Great Mining Camps of Canada 1.

The History and Geology of the Keno Hill Silver Camp, Yukon Territory

R. J. (Bob) Cathro3230 Dogwood Road, Chemainus, BC, V0R 1K2, Canada

bobcat62@telus.net

Submitted, 15 March 2006; accepted as revised, 21 August 2006. Note added in proof: The publishers and authors gratefully acknowledge the financial contribution of the Yukon Geological Survey in presenting our colour images for this article.

SUMMARY

The Keno Hill Camp was one of The Great Mining Camps of Canada; it was not only Canada's second largest primary silver producer and one of the richest Ag-Pb-Zn vein deposits ever mined in the world, it was also one of the mainstays of the Yukon economy from the 1920s, after the rapid decline of the Klondike Goldfield, until the early 1960s. At its peak in the 1950s and early 1960s, it supported about 15% of the territorial population. It also produced more wealth than the Klondike, one of the richest placer gold districts in the world. Following a small amount of hand mining between 1913 and 1917, larger scale production was almost continuous from 1919 to 1989, except during the war from 1942 to 1945. Two companies produced most of the ore, Treadwell Yukon Corp. Ltd. from 1925 to 1941, and United Keno Hill Mines Ltd. between 1947 and 1989. Both companies went bankrupt when silver prices failed to increase as quickly as mining costs. About three years of uneconomic ‘reserves' remained at closure.SOMMAIRE

Le camp minier de Keno Hill est l'un des principaux camps miniers du Canada. Non seulement s'agit-il du deuxième plus grand producteur canadien de minerai primaire d'argent et l'un des plus riches gisements filoniens de Ag-Pb-Zn exploité du monde, mais il a été aussi l'un des piliers économiques du Yukon à partir des années 1920, après le rapide déclin des champs aurifères du Klondike, jusqu'au début des années 1960. Au faîte de sa production, dans les années 1950 et début 1960, il fournissait du travail à environ 15% de la population du Yukon. De plus, il a créé plus de richesse que l'or du Klondike - l'un des plus riches districts d'or placérien au monde. Après une courte période d'extraction artisanale, de 1913 à 1917, a suivi une période d'extraction à plus grande échelle, presque continue, entre 1919 et 1989, sauf durant la guerre, entre 1942 et 1945. Deux sociétés minières ont assuré l'extraction de la presque totalité du minerai, soit la Treadwell Yukon Corp. Ltd., de 1925 à 1941, et la United Keno Hill Mines Ltd., de 1947 à 1989. Ces deux sociétés ont failli financièrement alors que le prix de l'argent a été surpassé par les coûts d'extraction. À la fermeture, le volume des réserves équivalait à environ trois années d'exploitation.

INTRODUCTION

1 Considerable research into mining geology and ore controls, along with systematic surface exploration, was conducted in the Keno Hill silver camp (hereafter referred to as the Keno Hill Camp) during the last 45 years of operation. Several geologists even held the title of Research Geologist. However, publication was not encouraged by United Keno Hill Mines Ltd. (UKHM) and little detailed information has been published on the subject since Boyle (1965), whose fieldwork dates from 1953 to 1955. Much of the accumulated geological wisdom and corporate memory is summarized for the first time in this paper, which is a synthesis of the observations made over the years by many mine and exploration geologists. The emphasis is on mining geology and how its ‘twists and turns' shaped the history of the camp.

2 Although most of the production and grades and geographic information were first reported in Imperial units, they have been converted to metric units throughout this paper. The only exception is Ag prices, which have always been quoted on world markets in $US/troy ounce (oz/ton). For simplicity, Ag assays and production figures are given in both Imperial and metric units. Although Ag grades are normally reported in the metric system as g/t, Keno Hill ore is so rich that they are given in kg/t throughout this report. To avoid confusion, ‘t' refers to tonne and the short ton is always spelled out. Also, mine levels (e.g. 650 level), which were named according to their approximate vertical distance in feet below the discovery showing, remain unchanged.

Location and Access

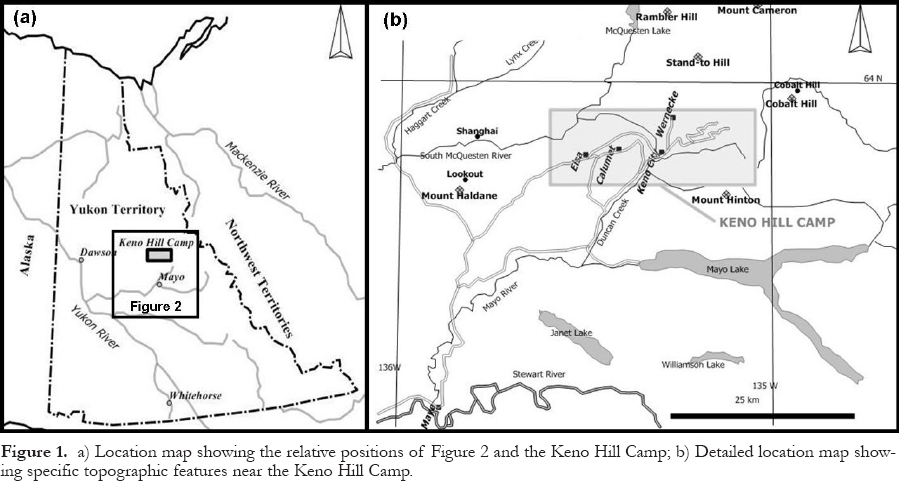

3 The camp is located close to the geographic centre of the Yukon Territory, at latitude 63°55'N and longitude 135°23'W, within NTS map-sheets 105 M/13, 14, and 15 (Figs. 1, 2). It is accessible by a 460 km road north from Whitehorse. The final 55 km is from Mayo, which is the nearest large town and a regional transportation and administrative centre. Mayo is situated on the Stewart River, one of the main tributaries of the Yukon River (Figs. 1, 2). The Keno Hill Camp is about 300 km south of the Arctic Circle and 80 km south of the height of land that separates the Yukon and Mackenzie River watersheds. North-facing slopes are without sunshine for 10 weeks every winter. Recorded temperatures at Mayo range from -63° to +35°C (-82° to +95°F), and annual precipitation averages about 28 cm, half of which falls as snow. July is the wettest month. One of the most pleasant climatic features is the periodic appearance of warm ‘Chinook' winds, similar to those that affect Calgary, which blow across from the Pacific coast during winter and suddenly raise the temperatures dramatically.

4 Yukon Territory remained relatively isolated until the Alaska Highway was built (for military purposes) in the early 1940s. The Keno Hill Camp was connected to the Alaska Highway at Whitehorse by an all-weather highway in the 1950s. Prior to that, freight and passenger service to Mayo was only available on sternwheel steamboats in summer and horse-drawn sleighs in winter. Air service to Mayo began about 1933 and passenger service became available to Edmonton by 1937.

5 Soon after the 1898 Klondike Gold Rush, there were over 200 boats of all sizes on the Yukon River system; in fact, it had more riverboats than any North American river except the Mississippi. The 700 km trip from Whitehorse to Dawson required two days for the downstream leg, travelling with the 6 knot current, and four days for the return voyage. The boats carried up to 100 passengers and 270 t of freight, some of which was pushed in front on barges. They were built with a draft of only 1.2 m so as to avoid the shifting sandbars. The quantity of wood fuel consumed by the boats was astounding, 25 cords on the downstream leg and 75 cords on the return trip. Each boat burned about 8,000 cords per season. Slightly smaller sternwheelers were used on the 270 km voyage that connected Mayo to the Yukon River. The river distance from Mayo to Whitehorse is about 860 km. Without this established river transportation system, development of the Keno Hill Camp would have been delayed for decades.

6 The ore was transported from Whitehorse to the seaport of Skagway, Alaska, on the White Pass and Yukon Railway, the nce to Vancouver or U.S. destinations by sea-going ships and finally by rail to a U.S. smelter. In the early years, the ore had to be handled as many as 10 times between the stope and the smelter.

Figure 1. a) Location map showing the relative positions of Figure 2 and the Keno Hill Camp; b) Detailed location map showing specific topographic features near the Keno Hill Camp.Camp Definition

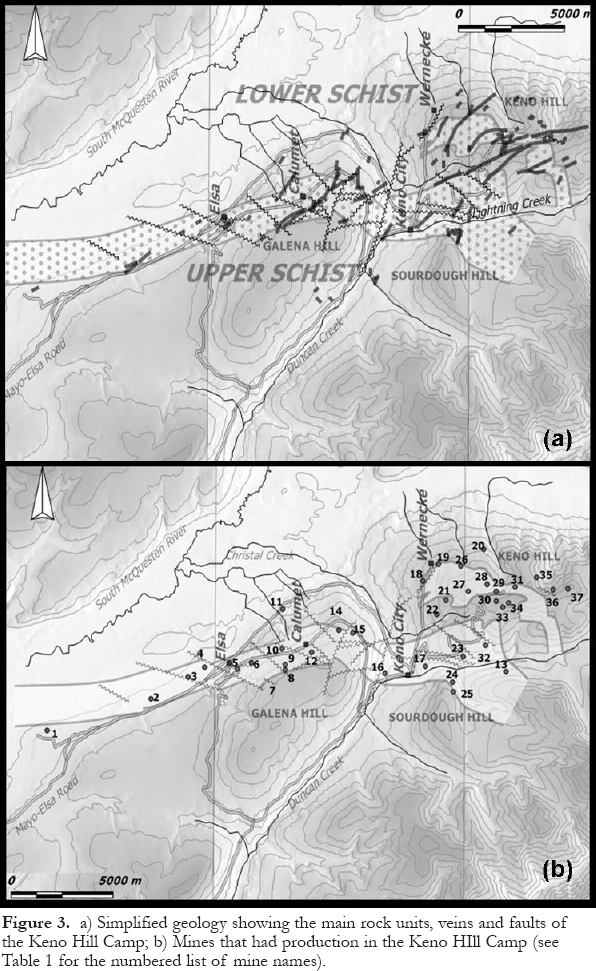

7 ‘Camp' is a term that is used to describe a cluster of deposits and occurrences that have a similar mineralogy and geological setting. The Keno Hill Camp is defined herein as a belt approximately 21 km long and 2 to 6.5 km wide that crosses parts of Galena, Keno and Sourdough Hills (Fig. 2). It extends from the Silver King mine (#2) at the west end, to the Caribou Hill mine (#37) at the east end (Fig. 3). The camp was named Keno Hill because the earliest large-scale mining took place there, even though most of the silver was actually produced from mines situated on Galena Hill.

8 The camp contains 16 ‘important' deposits, defined as those that produced over 15.55 t (500,000 oz) of Ag, another 19 that shipped smaller amounts to a smelter, and 35 minor occurrences. The deposits with recorded production are listed in Table 1. Two of the small producers in Table 1, Lookout and Cobalt Hill, lie outside the camp and are shown on Figure 1b.

Camp Overview

9 Camp Overview The camp is part of a larger Ag and Pb district that stretches 100 km northeast from Mount Haldane (Lookout Mountain) along the northern edge of the South McQuesten Valley, across the camp as defined above, and includes the eastern end of Keno Hill and Cobalt for additional references in the extensive government bibliography.

