditional farming. The group is extremely heterogeneous and should probably be regarded disaggregated. Some segments show 'normal', strong price sensitive supply behaviour, while other seem insensitive to prices. Even price-inverse supply behaviour can be found in some segments [4]. The heterogeneity of the group has increased with a growing proportion of non-farmer and non-resident forest owners [30]. The mission and objectives of NIPF-owners have changed, partly due to changes in operational environment [32]. Typically, the forest owner makes the decisions according to imperfect information [33]. According to Larson and Hardie [33], the forest owners' decision making is influenced by different external factors. Their behaviour resembles more that of a consumer than of a supplier [18]. The personal chemistry and relations between the vendor and the timber purchaser (analysed by e.g. [18, 34, 35]) are of great importance for the sawmill's supply of timber.

Managing the Raw Material Supply

Production of different timber assortments must be kept in balance with the demand. Usually, timber inventories are kept at a minimum level to maintain freshness of wood and to reduce capital costs. The wood procurement operations are geographically decentralised in a wide area and the size of the procurement area depends on e.g. the sawmill's demand for timber, the structure of the timber market and weather conditions. Typically, the planning horizon is much shorter for purchasing sawmills than for sawmills belonging to forest companies. This delimits the possibilities to manage the supply on a long-term basis. 'The crystal ball is my main tool for identifying demands', a sales officer in a Swedish sawmill states, then continues:

'I base my judgement on the previous season, although there are always differences. In the end we try to compensate by short-term spot market deals of timber that will get us off the hook' [17].

Kärhä [36] analysed timber procurement decision-making. The results indicate that the decision-making environment of managers responsible for timber procurement is in a constant flux. The managers regarded this to be the worst problem affecting decision-making. The major constraints influencing their decision-making was (in order of precedence): (1) used capacities of mills, (2) the willingness of forest owners to sell timber, (3) forest resources in their procurement area, (4) harvesting conditions, (5) the availability of forest machines and trucks, (6) speed required in decision-making, and (7) close and inflexible goals [36].

The development of information technology and its' introduction in forestry enables improved management of timber supply. Harvesters are equipped with computers and wireless data communication for receiving instructions concerning required log lengths and dimensions and for reporting daily output by assortments. Trucks may be equipped with computer-based, satellite-assisted navigation systems with road maps and data of location and specifications of roadside inventories. In the Nordic countries, private entrepreneurs normally own the timber trucks. To some extent, their limited means lead to investment restrictions. The secondary transport is of a great significance for the cost control of timber since it amounts to 40 per cent of the cost of procurement [3, 37].

Inventories and inventory planning are traditional ways to disconnect manufacturing from external uncertainties [38]. The principle of postponement-speculation by Bucklin [39] explains the process involved in the determination of inventory locations; efficiency is attained by postponing product changes to the latest point of the marketing process and in inventory location to the latest point of time. Thus, risk and uncertainty costs increase as the product becomes more differentiated.

Regarding the principle of postponement-speculation, the cut-to-length method for forest harvesting has absolute dominance in Sweden and Finland. The method involves bucking of the stems at the felling site. After this, possible lengths and dimensions of deals and boards are more or less fixed. In Denmark, the sawmills postpone bucking as far as to the sawing process. It is difficult to postpone bucking decisions farther than so, although finger-joint products and similar techniques offer possibilities for further postponement.

CONCLUSIONS

The sawmilling sector is severely fragmented. In a fragmented sector, no individual company is in possession of immediate and decisive influence on the market. Sawmills cannot act from a power situation, to control the supply chain, as 'channel leaders'. It is hard to identify 'leaders' which form the development of the industry. Often, the sector's development seems to be the result more of external events such as technological development and emergence of new customer groups, than of deliberate actions from the industry itself. The present structural concentration may change this, but in retrospect e.g. the introduction of new technologies - such as steam power - has improved the concentration of the sawmill industry in many steps over the years. Nevertheless, fragmentation still prevails. Fragmentation seems to be the result of a number of concurrent contingency factors, all pushing towards fragmentation.

The high saturation, intense competition and fragmented state of the sawmilling industry prevent sawmills from acting as channel leaders and demanding well-adapted and timely deliveries. At the same time, the poor economy is strongly pushing a structural change of the industry, which may eventually remedy this lack of power. The emerging industrial structure - with multi-mill combines - may give opportunities of exploiting the different economies of scale for different market segments, for production, sales and purchasing respectively.

In a fragmented industry, a key to competitive success is to break the dependency of the other companies and of external factors and to take charge of the own development. Rask and Andersson [40] found business logic in the sawmilling industry to be 'founded on maximizing saw operations yield and exploiting price differences between markets and seasons' a modus operandi more typical of small and medium size entrepreneurial firms' maximizing behavior than of large corporations. Clearly, the key to success will include the establishment of 'leading' companies, breaking free from the culture of petty entrepreneurial opportunism.

Customized products and services may be a solution. Also, new products like EWP neutralize the shortcomings of wood as a material may acquire brand name status and brings superior profit margins. But the new products also require higher levels of technical and managerial skills as well as higher investment levels combined with manufacturing control and intensive R and D, field testing and sales activities [5]. In the Nordic countries, sawmills have not been very active in this field while the North American sector has a number of prominent examples.