10 Hill, as well as three locations in the Davidson Range (Stand-to Hill, Rambler Hill and Mount Cameron; Fig. 1b). Scattered mineralization in the outlying parts of the district is similar to that within the camp, and several small occurrences received physical exploration and even shipped small amounts of ore, but no deposit was large enough to warrant further work.

11 In most parts of the world, these hills would be called mountains. Local relief ranges from the 525 m elevation at the South McQuesten River to 1975 m at the summit of Keno Hill. The topography is characterized by moderate to gentle slopes and extensive vegetation cover. Less than 5% of the hard resistant units, which are the most favourable host rocks to the silver deposits, form outcrops. The summit of Galena Hill is a long flat ridge at an elevation of about 1475 m. The only steep parts of the camp are the north sides of Keno and Sourdough hills. Permafrost extended to depths of about 80 m on the north side of the hills when mining commenced.

Information Sources

12 Information on mining geology is derived mainly from published and unpublished company files and personal recollections provided by former mine geologists. The main sources for regional geology are published reports of the Geological Survey of Canada (GSC) and various Territorial government surveys. Selected references are included at the end of this paper.

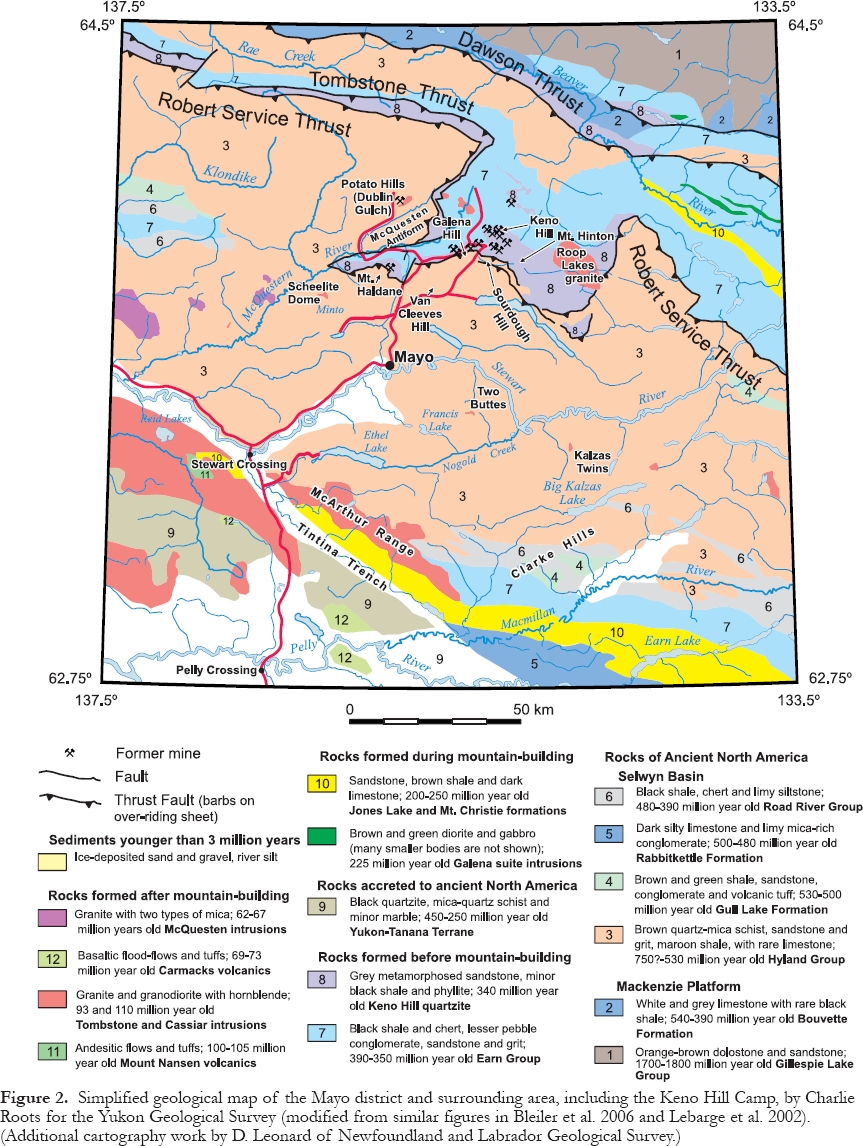

13 Four excellent books have been produced on the general history of the Mayo district in the last few years, starting with Gold and Galena (MacDonald and Bleiler 1990), which relied heavily on Aho (1972). The others, all lavishly illustrated in full colour, are K-L Services (2004), Aho (2006), which is an edited version of Aho (1972), and Bleiler et al. (2006). The latter contains a coloured geological map of the district, a simplified version of which is used in this paper (Fig. 2). Both the MacDonald and Bleiler(1990) and Aho (2006) bookscontain detailed information about the pioneers.

Figure 2. Simplified geological map of the Mayo district and surrounding area, including the Keno Hill Camp, by Charlie Roots for the Yukon Geological Survey (modified from similar figures in Bleiler et al. 2006 and Lebarge et al. 2002). (Additional cartography work by D. Leonard of Newfoundland and Labrador Geological Survey.)Figure 3. a) Simplified geology showing the main rock units, veins and faults of the Keno Hill Camp; b) Mines that had production in the Keno HIll Camp (see Table 1 for the numbered list of mine names).GEOLOGICAL SETTING

Regional Geology

14 A great deal of information has been published on this subject by the GSC, as well as the Yukon Geological Survey and its predecessors. A full treatment of this complex topic is beyond the scope of this paper, and the reader is referred to Boyle (1965), Murphy (1997), Roots and Murphy (1992), and Mair et al. (2006)

15

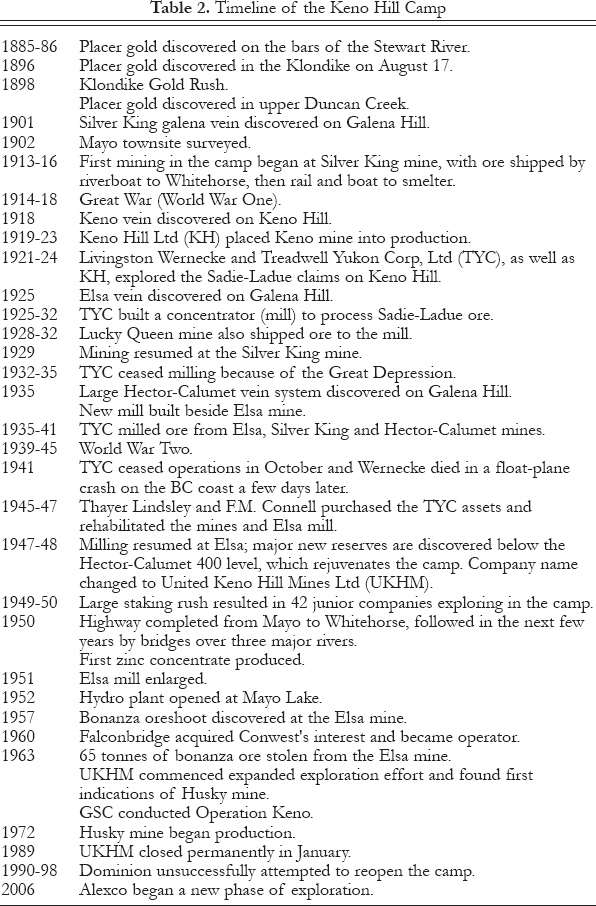

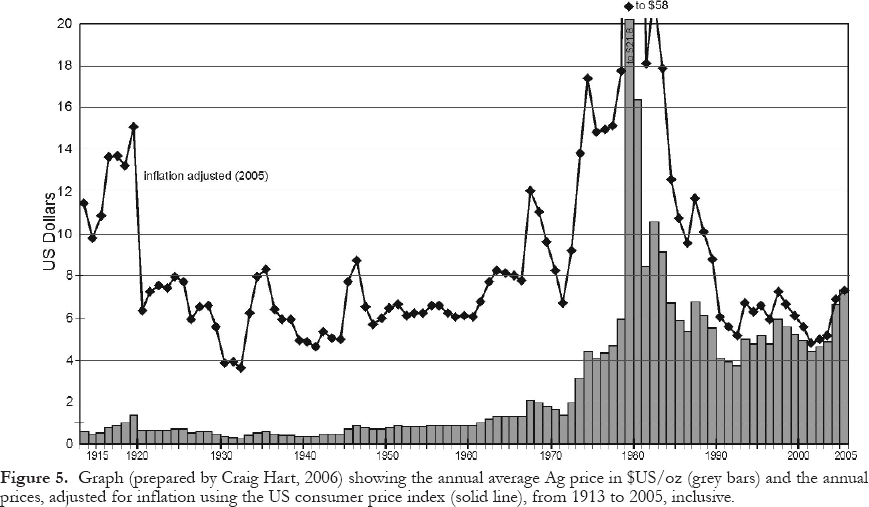

Table 1. Keno Hill Camp. Total recorded production - 1913 to 1990 (listed in order of decreasing Ag ounces)

Display large image of Table 1

16 Fingler (2005) has summarized the regional geology of Murphy (1997) as follows:

17 "The region is located within the western part of the Selwyn Basin. The stratigraphy consists of deformed and metamorphosed basinal sediments that accumulated at the edge of the Neoproterozoic to Paleozoic continental margin. During the Jurassic to Cretaceous periods (160 to 130 Ma), these rocks were subjected to compressional orogenesis related to large-scale plate convergence. This shortening episode also caused ductile, north-south directed thrusting, which generated three main thrust panels containing highly strained to transposed basin strata. In the Mayo-McQuesten district, the panels are separated by the Robert Service and Tombstone thrust faults.

18 Between 90 and 95 million years ago (Ma), a tectonic change from convergent-oblique to subduction-dextral strike-slip movement resulted in an episode of magmatism and the emplacement of the Tombstone series of intermediate to felsic plutons. About 65 Ma, renewed compressional tectonics that formed the Mackenzie Mountains induced another magmatic event and the emplacement of the McQuesten series of intrusions. The Tombstone plutons are genetically associated with sheeted stockwork Au-W-As quartz veins and Au-As skarn deposits that are present within a 700 km long belt that extends west from the Keno Hill district into Alaska."

19 The large Roop Lakes granite, a member of the Tombstone plutonic suite (Fig. 2), is considered to be the heat source linked to the concentration of the Keno Hill Ag-Pb-Zn mineralization, but not the source of the metals (Lynch 1989).

Camp Geology

20 By the late 1920s, a general picture of the geological setting and ore controls had been developed by mine geologists such as Livingston Wernecke, and byW.E. Cockfield of the GSC. Robert Boyle (1965) of the GSC conducted fieldwork from 1953 to 1955 and laboratory studies between 1953 and 1960 in an extensive study of the geochemistry, mineralogy and structure of the ore deposits and surrounding district, with the aim of determining the genesis of the silver ores. He also summarized the results of previous observations and mapping by mine and GSC geologists. The absence of outcrop, apart from man-made exposures, was partially compensated for by frost-heaved boulders and slabs of bedrock (felsenmeer), which are present as float in unglaciated areas. These move downhill for hundreds of metres in response to seasonal freeze-thaw cycles (solifluction or altipla-nation) and commonly result in a gradual transport of the larger fragments from the bottom of the thawed layer to the top.

Glacial History

21 While there is evidence in the region of very old continental glaciation, the camp experienced only light Pleistocene valley glaciation. Within the camp, till deposits from 10 to 50-m thick are present below an elevation of about 1100 m, which is about 575 m above the floor of the South McQuesten River Valley. Wernecke (1932) recognized a lateral moraine on Keno Hill near the 1200 m elevation that declines in elevation toward Galena Hill. Above that elevation, the terrain remained unglaciated during the most recent glacial period, although it may have been covered by a permanent snowcap. Except for local cirques on the higher north slopes of Keno Hill, the semi-arid climate probably prevented the formation of significant alpine glaciers.

Rock Units

22 The host rocks have a general strike of 100 to 110° and a southerly dip of 20 to 35° and form the gently south-dipping limb of the large McQuesten Antiform (Fig. 2). The layered succession has been metamorphosed to the greenschist facies. It was historically divided for simplicity into three informal units known as the Lower Schist, Central Quartzite, and Upper Schist, which were thought to be conformable (Fig. 3a).

23 The Lower Schist Unit consists of graphitic, calcareous and sericitic schist horizons, thin-bedded quartzite, and minor thick-bedded quartzite. In addition, sills and/or boudin of meta-diorite and metagabbro (greenstone) up to 1 km long and 30 m thick are common, principally on Keno Hill. The greenstone bodies form outcrops but the layered rocks weather recessively. When schist is exposed to surface weathering, it generally disintegrates quickly into small silica-rich fragments in a clay matrix.

24 The Central Quartzite Unit is approximately 700-m thick and consists primarily of bedded and massive quartzite and lesser thin schist and phyllite layers. This unit is the most important host to mineralization. Tight isoclinal folding has been exposed in underground workings and the walls of open-pits. Greenstone horizons are most common in the lower half of the unit. Although the quartzite would be expected to form prominent outcrops, they are actually rare. The thick-bedded and massive members are fractured and frost-heaved into large slabs of felsenmeer that raft downhill for considerable distances and locally override the Lower Schist Unit. A frozen field of these slabs blanketed by an insulating vegetation layer created a formidable barrier to prospecting and bedrock exploration. The irregular regional trend of the Central Quartzite Unit outside the camp is shown on GSC map 1147A (Boyle 1965). It is commonly referred to as the Keno Hill Quartzite.

25 The Upper Schist Unit consists of quartz-mica schist, quartzite, graphitic schist and minor limestone; it also weathers recessively. Rhyolite (quartz-feldspar porphyry) sills, conformable with schistosity, have intruded the Lower and Upper Schist units and perhaps the Central Quartzite Unit, as well. The largest sill is at least 40 m thick and has been traced across Galena Hill from west of the Silver King mine to Duncan Creek. A similar sill, at least 50-m thick, occurs near the portal of the Shanghai adit, across the South McQuesten River valley (Fig. 1b). The rhyolite sills are geochemically anomalous for Au and Ag (Alan Archer, pers. comm., 2005).

26 In the absence of fossil control, the Keno Hill structural succession was initially assigned to a regional basement unit named the Yukon Group, of assumed Precambrian or Paleozoic age. Although this early interpretation proved to be quite inaccurate, it had no adverse effect on exploration.

27 More recent studies, conducted mainly along the regional strike to the west, have demonstrated that the host rocks of the Keno Hill silver deposits are sandwiched between two regional thrust faults and are much younger than originally thought. A conodont-age determination by M.J. Orchard of the GSC (in Mortensen and Thompson 1990), shows that the Central Quartzite Unit is Mississippian. The Lower Schist Unit is underlain by the Tombstone thrust fault and has been correlated with the Devonian-Mississippian Earn Group. The greenstone lenses within the Lower Schist Unit are Middle Triassic (Mortensen and Thompson 1990). The Upper Schist Unit, which is now considered to be correlative with the Cambrian and older Hyland Group, is separated from the Central Quartzite Unit by the Robert Service Thrust fault (Tempelman-Kluit 1970). The Roop Lakes granite (also known as the Mayo Lake pluton), which lies southeast of the camp, has been dated at 93 Ma (Cretaceous) by the U-Pb method (Murphy 1997) and is approximately the same age as the porphyry and rhyolite sills (Sinclair et al. 1980). Tessari (1979) obtained a K-Ar age of 87 Ma for Ag-Pb-Zn stockwork mineralization in quartzite, slightly younger than the circa 105 Ma age of regional metamorphism (Mair et al. 2006).

28 It is ironic that the age and stratigraphic relationships of the host rocks were not established with any accuracy until over 75 years of mining activity had almost ended.

Ore Controls

29 Fortunately, the controls on ore emplacement are fairly simple. All Ag-Pb-Zn ore has been mined from vein-faults (herein called veins), where they cut the Central Quartzite Unit or green-stone bodies within the Lower Schist Unit. The two principal ore controls are vein orientation within the overall fault system and brittle fracturing, both of which accommodated tensional open-space filling while hydrothermal fluids were silver-rich. Veins are narrower and less well developed within greenstone than they are in quartzite because the former is not as brittle. Veins and faults commonly provide easy channel ways for groundwater to reach surface, hence a series of springs can indicate the presence of a transverse vein or cross-fault, if aligned in the correct orientation

30 The mineralized vein system is composed of two main sets. The oldest set comprises east-striking and steeply north-dipping ‘longitudinal' veins, which contain little Ag mineralization. Longitudinal veins are typically mineralized with massive quartz and can be up to 5-m wide. They can be weakly mineralized in places with arsenopyrite, pyrite and rare jamesonite and boulangerite ina quartz gangue. They were only found to contain Keno Hill type Ag-Pb-Zn ore shoots in a few places, mainly in the #6 and Porcupine veins at the Keno mine.

31 Almost all the economic silver mineralization occurs in a younger set of ‘transverse' veins, which strike within a N to N70°E arc, dip steeply southeast, and exhibit left-lateral movement of up to 150 m or more. The predominant gangue mineral in ore shoots is manganiferous siderite. The transverse veins have a cumulative strike length within the camp of about 160 km. They cut all rock units but change markedly depending on the competency of the wall rocks. Within schistose units, they consist of a number of slips and fractures carrying gouge and breccia and rarely exceed 0.3 m in thickness. In many cases, they are difficult to recognize at all because they are simply fractures or slips less than 0.1 m thick, along which the wall rocks have been dragged, contorted and smashed.

32 Where they intersect thick-bedded quartzite, the transverse veins can become up to 30-m wide and typically branch into a number of parallel to sub-parallel fractures filled by gouge or breccia, along which recurrent movement has occurred. Slips and fractures abound throughout a single fault zone, some of which parallel the veins and cut through the breccia. Others may branch from and rejoin the main structure but some die out into the wall rocks. A fracture zone consisting of thin mineralized stringers can extend up to 7 or 8 m away from the main vein. The footwall of transverse veins is commonly sharp and defined by the main fault plane whereas the hanging wall is less well defined and tends to be associated with more splits and fractures.

33 Many decades of mining experience have shown that ore shoots within transverse veins generally occurred: a) where quartzite or greenstone is present on one or both walls of the vein; b) adjacent to, or in, the footwall of cross-faults; c) at vein junctions or cymoid loops; or d) where the veins change dip. Early work at the Keno, Silver King and Bermingham mines suggested that places where veins intersected the Central Quartzite unit immediately beneath the thrust-faulted contact with the Upper Schist Unit were particularly favourable environments. Further exploration and development demonstrated that this hypothesis was unreliable.

34 Alan Archer was probably the first geologist to recognize that the widest, strongest and richest parts of the transverse veins generally developed where they were intersected by a cross-fault, the stronger the better. The best examples were at the Hector-Calumet mine, which is bisected and bifurcated by the 30-m wide Hector cross-fault, and the Elsa and Husky mines, which are believed to be parts of the same ore-body offset by the Brefalt Creek cross-fault. In these situations, the compressive force absorbed by the highly sheared fault appears to have increased the opportunity for tensional openings to form within the adjacent transverse veins. This suggests that movement was taking place along the veins and cross-faults at the same time that mineralization was being precipitated. Even though mineralization was locally dragged along the cross-faults for a short distance, the faults themselves were never mineralized. The horizontal offsets of the transverse veins range from over 350 m at Hector-Calumet to less than 5 m at Lucky Queen, with the average perhaps 100 m (Alan Archer, pers. comm., 2005).

35 One of the most important and hotly debated ore control topics was whether or not the Keno Hill orebodies had depth potential. The earliest mines all appeared to bottom-out at depths of about 120 m or less, either by pinching out (Elsa, Keno ‘9' vein, and Lucky Queen) or by bottoming in Zn-rich and Pb-poor mineralization (Hector-Calumet and Sadie-Ladue). The most dramatic example is the Hector-Calumet mine, which had been an impressive producer from surface to a depth of 120 m, where it bottomed in a sphalerite-rich zone. It was regarded as a salvage operation until 1948, when the huge 3 vein orebodies were discovered below the 400 level adit. The discovery of those new galena-rich ore shoots (which are described later) changed the exploration focus and revitalized the entire camp (Alan Archer, pers. comm., 2005).

36 It was eventually realized that individual ore shoots have a characteristic zoning from a Ag-Pb-rich top to a Zn-rich bottom, but that similar zoning can be found in other ore shoots at deeper levels. The larger mines were composed of separate ore shoots that were stacked one above the other in favourable structural and stratigraphic settings. None of the deep mines contained continuous ore shoots that extended from surface to the bottom. The Hector-Calumet deposit was mined to a depth of 365 m, the Bellekeno deposit to over 335 m, the Keno deposit down to 290 m, and the Elsa deposit to a depth of about 250 m. In most cases, the ultimate depth of mining was controlled by the elevation chosen for an adit level or the depth selected for a shaft, which were arbitrary planning decisions. The principal factors that influenced decisions about whether to explore deeper were the potential grade and thickness of silver mineralization versus the cost of a new adit or deepening a shaft.

37 Franzen (1979) pointed out that a strong relationship appears to exist between the present surface and the position of the orebodies. There is no logical reason for such a relationship because the age of the mineralization is about 87 Ma and the present surface is probably less than a million years old. In addition to the deposits found within the rather shallow depths that have been explored, erosion and several stages of glaciation have probably removed others, and still more may exist at greater depths, at least to the lower limit of the transverse veins within the Central Quartzite unit.

Mineralization

38 Keno Hill mineralization has been classified as part of a distinct family of vein deposits by Beaudoin and Sangster (1992), who named the family "silver-lead-zinc veins in clastic metasedimentary terranes". Other major silver camps that they included in this family are: Kokanee Range (Slocan), British Columbia; Coeur d'Alène, Idaho; Freiberg and the Harz Mountains, Germany; and Príbram, Czech Republic.