Baldwin [5] states 'Being agile, aware and responsive and being able to deal with complexity are the winning characteristics that will typify the successful individual and company'. Control of the raw material flows is a key element for such behaviour [10]. The influx of raw material is of vital importance to the sawmilling industry. It is decisive for the achieved mix of products and thus for the rate of turnover and the level of prices. Further, the amount of control a sawmill has on its raw material flow will influence its possibility to respond to market fluctuations. Although control of the raw material flow is thus important to the sawmills, most sawmills today exert limited influence on their suppliers.

Due to logistical reasons, raw material procurement will continue to be local. Most raw materials will be procured from NIPF. This makes raw material procurement complex. NIPF constitute a large and heterogeneous group. Contacts with this group must be individual and personalised. A special problem is that modern NIPF seldom rely on their forest for their income, thus, other than economical stimuli must be considered.

The main focus for competitive strategy in the sawmilling industry has traditionally been on keeping up with technical developments and on mill productivity. The two other battle grounds for competitive advantage; control and management of raw material flows and establishment of close contact with the markets of the sawn products has received only limited attention, in spite of the vital importance of these areas. Control of raw material procurement and ways of communicating the short-term needs to the suppliers are vital issues for the purchasing sawmills. A sawmill with superior control of the inbound sawlogs will always have the upper hand on competition because it may produce and sell its products with high economical efficiency.

ACKNOWLEDGEMENT

This study was made possible by financing through the Wood Design and Technology Program (WDAT) at Växjö University.

AUTHOR CONTACT

Klara Helstad can be contacted by e-mail at

Klara.Helstad@vxu.se

REFERENCES

[1] Gustafsson, Å. 2003. The distribution channel for softwood lumber and its logistical requirements. Lic. Thesis, Reports # 4, School of Industrial Engineering, Växjö University.

[2] Official statistics of Sweden, Statistical yearbook of forestry 2004, July 15 2004 at www.svo.se/fakta/stat/ska2/

[3] Hakkila, P. 1995. Procurement of timber for the Finnish forest industries. Metsäntutkimuslaitoksen tiedonantoja 557. The Finnish Forest Research Institute. Research Papers 557. 73 p. ISBN 951-40-1433-2.

[4] Solberg, B. and A. Moiseyev (eds.). 1997. Demand and Supply Analyses of Roundwood and Forest Products Markets in Europe - Overview of Present Studies. EFI Proceedings No 17, 416 p.

[5] Baldwin, R.F. 2000. Maximizing Forest Product Resources for the 21st Century: New Processes, Products and Strategies for a changing World. Miller Freeman Books, San Francisco. 232 p.

[6] Alkbring, M. 2003. Branschreceptets dubbelhet. En studie av sågverksbranschen i norra Sverige. (The duality of the business recipe. A study of the sawmilling business in northerna Sweden) Umeå University, School of Business and Finance, FE 2003:169

[7] Staland, J., M. Navrén, and M. Nylinder. 2002. Resultat från sågverksinventeringen 2000. (Results from the Swedish sawmill inventory 2000). Department of Forest Products and Markets, The Swedish University of Agricultural Sciences, Uppsala, Sweden. Report No. 3. 104 p.

[8] Hansen, E., J. Seppälä, and H. Juslin. 2002. Marketing strategies of softwood sawmills in western North America. Forest Products Journal, Vol. 52, No. 10, pp. 19-25.

[9] Månsson, J. 2002. Economies of Scale in the Swedish sawmilling Industry. Växjö University, School of Management and Economics. Working Paper Series 2002/2.

[10] Karlsson, E. 1999. Logistikkanaler för livsmedel - en förstudie. (Supply channels for the food industry _ a pilot study). FE-reports 1999-368, School of Economics and Commercial Law, Gothenburg University, Sweden.

[11] Helstad, K. 2004. Managing supply uncertainties in procurement of sawlogs for sawmills. In: Aronsson, H. (Ed.), NOFOMA 2004: Challenging Boundaries with Logistics, Proceedings of the 16th Annual Conference for Nordic Researchers in Logistics. UniTryck, Linköping. pp 277-292.

[12] Hambrick, D. and D. Lei. 1985. Toward an empirical prioritization of contingency variables for business strategy. Academy of Management Journal 4, pp. 153-173.

[13 ] Buzzel, R.D., B.T. Gale, and R.G..M.Sultan. 1975. Market Share - A Key to Profitability. Harvard Business Review January-February 1975, pp. 97-106.

[14] Andrews, K.R. 1971. The concept of corporate strategy. Homewood, Ill. Dow Jones-Irwin.

[15] Porter, M.E. 1980. Competitive Strategy, Techniques for Analyzing Industries and Competitors. The Free Press, MacMillan Publishing Company

[16] Spelter, H. and T. McKeever. 2001. Profile 2001: Softwood sawmills in the United States and Canada. Res. Pap. FPL-RP-594. Madison, WI: U.S. Department of Agriculture, Forest Service, Forest Products Laboratory. 73 p.