39 They defined this class of veins as having "characteristic metal ratios and … (being) comprised (sic) of galena, sphalerite and a diverse suite of Ag and sulfosalt minerals in a gangue of siderite, quartz, or calcite. The veins are typically enclosed by spatially restricted phyllic alteration, … hosted by monotonous sequences of clastic rocks intruded by gabbroic to granitic plutons, and metamorphosed to at least the greenschist facies. The veins are late features in the tectonic evolution of an orogen, commonly occur near a crustal-scale fault, and are not genetically related to felsic intrusions. Mineralization occurs at temperatures near 250° to 300°C from dilute to saline fluids at an average depth of 6 km. Precipitation results from district-scale mixing of up to three distinct fluids and localized boiling. These fluids include a deep-seated hydrothermal fluid, an upper crustal fluid of ultimate meteoric origin, and a late-stage meteoric-dominated fluid. Sulfur is derived from the local country rocks, whereas carbon is derived from organic and/or deep-seated sources. Pb is mainly derived from the local upper crustal country rocks."

40 To compare the mineralization from each of the selected camps, Beaudoin and Sangster (1992) calculated the ratio of Ag x 100/(Ag x 100) + Pb for the historical production. This provides a measure of the relative Ag content of tetrahedrite and sulfosalts associated with galena. No attempt was made to compare cutoff grades among the camps or consider how they might affect the ratios. The calculations showed that Keno Hill has a ratio of 0.63, much higher than the range of 0.22 to 0.44 from the other camps.

41 They also calculated the Pb/(Pb + Zn) ratio of the Keno Hill Camp as0.6, near the middle of the range for the family of 0.51 to 0.72. However, this is not as useful a measurement for Keno Hill as it is for the other camps, all of which were situated near smelters or railways. It appears that Beaudoin and Sangster (1992) were unaware that the remote location of Keno Hill caused its ratio to be artificially high because the recorded production of Zn is far lower than the Zn content of the ore deposits (mined and unmined). Zinc production records for the Keno Hill Camp do not reflect the true Zn content of the ore deposits because the high transportation costs to the smelter made it uneconomic to recover and ship the metal during most of the life of the camp. Zn-rich zones that did not exceed the cut-off grade for Ag were not mined and did not show up in ore reserves. Zinc that was mined with the Ag-Pb ore was only recovered in the mill from 1950 to 1977 and 1986 to 1988.

42 A large amount of the Zn in the deposits was left unmined, dumped on waste dumps, or discarded to tailings ponds. The amount was never measured but it was certainly considerable. As an educated guess, the extra amount of Zn that would have been shipped to a smelter if the camp had been better located is at least double the amount shown in the production records. If the Zn production figures that were used in the calculations of Beaudoin and Sangster (1992) were doubled, the Pb/(Pb + Zn) ratio for the Keno Hill Camp would be reduced from 0.60 to about 0.43, which is significantly lower than the ratios from the other camps.

43 Historically, mine geologists and prospectors used a simple rule of thumb to measure the Ag/Pb ratio, simply dividing the Ag assay in oz/ton by the Pb assay in %. This method produces an average ratio of 6.0 for the entire camp production. Individual mines show a considerable range between 2.5 and 12.8 (Table 1). The highest ratios for ‘important' deposits (defined on page 104) belong to the Elsa and Husky mines, at the west end of the camp, and the Black Cap and Lucky Queen mines at the east end.

44 Silver was responsible for about 80% of the value of typical Keno Hill ore. The Ag-rich minerals are present mainly within galena, hence, the Keno Hill Camp was essentially a cluster of galena mines. The principal Ag mineral is tetrahedrite (called ‘grey copper' by prospectors), which is ubiquitous throughout the camp. Another less important Ag mineral is pyrargyrite (called ‘ruby silver' by prospectors), which was only abundant in the Silver King, Husky, Elsa and, particularly, the Lucky Queen mines. Although Boyle (1965) concluded that most of the pyrargyrite was of secondary origin, it is actually primary. He noted that several stages of mineralization are present in the camp. Mine geologists estimated that at least 30 separate pulses of Ag-Pb-Zn mineralization were present in the Hector-Calumet 3 vein (see for example, Boyle 1965, p 129-130).

45 The complicated relationship between tetrahedrite, galena, and silver was clarified for me by John Jambor (pers. comm., 2005), for which I am greatly indebted. Tetrahedrite is the Sb-rich member of a sulfosalt series, sometimes called ‘fahlore', in which Sb and As can substitute for one another. It is a complex mineral in which Ag can substitute for Cu, and Zn can substitute forFe. When the formula amount of As exceeds Sb, the mineral is called tennantite. The generally accepted upper value for the amount of Ag that can be present within the crystal structure of galena is about 3.6 kg/t (105 oz/ton). If apparently ‘pure' galena in the Keno Hill Camp produces a Ag assay that approaches this level, some or perhaps most of the Ag must be present in another mineral, normally tetrahedrite. Keno Hill galena is, in effect, only a host or carrier for the Ag-bearing tetrahedrite.

46 The general formula of tetrahedrite is Cu6Ag4(Fe,Zn)2(Sb,As)4S13. The name is retained as long as the number of Ag atoms does not exceed those of Cu; thus, for nomenclature purposes, the maximum allowable substitution is to Ag5Cu5(Fe,Zn)2Sb4S13. When Ag atoms exceed Cu atoms, however, the mineral is called freibergite, which is very rare worldwide. The maximum theoretical ratio of Ag:Cu atomsin freibergite is thought to be about 7:3, which would result in a Ag assay of about 377 kg/t (11,000 oz/ton). For convenience in this paper, Ag-rich tetrahedrite from the Keno Hill Camp is referred to as freibergite.

47 Grains and patches of freibergite are clearly visible in the richest Keno Hill mineralization but most of it can only be seen microscopically. Etching of polished sections of apparently ‘pure' galena with acid reveals spectacular textures, showing that the galena is riddled with small elongate blebs of freibergite that average 20 microns in length. There is no easy way to predict how much of the Ag in a specimen is present as freibergite rather than within the crystal structure of gale-na, although it is probably safe to assume that as the assay becomes richer, the portion contained in galena will increase toward the 3.6 kg/t (105 oz/ton) maximum.

48 The highest Ag assay reported from Keno Hill freibergite, about 257 kg/t (7500 oz/ton), came from the Elsa mine. Although a systematic and scientific study was never carried out during mining, mine geologists found that apparently ‘pure' freibergite specimens from different mines showed considerable variation in Ag assays. However, the Ag content was found to be fairly consistent within an individual mine. For example, freibergite from the Keno mine averaged about 189 kg/t (5500 oz/ton), compared to about 137 kg/t (4000 oz/ton) from the Hector-Calumet and only about 47 kg/t (1500 oz/ton) from the Onek (Alan Archer, pers. comm., 2005).

49 To follow up on a question posed by Boyle (1965) and to improve on the analytical accuracy from the mine assay office, Lynch (1989), and later Sack et al. (2003), analyzed freibergite from throughout the camp to determine if large-scale hydrothermal zoning of Ag was present. Based on Ag/(Cu + Ag) values, Lynch (1989) identified seven distinct mineralogical zones extending outward from the Roop Lakes granite and found that both Ag/Cu and Fe/Zn ratios are highest at the west end of the camp, where they are associated with veins of ‘epithermal character'.

50 These epithermal features, which are not common in the camp, are best developed in the Husky and Husky Southwest mines. The Husky deposit consists of two main veins with ramifying structures, resulting in up to four parallel veins and brecciated zones. The two deposits together became the third largest producer in the camp, totalling 567.4 t (18.30 million oz) at an average grade of 1.41 kg/t (41.2 oz/ton). Their combined Ag/Pb ratio of 10.7 was exceeded only by the ratios at the Black Cap, Lucky Queen and Elsa mines. While most of the Husky mineralization consists of typical argentiferous galena hosted by siderite breccia, another unusual assemblage is also present in places. Pyrargyrite stockwork in siderite and quartz-encrusted cavities, together with acanthite, native silver, barite, kaolinite, and museum-quality specimens of polybasite and stephanite were noted (Jeff Franzen and Ken Watson, pers. comm., 2005). Similar epithermal characteristics were noted locally by mine geologists in the Lucky Queen mine, the Ram occurrence, the upper levels of the Bellekeno mine, and in parts of the Elsa and Silver King mines.

51 The Husky Southwest deposit lies on the same vein system about 900 m southwest of the Husky mine. Its gangue and ore assemblage, which was hosted by quartz breccia with very little siderite, was unique to the camp. The main sulfide is pyrite (1 to 5%) while galena is rare and non-argentiferous. Silver occurred as discrete microscopic crystals of native silver and argentite. The ore was extremely difficult to recognize visually and grade control was done entirely with assays. The Ag/Pb ratio was estimated to be as high as 125 (Watson 1986, and pers. comm., 2005).

52 Because very little of the Keno Hill ore was scoured away by Pleistocene glaciation, mineralization was locally oxidized to some degree to depths of more than 200 m. Within the oxidized zones, the primary sulfide minerals were commonly converted to limonite, pyrolusite, cerussite, anglesite, argentojarosite and plumbojarosite (basic sulfates of Fe), and native silver, with traces of malachite and azurite. In total, about 85 primary and secondary minerals have been identified from the camp (Watson, undated UKHM report).

53 Galena is present mainly as the common coarse-grained, well-crystallized and friable type, but also displays several other textures, such as fine-grained, sheared, massive, and ‘steel' (a dense, extremely fine-grained, almost cryptocrystalline type). Sheared and steel galena textures were caused by post-ore shearing of coarse-grained galena and it was not uncommon to find the three varieties side-by-side. These textural variations had important implications for exploration because the more massive and fine-grained types, which are less friable, were not affected as much by oxidation. As galena was released by erosion from the oxidized vein subcrops, it tended to develop a protective white rind of the Pb sulfate anglesite, and to collect downhill from the vein as a dispersion (float) train. Because of their high specific gravity, galena and anglesite concentrated on the bedrock surface as the fragments migrated downhill. These fragments range in size from individual grains to boulders weighing up to several tonnes, extend downslope for up to 100 m from the source and can be used as prospecting guides. Some of the trains are extensive enough to be mined by hand or mechanical methods, which is described elsewhere in this paper.

54 Keno Hill sphalerite is a Fe-rich variety called ‘marmatite', which is dark brown to black and known to prospectors as ‘blackjack'. The Fe substitutes for Zn, thereby decreasing the Zn content of ZnS, normally 67.1%, to about 60% in marmatite. According to Boyle (1965), the sphalerite contains 0.71 to1.16% Cd (which was recovered at the smelter) and up to 800 ppm of unrecoverable Sn. ‘Pure' sphalerite from most occurrences in Yukon and the Cordilleran part of the Northwest Territory commonly contains 0.4 to0.5% Cd (Alan Archer, pers. comm., 2005). A new, rare cadmium mineral, hawleyite (CdS), was first recognized by Boyle (1965) at the Hector Calumet mine and was later noted by mine geologists at the Onek, Silver King, Bellekeno and Galkeno mines. It forms bright yellow, earthy coatings on sphalerite, pyrite and siderite in the oxidation zone.

55 A typical oreshoot displays a predictable vertical zoning from Pb-rich at the top to Zn-rich at the bottom. Mineralogically, the ore changes with increasing depth from galena to galena-freibergite, to galena-freibergite-sphalerite-siderite, to sphalerite-freibergite-galena-siderite, to sphalerite-siderite, to siderite-pyrite-sphalerite. Tessari (1979) showed that a related metal zoning pattern, from Zn outward to Ca, is detectable geochemically in the plane of the vein around ore shoots.