[17] Unpublished sources; Helstad, K. Unpublished interviews with Nordic purchasing sawmills management; Pers. comm. Dahl, S., 2003. Re. VIDA AB, Vislanda, Sweden; Pers comm. Schön, S. 2004. Re. Swedish softwood lumber production; Pers comm. Asikainen, A. 2002. Re. Finnish softwood lumber production.

[18] Sikanen, L. 1999. Discrete Event Simulation Model for Purchasing Process of Marked Stands as a Part of Customised Timber Procurement in Finland. Faculty of Forestry, University of Joensuu, Finland. Research Notes 95. ISBN 951-708-829-9.

[19] Warensjö, M. 1997. The sawmilling industry 1995, Part 1. Production and timber requirement. Department of Forest Products, The Swedish University of Agricultural Sciencies, Uppsala, Sweden. Rapport Nr. 251.

[20] Bush, R.J. and S.A. Sinclair. 1991. A multivariate model and analysis of competitive strategy in the U.S. hardwood lumber industry. Forest Science, Vol. 37, No. 2, pp. 481-499.

[21] Rich, S. U. 1986. Recent shifts in competitive strategies in the U.S. forest products industry and the increased importance of key marketing functions. Forest Products Journal, Vol. 36, No. 7/8, pp. 34-44.

[22] Lumber firms face tough year, 2002. Monday's Globe and Mail, 30 December.

[23] Svenska sågverk flyr USA-marknaden (Swedish sawmills abandon the US market). ATL (Swedish journal), Nov 21, 2002.

[24] Johansson, M. and K. Rosling. 2002. The Timber Cost of a Board. Scandinavian Journal of Forest Economics, No.39, 229-239, 2002

[25] Isläget skapar brist på importerat timmer (Ice behind shortages of import timber). ATL (Swedish journal), Jan 13, 2003.

[26] Finnish Statistical Yearbook of Forestry. 1998. Finnish Forest Research Institute. 348p.

[27] UN-ECE/FAO. 1992. The Forest Resources of Temperate Zones _ The Forest Resource Assesments 1990. UN. New York, 348 p.

[28] Bondeson, L. (Ed.). 2001. Skogsvårdsorganisationens utvärdering av skogspolitikens effekter _ SUS 2001. (Evaluation by the Swedish Forest Administration of the effects of Swedish forest legislation and policies.) Swed. Natl. Board of Forestry. Central Tryckeriet, Borås, Sweden. 275 p.

[29] Ripatti, P. 1994. Yksityismetsien omistusrakenteen muutokset. (Changes in ownership patterns of private forest owners) In: Ovaskainen, V. & Kuuluvainen, J. (eds.). Yksityismetsänomistuksen rakennemuutos ja metsien käyttö. Metsäntutkimuslaitoksen tiedonantoja 484. pp. 12-24.

[30] Ripatti, P. and V.-P. Järveläinen. 1997. Forecasting structural changes in non-industrial private forest ownership in Finland. Scandinavian Forest Economics, Vol. 36, pp. 215-230.

[31] Harstela, P. 1997. Decision Support Systems in Wood Procurement. A Review. Silva Fennica, Vol. 31(2): 215-223.

[32] Kurttila, M., K. Hämäläinen, M. Kajanus, and M. Pesonen. 2001. Non-industrial private forest owners' attitudes towards the operational environment of forestry - a multinominal logit model analysis. Forest Policy and Economics 2(1): 13-28.

[33] Larson, D.M. and I.W. Hardie. 1989. Seller behaviour in stumpage markets with imperfect information. Land Economics, 3: 239-253.

[34] Kärhä, K. and S. Oinas. 1998. Satisfaction and Company Loyalty as Expressed by Non-Industrial Private Forest Owners towards Timber Procurement Organizations in Finland. Silva Fennica, 32(1): 27-42.

[35] Lönnstedt, L. and T. Törnqvist. (1990). Ägaren, fastigheten och omvärlden. Den skogliga beslutssituationen inom privat, enskilt skogsbruk. [The owner, the estate and the external influences : nonindustrial private forest owner's management decisions.] Institutionen för Skog-Industri-Marknad Studier, Sveriges Lantbruksuniversitet, Uppsala. Report # 14.

[36] Kärhä, K. 1998. The Decision-Making Environment at Different Hierarchical Levels in Timber Procurement. Scandinavian Journal of Forest Research, 2: 224-236.

[37] Metsäteollisuuden vuosikirja. 1994. Yearbook of the Finnish Forest Industries.

[38] Thompson, J.D. 1967. Organization in action. McGraw-Hill, New York.

[39] Bucklin, L.P. 1966. Postponement, Speculation and the Structure of Distribution Channels. In: Mallen, B. E. (Ed.), The Marketing Channel: A Conceptual Viewpoint, John Wiley and Sons, New Your, pp 67-64.

[40] Rask, L.-O. and P. Andersson. Supply chain configuration and logistical solutions in Swedish sawmilling industry. A contingency approach. (Växjö University, School of Technology and Design, in manus).