56 Exploration was made more complicated by the fact that veins can change from well mineralized to barren while exhibiting no other apparent change. Evidence that the chemistry of the fluids changed over time is provided by the occasional presence of large lenses of Ag-poor galena within ore-grade zones.

57 Pleistocene ice, which occurs in most veins within the permafrost zone, was first studied in the Lucky Queen mine (Wernecke 1932). Two types are present, a clear variety with tiny air bubbles and a milky type intergrown with ice crystals. Wernecke (1932) thought that the ice had formed from meteoric water but Boyle (1965) concluded that some of the ice could be produced by diffusion of water vapour from surface. Wernecke (1932) measured the temperature variation of the ice at the Lucky Queen mine and found that it decreased about 0.75°C for every 30 m of depth.

58 Native silver is an unusual component of the ice, occurring as needles, leaves, wires and flake-like crystals at the Lucky Queen, Elsa and Keno mines. It is thought to be of secondary origin, with silver growth occurring at the same time as the ice crystals. In 1990, geologist Bill Wengzynowski discovered a specimen of leaf silver at the Lucky Queen mine and was able to deliver it, still frozen in ice, to the Canadian Museum of Nature in Ottawa. Boyle (1961, 1976) also identified native zinc and native lead from Keno Hill specimens.

59 Lynch (1989) described the camp as a large, continuous, complex, zoned, fossil hydrothermal system and postulated that the graphite content of the host rock assemblage may have acted as a barrier to a large-scale hydrothermal upflow, thus encouraging fluid flow to move predominantly in a lateral direction. Silver mineralization was related to a circulating hydrothermal system driven by thermal energy from a pluton. He further concluded that most of the pyrargyrite in the camp is primary and that the pluton was probably not the primary source of the metals. Boyle (1965) first suggested that the graphite schist horizons in the Lower Schist Unit, which he interpreted to be metamorphosed black shale, are a possible source of the Ag. Black shale sequences are well known globally for anomalous levels of numerous metals, including Ag. Boyle et al. (1970) showed that S isotope ratios supported the idea that ore and gangue elements had diffused from the country rock. Blusson (1978) suggested that the Pb-Zn-Ag mineralization was derived from shale members within the Devonian-Mississippian Earn Group,the correlative of the Lower Schist Unit.

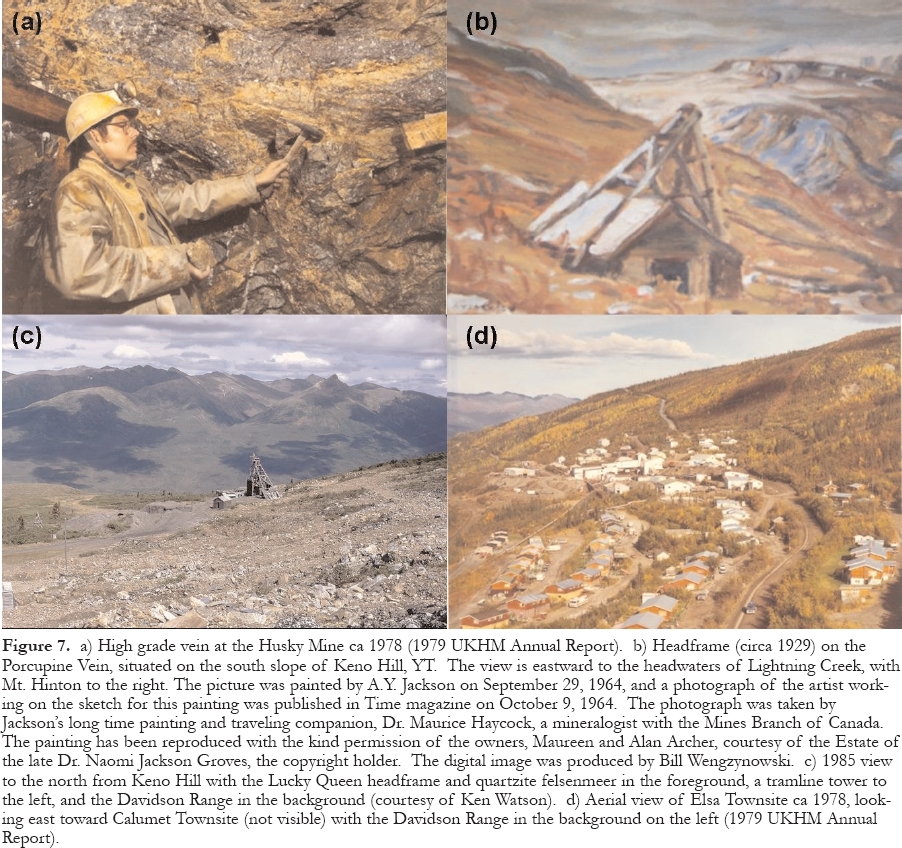

60 Gold production records were never kept and mineralization was not routinely assayed for gold because it was not a significant factor in the value of the ore. However, a few drill core specimens averaging 2.6 g/t (0.077 oz/ton) Au showed that the Husky Southwest deposit had a higher Au content than the rest of the camp. The gold is present as electrum. In the early 1990s, Au assays averaging about 0.55 g/t (0.016 oz/ton) were reported from the Silver King mine.

61 Local concentrations of auriferous arsenopyrite occur in most longitudinal veins (which are described in the previous section). The richest is the Homestake occurrence (Fig. 3), where specimens from a fracture zone 90-m long returned assays of up to 100 g/t (3 oz/ton) Au. However, the average grade is insignificant because it occurs so sporadically. Some geologists have speculated that part of the more than33,000 oz of placer gold recovered from Duncan Creek (Lebarge et al. 2002) may have been derived from the erosion and oxidation of tiny lode occurrences such as these. Boyle (1979) studied lode gold occurrences at Keno Hill and Dublin Gulch, a placer gold creek situated west of the camp, and found that it is released during oxidation of auriferous pyrite and arsenopyrite and collects as "small slugs, rough wires and dust in the limonite-scorodite-quartz rubble". This gold is much coarser than that which is seen only rarely in the veins.

62 The best Au potential may be on the McQuesten property, which includes the Wayne and Aurex Hill vein occurrences at the west end of the camp. This property covers a large till-covered area extending southwest from the Wayne showing, which lies 5 km southwest of the Silver King mine. It represents a sudden change in metallogeny that is quite unlike the Keno Hill style of mineralization. For that reason, it is not considered to be part of the silver camp in this paper. The initial discoveries in 1981 consisted of a Au-WBi-As-Sb suite associated with a swarm of quartz veins, from which the best intersection returned an assay of 5.0 g/t(0.15 oz/ton) Au across 3.5 m. Two holes drilled in a pyrrhotite-chalcopyritepyrite-scheelite assemblage within quartz-calcite-diopside skarn near a rhyolite sill returned core assays of up to 34 g/t (1 oz/ton) Au and 2.1% WO3 over widths of 0.5 to 3.2 m.

63 According to Fingler (2005), an early stage of widespread, retrograde, pyrrhotitic skarn mineralization of variable intensity has replaced calcareous horizons within the Upper Schist Unit (here called the Yusezyu Formation). It was followed by northeast-trending quartz-pyrite veins containing arsenopyrite with lesser amounts of galena and sphalerite. A third stage consists of galena, sphalerite and siderite with lesser quartz in northwest-trending veins and breccia zones. The veins cut a subvertical granite dyke that intrudes the schist succession. These styles of mineralization represent locally different physical conditions and are commonly superimposed on each other. The associated geochemical signatures include variants of Au-Bi-W-As-Te-Sb and Ag-Pb-Zn-Au-As. This is reminiscent of several bulk-tonnage, intrusion-related gold deposits associated with Tombstone suite plutons such as those at Dublin Gulch and elsewhere in Yukon and Alaska. Lynch (1989) identified a similar zone close to the Roop Lakes granite. No intrusion has been recognized near the McQuesten property, although in 2000 a Newmont geophysicist interpreted a large airborne magnetic feature to the west as the possible signature of a buried intrusion. Contact metamorphic minerals have been recognized.

64 In spite of all the studies conducted in the camp, the question of why the tetrahedrite-tennantite series at Keno Hill contains so much more Ag than other silver occurrences in the Canadian Cordillera has never been explained.

HISTORY OF EXPLORATION AND DEVELOPMENT

Pre-1913

65 Prior to the Klondike gold discovery in August 1896, and the subsequent ‘Gold Rush of 1898', Yukon Territory was one of the most inaccessible parts of Canada, hemmed in between the St. Elias Mountains toward the Pacific coast and the northern end of the Rockies. The earliest arrivals and those who remained after the rush were among the most adventurous men (and a few women) who ever prospected or explored Canada.

66 Placer miners who had first entered Yukon and Alaska in the early 1880s found that the gravel bars of the Stewart River were gold-bearing, resulting in an influx of about 100 prospectors to that region in 1885 and 1886. Some of this gold probably came from the Mayo district but its source eluded them. After the Klondike Gold Rush began to subside, those who stayed behind resumed their search for the next Klondike and many returned to the Stewart River tributaries. In 1898, a rich paystreak was found near the headwaters of Duncan Creek, between Galena and Keno Hills. Duncan Creek is a tributary of the Mayo River (Fig. 1). By 1902, about 200 men were either mining or prospecting the area and the townsite of Mayo had been laid out.

67 The first discovery of Ag-Pb mineralization in the Keno Hill Camp was made in 1901 by a gold-placer prospector, Jacob Alexander (Jake) Davidson (Fig. 4a), who had entered the Yukon in 1898. He recognized galena or anglesite in his gold pan while prospecting a tributary of the South McQuesten River at the west end of Galena Hill. The source was a vein exposed in the wall of a small rock canyon, which later became the Silver King mine (see Cathro 2006, Fig. 1a). Although he staked it as the Hell's Gate lode claim in July 1903, he didn't perform any exploration and never returned to it again because his primary interest was gold and he felt that the vein was too narrow and too remote.

68 Before he left the Yukon in 1905, he gave a specimen to his partner, Harry McWhorter, who agreed to have it assayed. Even though it contained more than 10 kg/t (300 oz/ton) Ag, McWhorter didn't become excited, so the story goes, because he was only interested in gold as well. For some reason, the assays never reached Davidson, who went on to discover a gold showing at Matachewan, 40 km southwest of Kirkland Lake, in 1910. He and a partner, Weldon Young, formed the Young-Davidson Mining Company and optioned the property to Hollinger Consolidated Gold Ltd, which placed it into production between 1934 and 1955. Davidson died in Toronto in March 1945.

1913 to 1917

Silver King Mine

69 McWhorter finally re-staked the showing in 1913 as the Silver King claim with partners Jack Alverson and Grant Huffman. With financing from Thomas P. Aitken, a Nova Scotian dredge owner in Fairbanks, Alaska, the partners mined about 55 t of ‘shipping ore' by hand. Shipping ore is mineralization that is sufficiently massive or rich enough to be shipped directly to a smelter without being concentrated in a mill. During the winter of 1913-1914, it was hauled with horses in 50 kg burlap sacks for 32 km via Duncan Creek to Mayo, where it was stockpiled for shipment to the Shelby smelter in San Francisco in summer. Each man netted about $5,000, a large amount of money in those days.

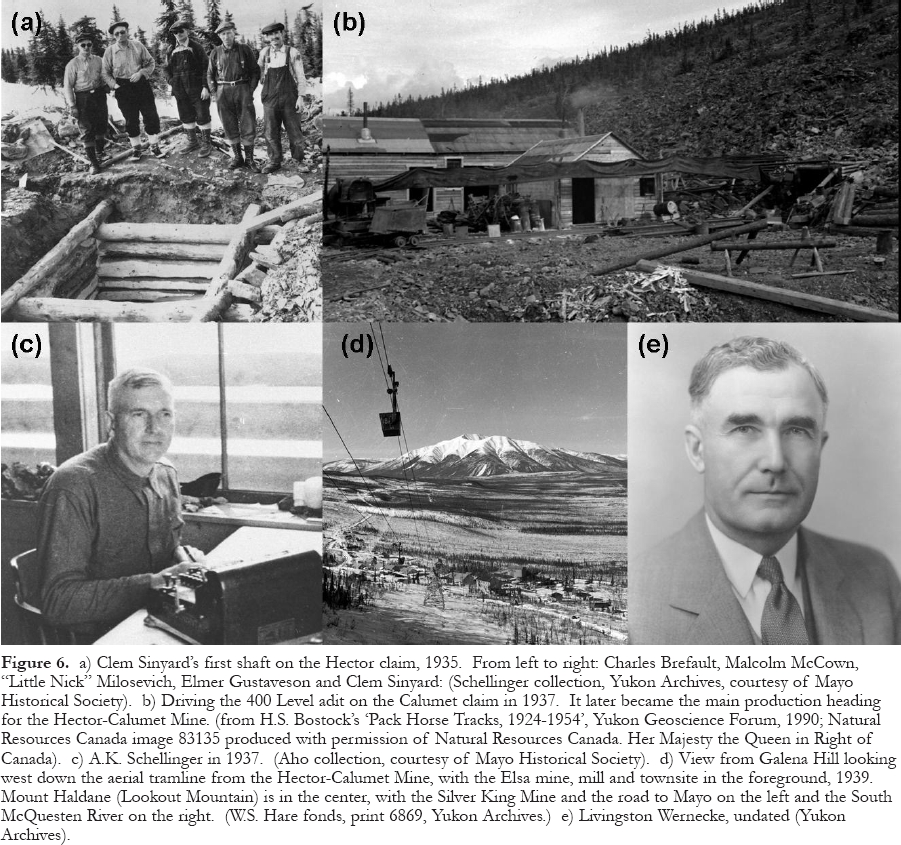

70 Aitken was so impressed that he purchased the claim group and produced another 3175 t of shipping ore by the end of 1916. Pyrargyrite and freibergite were noted in the Silver King ore for the first time. One shipment of about 1070 t assayed approximately 9.25 kg/t (270 oz/ton) Ag, $3 per ton in Au (about0.15 oz/ton), and about 31% Pb. Aitken reportedly netted about$500,000, a fortune at the time, but terminated his work when the ore appeared to become Zn-rich at a depth of 60 m. James Scougale then explored with a diamond drill, owned by the Territorial Government, without encouragement.

71 Meanwhile, others continued to prospect the district without success. Andy Johnson returned to Mt. Haldane (Lookout Mountain) in March 1915 to stake a showing he had discovered about 1905 (Fig. 1). Although D.D. Cairnes of the GSC insisted that the probability of finding more rich veins was high, interest in the new silver camp waned. The Great War (1914-1918) was probably a factor because many of the prospectors in Yukon were British-born men who enlisted in the army.

1918 to 1942

72 In the fall of 1918, Louis Bouvette discovered rich galena float on the steep slopes of Faro Gulch, a cirque on the north side of Keno Hill. Bouvette was one of the 80 or so prospectors who had staked claims near the Silver King mine, where he had become familiar with Keno Hill-type ore. Approaching winter prevented him from locating the source but he returned in July 1919, as soon as snow conditions permitted, and quickly traced the float uphill for 150 m to a frost-shattered vein, which he staked and sampled. It was situated about 120 m below the flat plateau that forms the summit of the hill. Further prospecting located many fragments of frost-heaved galena with brown to black, manganiferous siderite gangue in several locations.

73 The timing of the discovery was fortuitous because the war had just ended and the Ag price averaged $1.34 that year (Fig. 5), the highest point it reached in almost a century (1875-1967). That, and the obvious extent of the vein system, stimulated international interest in the camp and led to sustained exploration and development. By coincidence, the first two discoveries were located at the extreme ends of the camp, Keno to the east and Silver King to the west. Both would eventually become important mines.

74 Bouvette rushed to Mayo to show his samples to Fred Bradley, a mining executive from San Francisco who was visiting the district to examine the Lookout property on Mt. Haldane (Fig. 1b). It was being explored underground by a new junior company, Yukon Silver-Lead Mining Company Ltd. Bradley had already departed so Bouvette sent his samples, instead, to the Dawson assay office of the Yukon Gold Company (YGC), the pioneer Klondike gold dredging company. When Ag assays comparable to those from the Silver King mine were obtained, the assayer, a 1910 Stanford University graduate in geology and mining named Alfred Kirk Schellinger, was sent to examine the showing.

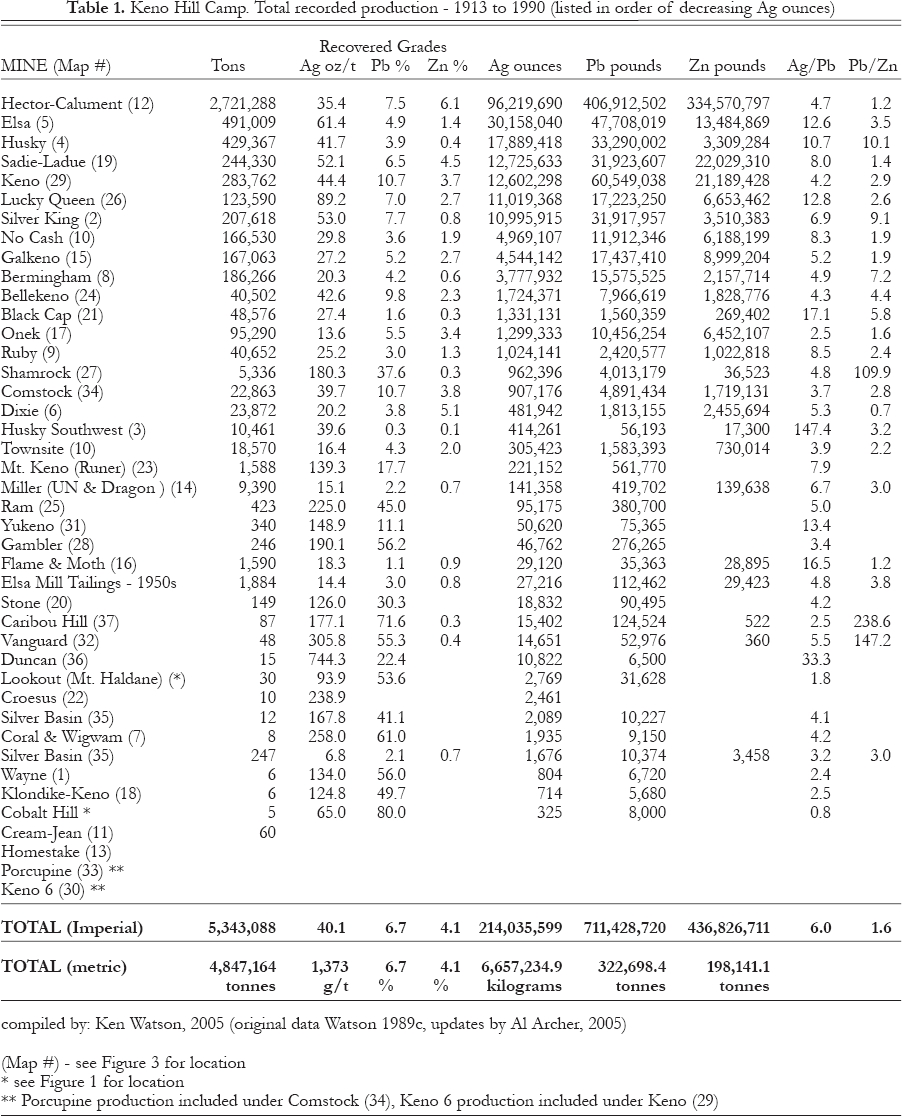

Figure 4. a) Jake Davidson (1870-1945) in 1931, courtesy of Tony Killingsworth. b) View to the west in 1920 showing the Keno Mine at the top of Keno Hill. The mine was perched on the edge of the cirque at the head of Faro Gulch. Note the power and telephone lines from Keno City (Schellinger collection courtesy of Mayo Historical Society). c) Sacks of galena ore being loaded on the sternwheeler ‘Canadian' and two barges at Mayo, May 1923. (photo by W.S. Hare, Ralph Rogers collection, courtesy of Mayo Historical Society). d) Wernecke Townsite of Treadwell Yukon Company, Limited on Keno Hill, ca. 1925. View looking east with the first mill in the camp on the left and the headframe in the centre. (Ed Kunze Collection, Mayo Historical Society.).

Display large image of Figure 4

Yukon Gold Company and Keno Hill, Limited

75 YGC was controlled by the Guggenheim family of New York. The patriarch of the family, Meyer Guggenheim, was an immigrant from Switzerland who had made money in the wholesale grocery business in Philadelphia and decided to buy a half-interest in a silver mine at Leadville, Colorado in 1879. After a ‘bonanza' lode was discovered, he and his seven sons then invested in a lead smelter at Pueblo, Colorado, which they gradually leveraged into the giant American Smelting & Refining Company (Asarco), a vast mining and smelting enterprise with operations in the U.S., Mexico, and Chile. In the period between 1906 and 1912, the words Guggenheim and copper seemed to be almost synonymous. The family held sizable or controlling interests in some of the largest mines in the world, including Bingham Canyon, Utah; Braden and Chuquicamata, Chile; Kennecott, Alaska; Ray and Chino, Arizona; and Ely, Nevada. Some of these mines are stillin production.

77 YGC, which operated from 1906 to 1925, had been a bit of a flier for the family and it turned out to be a financial disappointment. By the time YGC became interested in Keno Hill, its reserves were nearly exhausted and its operations in the Klondike had been reduced from nine dredges to two, plus a couple of hydraulic mining projects. As dredges became idle, they were being dismantled and shipped to other placer gold districts in places such as Malaya. YGC, like the Guggenheim family itself, was becoming a much less dynamic mining organization as the sons began to retire and their children chose to enter different fields (Hoyt 1967).

78 The top of Keno Hill was a small, windswept plateau above timber-line, without a water supply or road access. It was clearly an inhospitable and challenging place to build and operate a mine. In spite of this, YGC acquired the key claims and formed a new operating company called Keno Hill, Ltd. (KH). Between late August and early October, 1919, Schellinger sent three riverboats to Mayo, each loaded with about 70 t of mining and camp equipment. The last boat was frozen-in at Mayo for the winter. The freight was hauled the 68 km from Mayo to the site with horses and sleighs. The last half of the route was a poor winter trail and the final 6 km were up a steep hillside with an elevation gain of 760 m. Timber and water were hauled from local sources, a tent camp was built, and underground mining commenced on the available shipping ore.

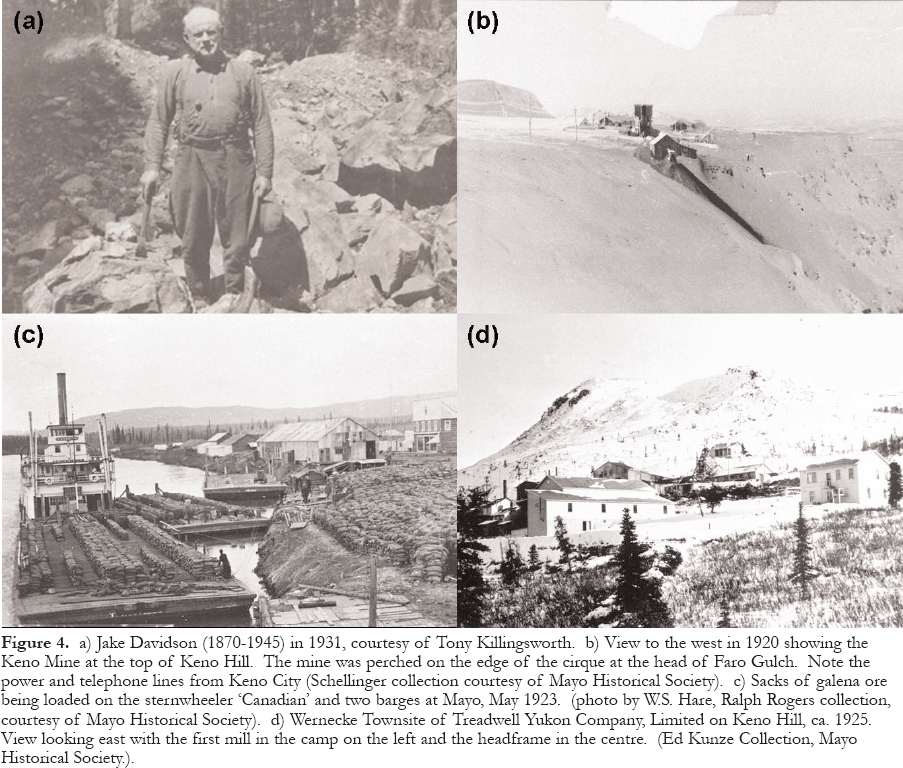

Figure 5. Graph (prepared by Craig Hart, 2006) showing the annual average Ag price in $US/oz (grey bars) and the annual prices, adjusted for inflation using the US consumer price index (solid line), from 1913 to 2005, inclusive.

Display large image of Figure 5

79 Mining engineer R.H. Humphrey was sent from New York to manage the program and Schellinger became the mine geologist/engineer. A pattern was already being established in which the financial and technical people and foremen in the Keno Hill Camp were all Americans, with no involvement by Canadian or British mining interests. That trend would continue until 1945.

80 One of the main reasons that such a rapid start-up was possible in such a remote area was because of the large pool of experienced prospectors, miners, teamsters and other skilled workers who had been attracted to the Yukon and Alaska before and during the Gold Rush. Some of them had gained their experience in the gold placer and silver-gold hardrock camps in the southwest United States, British Columbia and Alaska. When the Keno mine was discovered, many of those men, including some veterans who had just returned from the Great War, flocked to the district to work at the mine or to prospect and stake claims. News of the YGC deal led to a staking rush in which over 500 claims were recorded during the first year, a number that gradually increased to about 1000 by 1923. At that time, each man was only allowed to stake one claim on each vein, and most could only afford one in the entire camp because of the cost and time required to perform the work needed to hold them. That is a good indication of how many prospectors and amateurs were attracted to the camp. Yukon lode claims (also called quartz claims) were staked with two posts and could be up to 457 m (1500ft) square, with a maximum area of 21 ha (51.5 acres).

81 Those who chose to remain in the district during the winter of 1919-1920 worked and lived at the mine (Fig. 4b), found accommodation in Mayo, or built a cabin on their claim if timber and water were available. Some built cabins in a new townsite called Keno City, which was established at the foot of Keno Hill beside Lightning Creek, a tributary of Duncan Creek. It was soon equipped with the usual amenities of a frontier town such as hotels, brothels, and saloons. Electricity was provided by a 75 KW powerhouse that consumed two cords of wood daily. Many of the prospectors spent the winter(s) working as teamsters, woodcutters, or hunters supplying moose and caribou meat to the mine and the community.

82 During that first winter, approximately 2000 t of shipping ore were mined by KH from a shaft and two adits and hauled to Mayo with horses in 50 kg burlap sacks. A thickness of over 3 m of galena was found in the best ore-shoot.

83 The main elements of the mineralogy and ore controls were quickly recognized by KH and GSC geologists. They had already noted the importance of quartzite and greenstone wall-rocks and began to distinguish between longitudinal and transverse veins.

84 The GSC deserves enormous credit for recognizing the significance of this new discovery and responding so quickly. At the time, the only means of communication between Ottawa and the territory was by telegram to Dawson or Whitehorse, or by mail. W.E. (Bill) Cockfield of the GSC was pulled off a project near Dawson in August 1919, and instructed to rush to the camp on one of the last boats of the year leaving for Mayo. He subsequently spent the summers of 1920, 1921 and 1922 in the camp. When he arrived in 1920, he learned that J.H. Farrell, a geologist from Los Angeles, had been hired by KH to map the top of Keno Hill with two assistants, P. Locke and C.E. Visel. They decided to collaborate, with Cockfield concentrating on regional mapping of Keno Hill and its extension to the northeast (Cockfield 1921; Williams 1922).

85 In the words of Aho (1972): "From this joint effort came the first picture of why ore occurred where it did and where more of it might be suspected … from then on, for years, it seemed that nearly every place that Cockfield had said to prospect, they found ore". There is, perhaps, no better example in the history of the GSC of the immediate impact of a Survey officer on mineral exploration. To quote Williams (1922), "With his assistants, (Cockfield) has played an important part in the development of the camp; ready at all times to give sapient instruction and advice to prospectors or to survey roads through the subarctic forests when no territorial funds were available, thus exemplifying the true scientific spirit in the best interests of the Survey". Bill Cockfield was in charge, later, of the Survey's Vancouver office, where he was highly respected.

86 It was not just prospectors who were attracted to the new camp. Visitors in 1920 included the Yukon Gold Commissioner, members of the Yukon Council, the Member of Parliament, and several senior officers from the Asarco office in New York. Governor-General Lord Byng visited in 1923.

87 The 1920-1921 mining program, under the direction of Frank Short, a San Francisco engineer and another Stanford graduate (1898), was even more aggressive, although mining was delayed for a few weeks by a miner's strike. The crew objected to the appalling conditions, living in cold bunkhouses with poor food, spending the few daylight hours underground, and drilling dry with hand-steel in dusty, freezing conditions. The strike was settled quickly when the company agreed to reduce the working shift from ten to eight hours at the same wage of $5/day, and to improve the meals and living conditions. A telephone line was also installed to Mayo. KH managed to ship about 3000 t in 1921.

88 As more veins were discovered, it became apparent that most of the ore occurred in transverse veins about 600m long, of which the 9 vein was the best. They were terminated by two longitudinal veins, the 1 vein (also known as the Main Break), which cropped out in Faro Gulch to the north, and the 6 vein, which crossed the top of the hill. Unlike elsewhere in the camp, good ore shoots were also found in the longitudinal veins. For a better understanding of the complicated vein pattern at the Keno Mine, see Boyle (1965). The best ore occurred where the transverse veins intersected a 50-m-thick greenstone body that formed a small knob on the summit, or a thick quartzite unit in the footwall that was separated from the greenstone by about 100 m of schist. Native silver and argentite, thought to be secondary in origin, were found in the Pleistocene ice that filled open spaces in the veins.

89 Based on its declining underground results and knowledge that the Silver King mine appeared to have bottomed in zinc mineralization and that many silver camps fail to persist to depth, KH became concerned about the future of the Keno mine. In the summer of 1922, with over 900 m of underground development completed on 12 veins, Superintendent Warren McFarland and consulting geologist Fred Hellman, from New York, were instructed to conduct a thorough appraisal. Hellman recommended that a reduced underground exploration program should be conducted and that the mine should be abandoned if it was unsuccessful. Based on thin section and polished section work, mineralogist R.J. Colony concluded that there was no secondary enrichment, that the ore consisted of vein filling with no replacement, and that ore shoots were only terminated for structural reasons.

90 Within a year, the end of the Keno mine came almost as Hellman had anticipated. By the time mining ended late in 1923 and the last of the ore had been shipped (Fig. 4c) to the smelter in 1924, it had produced an estimated 57.8 t (1.8 million oz) of Ag from 8425 t of hand-sorted ore with an average grade of approximately 6.86 kg/t (200 oz/ton) Ag and 54% Pb. Most of the ore had been mined from the 9 vein, which was up to 10-m thick and graded about 15.4 kg/t (400 to 500 oz/ton). The largest oreshoot contained 0.3 m of solid gale-na over a vein area of about 30 m by 20m. The cutoff grade for the mine was about 4.3 kg/t (125 oz/ton) Ag and 40% Pb, and thousands of tons of milling ore were either discarded or left unmined. The cost of hauling the ore to Mayo had been about $27/t, roughly the same as the cost to ship it from Mayo to the smelter in the United States. The production from the individual veins is grouped together under Keno mine in Figure 3 and Table 1.

91 The intersection point where the Keno veins would have passed through the top of the brittle rock formation and entered the overlying schist unit is very close to the present top of Keno Hill. If the top of the hill had received 5 or 10 m less erosion and the vein system had not been exposed by the glacial cirque on the north side, the veins would have been in schist at surface and unmineralized. In that case, the rich Keno ore would not have cropped out and the history of the camp might have been much different (Alan Archer, pers. comm., 2005).

92 While production was underway at the Keno mine, prospectors made several new discoveries at lower elevations northwest of the mine. Float from a vein that was later found to extend across three claims (Ladue, Sadie, and Friendship) was located as early as 1920 by Ray Stewart, Dave Cunningham and others and found to assay up to 17 kg/t (500 oz/ton). It would become the largest deposit found on Keno Hill. Other discoveries of rich float were made in 1921 on the Lucky Queen and Shamrock claims.

Bradley and Wernecke

93 Early in 1921, Frederick W. Bradley, who had visited the Lookout property in 1919, became sufficiently impressed by the news from the Keno Hill Camp that he agreed to buy the Gambler claim, located beside the KH property, for $10,000 - sight unseen. One of the most prominent mining executives in western North America, he was to have a major impact on the development of the Keno Hill Camp. Born in 1863 at Nevada City in the California Gold Fields, he dropped out of the University of California before graduation to return home and make his name at the age of 21 by saving the bankrupt Spanish mine through record-setting, low-cost mining and milling. In 1890, he became the manager of the new Bunker Hill silver mine in Idaho and was promoted to president in 1897. He then became involved in affiliated companies in the Juneau gold camp, becoming president of the Alaska Juneau mine in 1900 and the Treadwell Complex, an amalgamation of four adjacent mines on Douglas Island, across the channel from Juneau, in 1911. The Juneau camp, which had been in production since 1891, had interesting Canadian connections. The first lode showing, discovered by a French-Canadian, Pierre Joseph Erussard, was sold to John Treadwell from St. Stephen, New Brunswick. It was Treadwell who arranged the financing and construction of the first mill at Juneau, and whose name was later associated prominently with the Keno Hill Camp.

94 Bradley was a metallurgical expert whose principal contribution to the extremely low-grade Juneau Camp was in expanding the operations to achieve economies of scale, and introducing more advanced milling techniques. By 1915, the Treadwell Complex was milling about 4500 t/day in a 960 stamp mill, the largest in the world. By 1926, almost 23,000 t were being treated daily. Between 1898 and 1944, about 82 million t were mined underground at Juneau at the incredibly low grades of2.1 to 3.8 g/t (0.06 to 0.11 oz/ton) Au. Bradley was obviously comfortable with northern operations and was not afraid of technical or logistical challenges or financial risks. He served as president of the American Institute of Mining and Metallurgy in 1929 (Stone and Stone 1983).

95 Bradley sent his senior engineer and scout, Livingston Wernecke, to Keno Hill on the first boat in June 1921 (Fig. 6e). His instructions were to acquire properties of merit for a syndicate financed by The Bunker Hill and Sullivan Mining and Concentrating Company (the largest producer in Idaho's Coeur d'Alène silver camp), the Treadwell Alaska Company (from Juneau) and two smaller affiliates. Wernecke, who was Bradley's protégé, would go on to become the most important figure in the history of the Keno Hill Camp. He was named after the Montana town where he was born in 1883, had trekked over the Chilkoot Trail during the Gold Rush at the age of 15 as a member of an expedition to Alaska led by a botanist, had obtained a degree in geology and mining from the University of Washington in 1905, and then gained mining experience at Ely, Nevada and several projects in Alaska. From 1914 to 1921, he had worked for Bradley at the Alaska Treadwell and Alaska Juneau gold mines.

96 Wernecke visited all the active prospects and soon became a serious competitor to KH, which optioned the Sadie and Friendship claims for $70,000 in July (under the usual arrangement in the camp of 10% down) and offered $75,000 for the Ladue. KH broke off discussions with the owners of the Ladue claim when they countered with a demand for $500,000, which gave Wernecke an opportunity to begin negotiations. Having observed that the vein was wide and strong, that it cut the favourable greenstone and quartzite wall-rocks, and that the mineralization gave high Ag assays, he optioned the Ladue claim plus a few others for $260,000 over five years, with $20,000 down. This was a much more aggressive deal than the camp had seen before. The syndicate was incorporated as a new operating company, Treadwell Yukon Company, Limited (TYC), and suddenly the future of the camp looked much brighter. The only black cloud on the horizon was the Ag price, which declined to the $0.64 to 0.69 range in 1920, and remained there until 1929.

Treadwell Yukon Company, Limited

97 Now it was Wernecke's turn to show if he could be as competent as KH in coping with the transportation difficulties and short shipping season. By the end of September, a camp had been built and surface trenching had uncovered an ore shoot that averaged 10.1 kg/t (296 oz/ton) Ag and 41% Pb across a thickness of approximately 0.5 m, for a length of 120 m. Wernecke stated "If there's not a mine here, the text books are all wrong" (Aho 1972). Unlike KH, which never developed much confidence in the potential of the camp, Wernecke and Bradley believed from the beginning that sufficient reserves would be found to support a milling operation that could be supplemented with shipping ore.

98 Mining equipment was rushed from Juneau before the shipping season ended and William Hargreaves, a mining engineer with a degree from MIT and operating experience in Ontario gold mines, was brought in as Superintendent. By the spring of 1922, the camp had been enlarged to accommodate 60 men, two shafts had been sunk, 3600 t of 7.9 kg/t (230 oz/ton) shipping ore had been mined from above the 200 level and sent to Mayo, a large quantity of milling ore was stockpiled, a rough road had been built to Keno City, and a sawmill was in operation.

99 At the same time, KH had sunk a shaft on the Sadie claim and found 360 t of shipping ore and a large tonnage of milling ore. No permafrost was encountered there because it had been thawed by a nearby creek. In contrast, the Ladue #2 shaft reached the bottom of the permafrost at a depth of about 80 m, where it was forced to stop by water under strong hydrostatic pressure. By May 1923, Wernecke had obtained approval for a $1.5 million underground development program that included a drainage and production adit 790-m long at the 600 level. By the end of the year, TYC had blocked out over 27,000 t of 2.2 kg/t (64 oz/ton) milling ore and produced 7100 t of shipping ore averaging6.9 kg/t (202 oz/ton) Ag, 31% Pb, and 11% Zn. Discontinuous ore shoots had been found along the vein for a length of 500 m. By May 1924, plans had been completed for a 90 t/day bulk flotation mill using a flowsheet designed from metallurgical tests conducted in Juneau and pilot plant tests in New York.

100 When the 600 level was found to be mineralized only with a sideritepyrite assemblage containing minor freibergite, it became obvious that TYC did not have sufficient ore reserves. By negotiating a 10-year lease on the Sadie and Friendship claims with KH in August, Wernecke was able to reach the required ore reserve minimum of five years to justify the construction of the mill. KH was now reduced to the status of a claim owner and Schellinger became TYC's assistant engineer. TYC bought all the KH claims in 1934 for $25,000 (Bradley 1941).

101 By the time the river freighting season was over, all the mill equipment had been shipped to Mayo from Juneau and San Francisco. It was assembled at a new townsite that was situated at the Sadie-Ladue mine, on a gentle west-facing slope just below timberline. The townsite was named Wernecke (Fig. 4d). Interestingly, the house built at the mine for Wernecke and his family is the only building still standing. It was repaired and used during a surface high-grading program during the 1980s.

102 The mill was in operation at a capital cost of $200,000 by the beginning of 1925, and treated an average of 122 t/day of ore and produced 14.5 t of concentrate grading 20.8 kg/t (607 oz/ton) Ag, 55% Pb and 8% Zn, with minor Au and Cu, throughout the year. Recoveries averaged 97.6% for Ag and 92% for Pb. The bulk concentrate was shipped to the Bunker Hill smelter at Kellogg, Idaho. Smelter receipts from 1926 show that TYC was paid for 95% of the contained Ag and Au, and 90% of the Pb.

103 Bunker Hill had been noted for its poor labour relations. In fact, relations between the workers and management were so bad that its smelter was demolished in an explosion triggered by disgruntled miners in 1899, while an attempt to kill Bradley with a bomb placed outside his San Francisco home in 1904 was unsuccessful. Bradley had learned how important a contented workforce was to a productive northern operation when he became involved at Juneau. The Treadwell Complex had built comfortable bunkhouses and homes for its workers as well as impressive recreation facilities that included an indoor swimming complex and a library with 15,000 books and 150 magazines and newspapers.

104 While at Juneau, Wernecke had also learned the importance of maintaining a happy workforce. In spite of its remoteness, he ensured that the new townsite was a pleasant place to live and work. It was equipped with an excellent cookhouse and bunkhouses, a recreation building containing a pool hall, bowling alley, library, laundry, barber shop, radio room and silent movie theatre, as well as outdoor skating and curling rinks. A telephone line was installed to Mayo in 1923, which connected with a radiotelegraph link to Dawson and ‘outside' (the south). In the mine, wet drilling provided a safer and cleaner workplace and safety was encouraged. While no drunkenness or vice was tolerated in the town-site, it was always available in Keno City, which also offered tennis, a pool hall, a baseball diamond, and a trustworthy assay office operated by the territorial government.

105 Aho (1972) summarized his impressions of Livingston Wernecke as follows: "The Treadwell Yukon operations were a monument to Wernecke's dedication, engineering, efficiency, business ability and capacity to integrate government and social problems with pioneering the frontier of the north." Based on interviews with many of the camp pioneers, as well as the Wernecke and Schellinger families, Aho gained many valuable insights into his personality. His principal strengths were his imagination and vision as an explorer and developer. He was remembered as optimistic, efficient, frugal, taciturn, modest and shy, with little interest in social events. A workaholic with piercing eyes and a stern appearance, he could be grumpy and temperamental and was a terse communicator whose instructions were often confusing. As time went on, he became the autocratic ruler of the camp, a benevolent dictator whose word was absolute law. "He tolerated no interference from below and virtually ignored it from above."

106 In addition to getting the mine and mill up-and-running, another priority was to improve the freighting system and reduce shipping costs. In 1922, TYC purchased a Jeffery ‘Quad' (4x4) truck and a ‘5-ton' Holt Caterpillar tractor, which were used to haul 2000 cords of wood to the mine on winter roads. A year later, the company bought a second bulldozer, twice as big, to haul ore to Mayo and backhaul diesel fuel to run the generators. The bulldozers were capable of hauling over 25 t/trip, thereby replacing 96 horses and lowering the freighting cost from $26.00 to $8.50/t. Wernecke was so impressed that when he found a third one for sale on the Alaska coast in January 1924, he had it shipped to Whitehorse and sent a crew to walk it overland to Mayo. The 400 km trip was accomplished in 16 days. Aho (1972) suggested that this may have been the first overland cat train in Canada. Two more bulldozers were purchased for the winter of 1925-26, which resulted in the end of the horse era. When the drivers were put on a bonus contract, the two day return trip to Mayo was reduced to one day.

107 Whereas the path from float discovery to production had been quick and simple at both the Keno and Sadie-Ladue mines, the history of the Lucky Queen mine, situated uphill from the Wernecke townsite, could not have been more different. It had been staked in February 1920 by Hector Morrison, who found float assaying up to 29.7 kg/t (865 oz/ton) Ag and traced it to a narrow vein between a greenstone footwall and a schist hanging wall, from which he dug a few t of shipping ore by hand. Slate Creek Mining Co. optioned his ground for $5000 and paid him to continue prospecting but dropped the option in 1922 when the results were disappointing (Williams, 1922). While occasional specimens of rich float kept turning up and Morrison continued to drive short adits and dig pits and shallow shafts, he could not find a strong vein. No one would option or buy his claims, he could not even give them away, and he was almost ready to give up by 1927.

108 The next spring, acting on a friend's hunch, he dug in a new spot and found an impressive float train that quickly led him to an exceptionally rich vein about one metre thick,cutting quartzite. Although the mineralization was only about 15 cm thick where it was first intersected, specimens assayed as high as 58.3 kg/t (1700 oz/ton). According to Alan Archer (pers. comm., 2005), the Lucky Queen vein was the weakest structure associated with an important deposit in the entire camp. However, an adequate dilation zone had existed to form an orebody about 100 m long, which was cut off at both ends by weak cross-faults that only offset the vein about 3 m. The heart of the deposit was only 25 m long. Among the important producers, the Lucky Queen mine had the highest average grade in the camp, 3.06 kg/t (89.2 oz/ton), and the second highest Ag/Pb ratio at 12.8. Much of the Ag was present in pyrargyrite rather than freibergite, which was unusual within the camp. It was a unique deposit that broke all the camp rules.